NFPE WESTERN ZONE STUDY CAMP

2013 August 25th & 26th Pushkar (Rajasthan)

As you are aware the South Zone Study Camp of NFPE was held at Chennai, Central Zone Study Camp was held at Vidisha (MP) and Eastern Zone Study Camp at Guwahati (Assam) was also held successfully. The next camp for Western Zone will be held at Pushkar (Rajastahan). Delegates from affiliates of NFPE from Rajasthan, Delhi, Himachal Pradesh, Haryana, Punjab and Jammu & Kashmir shall attend the two days Western Zone Study Camp.

The number of delegates allotted to each circle union is furnished as below:

Circle

|

P3

|

P4

|

R3

|

R4

|

GDS

|

Admin

|

Postal Accounts

|

SBCO

|

Civil Wing

|

Casual Labour

|

Total

|

Rajasthan

|

50

|

50

|

10

|

5

|

10

|

1

|

1

|

1

|

--

|

1

|

129

|

Delhi

|

15

|

15

|

10

|

3

|

2

|

1

|

1

|

1

|

--

|

1

|

49

|

Himachal Pradesh

|

10

|

10

|

5

|

1

|

5

|

1

|

1

|

1

|

--

|

--

|

34

|

Haryana

|

10

|

15

|

10

|

2

|

5

|

1

|

1

|

1

|

--

|

1

|

46

|

Punjab

|

15

|

12

|

10

|

2

|

5

|

1

|

1

|

1

|

--

|

1

|

48

|

J & K

|

5

|

5

|

3

|

-

|

3

|

1

|

1

|

1

|

--

|

--

|

19

|

Total

|

105

|

107

|

48

|

13

|

30

|

6

|

6

|

6

|

--

|

4

|

325

|

In addition all General Secretaries of the above unions shall attend the camp.

Circle Secretaries are requested to select the delegates of their union immediately and instruct them to book the up and down tickets without any further delay. They should reach Pushkar (Rajasthan) before 08-30 AM on 25th August 2013. They can leave the camp only after 6 PM on 26th August 2013. Maximum lady comrades may be included as delegates. The names of the delegates attending the camp should be intimated to the respective General Secretaries before 15th August 2013. Delegates fee per head is fixed as Rs. 600/- (Rs. Six Hundred only). Exact venue and programme notice will be sent separately.

All General Secretaries are requested to instruct their circle Secretaries suitably for immediate follow up action.

Offline Software for Typing Test - Study material for PA/SA Examination 2013

OFF LINE SOFTWARE FOR TYPING TEST

1. Download the folder

2. Unzip the folder 3. Install your computer 4. Try it and improve your speed 5. No need of internet connection |

Source : http://postalguide100.blogspot.in/ &

|

TREATMENT ON EMERGENCY CAN BE MADE IN NON EMPHANELLED PRIVATE HOSPITAL

C. G. Employees and their dependents can avail treatment in a non empanelled Private hospitals in emergency conditions and get reimbursement

(G.I MH OM No. F. No. S. 14025/14/2012-MS, dated 11.06.2013)

Revision of rates for reimbursement of medical expenses incurred in emergency conditions under CS (MA) Rules, 1944

The undersigned is directed to state that the issue of revision of rates for reimbursement of medical expenses incurred on availing medical treatment in emergency conditions under CS (MA) Rules, 1944, when treatment is taken in a non-empanelled private hospital, has been under consideration of the Government for some time.

2. It has now been decided that, reimbursement of medical expenses incurred by a Central Governmentemployee covered under CS(MA) Rules, 1944 on availing medical treatment for himself and his dependent family members in emergency conditions, would be allowed as per the prevailing non –NABH CGHS rates as applicable to a CGHS covered city and non-NABH rates applicable to the nearest CGHS covered city in case of non-CGHS city, as the case may be, or the actuals, whichever is less.

3. For the medical treatment in such cases where package rates are prescribed under CGHS, the non-NABH rates of the CGHS covered city and non-NABH rates of the nearest CGHS city (in case of non-CGHS covered city) or the actuals, whichever is less, will be applicable.

4. This OM supersedes all earlier orders issued from time to time under CS (MA) Rules, 1944 on this subject for allowing reimbursement of medical expenses in emergency conditions when treatment is taken in a non-empanelled private hospital.

5. This OM will come into effect from the date of issue.

6. This issue with the concurrence of the Integrated Finance Division vide their Dy. No. C-282, dated 22.05.2013.

New Rules of filing Tax returns

The tax authorities have introduced several new guidelines for filing returns this year. Find out how these changes are likely to impact you.

First they made it compulsory for businesses to e-file their tax returns. Then they made it mandatory for taxpayers with incomes of over 10 lakh to take the online route. This year, the income tax authorities have cast a wider net and made e-filing compulsory if your taxable income is above 5 lakh a year.

The lowered threshold represents one of the key changes in the tax filing rules this year. Some of these are mere tweaks, such as mentioning your bank's IFSC number, instead of the MICR code, in the return. However, some of these variations are tectonic, such as the mandatory e-filing for incomes above 5 lakh a year. In the following pages, ET Wealth explains the new rules and how they will affect the way you file your tax return this year.

E-filing tax returns

The change has spawned a massive opportunity for tax e-filing portals. These websites charge individual taxpayers between 200 and 4,000 for uploading their tax returns. You can also do it for free on the official website of the Income Tax Department. However, private tax filing portals hand-hold the taxpayer through the process. They guide you while filling the form and even correct you if you make a mistake.

Filing tax returns online is easy.

The average taxpayer won't take more than 30-40 minutes to enter all the details and upload the return. However, the average taxpayer also harbours several misconceptions about e-filing . Tax returns are picked up for scrutiny through a computer assisted selection procedure that has no human intervention. If the computer detects certain discrepancies in the return, it raises the red flag and the individual gets a notice. In fact, there is a greater probability that a return filed offline will get picked up for scrutiny . The information in your physical return is ultimately fed to the computer by operators. A typing error at this stage can introduce a discrepancy in the return, leading to a notice being sent to you.

This problem can be avoided when you file online because the chances of going wrong are lesser. The e-filing portals further reduce the risk of errors by calculating the tax as you fill in the form. Some e-filing companies , such as Taxspanner, even verify your return for a small fee. If you are ready to shell out 200, the portal will check if you have entered correct information and alert you when you are going wrong. Tax professionals go through your return form, tallying the numbers and cross-checking the information before it is uploaded.

Choose the right form

The online filing data reveals that more than 32% of the 2 crore individual taxpayers used the basic ITR 1, also known as Sahaj, to file their returns last year. Only 11% used the more complicated ITR 2. These statisticsindicate that a lot of taxpayers who should have used ITR 2 filed their returns using the simpler Sahaj form. The income level does not matter; what is important is the source of income. For instance , if one had made capital gains or earned rent from more than one house, he should have used ITR 2.

If you have not filed your return for last year as well, you can do so now. A return filed after the due date is a delayed return. If you file your delayed return before you get a notice, you have a better chance of getting awaylightly. The taxman will not take you to task for not filing your returns, just give you a mild rap for waking up late.

Automatic choice for e-filers

For some online tax filers, choosing the right form is not an issue. "A taxpayer has to just enter what he has earned under different heads of income and the portal automatically chooses the applicable form," says Sudhir Kaushik, co-founder and CFO of Taxspanner.com. For instance, if the person has only income from salary and no exempt income, his return will be filed using ITR 1, but if he made some capital gains, has rental income from more than one house or his exempt income exceeds 5,000, ITR 2 will have to be used.

However, taxpayers who upload their returns through the official Income Tax Department website will have to be more careful about the form they use. Delhi-based Kuldip Kaushik used the ITR 1 last year, but since he had dividend income of over 5,000 for the year 2012-13 , he will have to use ITR 2 this year.

If a taxpayer uses the wrong form and the mistake is discovered by the tax authorities, the return may be rejected . Every year, thousands of defective returns are sent back to taxpayers. A defective return is not an earth shattering matter. If you get a notice, you will have to file a revised return within 15 days. If you meet the deadline, the return is treated as valid. Get delayed and your return will become invalid and you will have to file afresh.

"If you discover on your own that you have made a mistake in the return or used the incorrect form, you can file a revised return to rectify the mistake ," says Vineet Agrawal, director KPMG. Your new return will overule the previous one if the assessment has not been completed.

Check your TDS details

Before you sit down to file your returns this year, spend a few minutes to check whether the tax you paid for last year has been correctly credited to your name. The Form 26AS has details of the tax deducted on behalf of the taxpayer and can be easily checked online. Noida-based Brijendra Singh wishes he had done so last year. The former army officer got a tax notice because of a clerical error by his bank. The TDS paid on his income from fixed deposits was credited to another PAN by mistake. Though he was eventually given credit for his TDS, Singh is not taking any chances this year. He has diligently matched all his TDS details with his Form 26AS online.

Checking your tax credit details online is child's play if you have a Net banking account with any of the 35 banks that offer this facility. Otherwise you can go to the official website of the Income TaxDepartment and click on 'View Your Tax Credit' . First-time users will have to register but it takes less than five minutes before you can log on and view your details. "It is necessary that taxpayers check their TDS when they file their returns," says Kuldip Kumar of PwC.

Forms seek more information

If salaried people are feeling jittery about using the more detailed ITR 2, imagine what partners in firms and businessmen are going though. In an attempt to dig deeper for undisclosed income, the government has made it mandatory for partners, professionals and businessmen with an income of over 25 lakh to furnish details of their assets and liabilities. There is a new 'Schedule AL' in the ITR 3 and ITR 4. If the taxpayer's income exceeds 25 lakh during the year, he will have to declare his assets and liabilities.

Read More: http://timesofindia.indiatimes.com

Issue of Identity Cards to Central Govt. Pensioners reg.

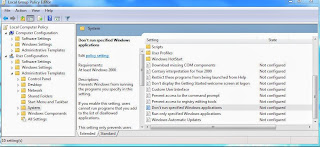

How to Block specific applications using Group policy

1. Type “gpedit.msc” in run

2. Expand User configuration followed by Administrative Templates

3. Click System

4. On right side open “Don’t run specified windows application”

5. Click “Enable” then add the specified applications

Please see the attached screenshots for your reference.

ANDHRA PRADESH PINCODE LIST

| Sl. No. | Office | Pincode |

|---|---|---|

| 1 | ACHANTA SO | 534123 |

| 2 | ADDANKI SO | 523201 |

| 3 | ADDATEEGALA | 533428 |

| 4 | ADILABAD HO | 504001 |

| 5 | ADMN. BLDGS. TSO | 502032 |

| 6 | ADONI HPO | 518301 |

| 7 | AGS PO | 500004 |

| 8 | AIRFORCE ACADAMY | 500043 |

| 9 | AKIVIDU SO (BHM) | 534235 |

| 10 | AKKAYYAPALEM S.O | 530016 |

| 11 | AKNAGAR LSG SO | 524004 |

| 12 | ALLAGADDA | 518543 |

| 13 | ALLURU SO | 524315 |

| 14 | ALWAL SO | 500010 |

| 15 | AMADALAVALASA HO | 532185 |

| 16 | AMALAPURAM HO | 533201 |

| 17 | AMARAVATHI | 522020 |

| 18 | AMBAJIPETA | 533214 |

| 19 | AMBERPET SO | 500013 |

| 20 | ANAKAPALLE HO | 531001 |

| 21 | ANANTAPUR H.O | 515001 |

| 22 | ANAPARTHI SO | 533342 |

| 23 | ANDHRA UNIVERSITY S.O | 530003 |

| 24 | ANDRA MAHILA SABHA SO | 500044 |

| 25 | ANNAVARAM | 533406 |

| 26 | ANTHARVEDIPALEM | 533252 |

| 27 | AOC RECORDS SO | 500015 |

| 28 | APSPCAMP | 533005 |

| 29 | ARMOOR HO | 503224 |

| 30 | ARYAPURAM | 533104 |

| 31 | ASOKANAGAR SO (ELR) | 534002 |

| 32 | ATMAKUR | 518422 |

| 33 | ATMAKURU SO | 524322 |

| 34 | ATTILI MDG | 534134 |

| 35 | AUTONAGAR SO | 520007 |

| 36 | AVANIGADDA HO | 521121 |

| 37 | B KOTHAKOTA SO | 517370 |

| 38 | BADVEL SO | 516227 |

| 39 | BAHADURPURA SO | 500064 |

| 40 | BALANAGAR SO | 500037 |

| 41 | BANAGANAPALLE LSG SO | 518124 |

| 42 | BANJARA HILLS | 500034 |

| 43 | BANSWADA SO | 503187 |

| 44 | BANTUMILLI SO | 521324 |

| 45 | BAPATLA HO | 522101 |

| 46 | BEGUM BAZAR SO | 500012 |

| 47 | BEGUMPET SO | 500016 |

| 48 | BELLAMPALLI SO | 504251 |

| 49 | BHADRACHALAM HO | 507111 |

| 50 | BHAINSA SO | 504103 |

| 51 | BHATTIPROLU | 522256 |

| 52 | BHEEMUNIPATNAM S.O | 531163 |

| 53 | BHIMADOLE SO (JRG) | 534425 |

| 54 | BHIMAVARAM HO | 534201 |

| 55 | BHONGIR HO | 508116 |

| 56 | BHPV S.O | 530012 |

| 57 | BITRAGUNTA SO | 524142 |

| 58 | BOBBILI HO | 535558 |

| 59 | BODHAN SO | 503185 |

| 60 | BOLARUMSO | 500010 |

| 61 | BOWENPALLY SO | 500011 |

| 62 | BUCHIREDDYPALEM SO | 524305 |

| 63 | BUCKINGHAMPET | 520002 |

| 64 | CENT.SECRETARIATE PO | 500022 |

| 65 | CENTRAL UNIVERSITY CAMPUS PO | 500046 |

| 66 | CHALLAPALLI | 521126 |

| 67 | CHANDANAGAR SO | 500050 |

| 68 | CHANDRAGIRI HO | 517101 |

| 69 | CHATAPARRU | 534004 |

| 70 | CHEBROLE S.O. | 522212 |

| 71 | CHEBROLE SO (JRG) | 534406 |

| 72 | CHENNUR SO | 504201 |

| 73 | CHILAKALAPUDI S.O | 521002 |

| 74 | CHILAKALURIPETAHO | 522616 |

| 75 | CHIMAKURTY | 523226 |

| 76 | CHINTALAPUDI SO (JRG) | 534460 |

| 77 | CHINTAPALLE SO | 531111 |

| 78 | CHIPURUPALLI | 535128 |

| 79 | CHIRALA | 523155 |

| 80 | CHITTIVALASA S.O | 531162 |

| 81 | CHITTOOR HO | 517001 |

| 82 | CHODAVARAM MDG | 531036 |

| 83 | CHOWDEPALLE SO | 517257 |

| 84 | CM NAGAR (GUNTUR) | 522007 |

| 85 | COLLECTORATE(KHM) SO | 507002 |

| 86 | COMMON SERVICE CENTRE | 500002 |

| 87 | 500016 | |

| 88 | CTR COLLECTORATE LSG SO | 517002 |

| 89 | CUDDAPAH HO | 516001 |

| 90 | CUMBUM LSG SO | 523333 |

| 91 | CYBERABAD PO | 500081 |

| 92 | DABAGARDENS S.O | 530020 |

| 93 | DACHEPALLE | 522414 |

| 94 | DANAVAIPETA | 533103 |

| 95 | DARGAMITTA SO | 524003 |

| 96 | DARSI | 523247 |

| 97 | DESHAIPET SO | 506006 |

| 98 | DEVARAKONDA SO | 508248 |

| 99 | DHARMARAM SO | 506330 |

| 100 | DHARMAVARAM HO | 515671 |

| 101 | DHONE LSG SO | 518222 |

| 102 | DHS | 506011 |

| 103 | DISTRICT COURT BUILDINGS S.O | 530002 |

| 104 | DONAKONDA RS | 523305 |

| 105 | DORNAKAL SO | 506381 |

| 106 | DOWLAISWARAM | 533125 |

| 107 | DRAKSHARAMAM | 533262 |

| 108 | DUBBAK SO | 502108 |

| 109 | DUGGIRALA SO | 522330 |

| 110 | DWARAKANAGAR S.O | 530016 |

| 111 | DWARAKATIRUMALA SO | 534426 |

| 112 | ECIL SO | 500062 |

| 113 | ELURU COLLECTORATE SO | 534006 |

| 114 | ELURU HO | 534001 |

| 115 | ELURU RAILWAY STATION SO(ELR) | 534005 |

| 116 | EMERECORDS SO | 500021 |

| 117 | ENGCOLLEGE SO | 533003 |

| 118 | FALAKNUMA SO | 500053 |

| 119 | FERTILIZER CITY | 505210 |

| 120 | G.L.PURAM S.O | 535523 |

| 121 | GACHIBOWLI PO | 500032 |

| 122 | GADWAL HO | 509125 |

| 123 | GAJAPATHINAGARAM | 535270 |

| 124 | GANAPAVARAM SO | 534198 |

| 125 | GANDHI BHAVAN PO | 500001 |

| 126 | GANDHICHOWK(KHM) SO | 507003 |

| 127 | GANDHIGRAM S.O | 530005 |

| 128 | GANDHINAGAR SO | 500080 |

| 129 | GANDHINAGARAM(VJA) | 520003 |

| 130 | GANNAVARAM SO | 521101 |

| 131 | GAZUWAKA S.O | 530026 |

| 132 | GEORGEPET S.O | 515004 |

| 133 | GIDDALUR | 523357 |

| 134 | GLPURAM SO | 535500 |

| 135 | GODAVARIKHANI SO | 505209 |

| 136 | GOKAVARAM SO | 533286 |

| 137 | GOLCONDA PO | 500008 |

| 138 | GOOTY | 515401 |

| 139 | GOOTY R.S | 515402 |

| 140 | GOPALAPATNAM | 530027 |

| 141 | GOVT DAIRY FARM S.O | 530040 |

| 142 | GUDIVADA HO | 521301 |

| 143 | GUDLAVALLERU | 521356 |

| 144 | GUDUR HO | 524101 |

| 145 | GUJVAIL | 502278 |

| 146 | GUNTAKAL HO | 515801 |

| 147 | GUNTUR BAZAR | 522003 |

| 148 | GUNTUR COLLECTORATE | 522004 |

| 149 | GUNTURHO | 522002 |

| 150 | GURAZALLASO | 522415 |

| 151 | H B COLONY S.O | 530022 |

| 152 | HAKIMPET SO | 500014 |

| 153 | HAL SO | 500042 |

| 154 | HANAMKONDA HO | 506001 |

| 155 | HANUMAN JUNCTION SO | 521105 |

| 156 | HIGHCOURT SO | 500066 |

| 157 | HILL COLONY S.O. | 508202 |

| 158 | HIMAYATNAGAR PO | 500029 |

| 159 | HIMMATNAGAR | 500025 |

| 160 | HINDUPUR HPO | 515201 |

| 161 | HIRAMANDALAM SO | 532459 |

| 162 | HMT TOWNSHIP SO | 500054 |

| 163 | HOLMESPET SO | 516360 |

| 164 | HUMAYUNNAGAR PO | 500028 |

| 165 | HUZURABAD HO | 505468 |

| 166 | HUZURNAGAR | 508204 |

| 167 | HYDERABAD GPO | 500001 |

| 168 | HYDERABAD JUBILEE HO | 500002 |

| 169 | IBLINES PO | 500031 |

| 170 | ICHCHAPURAM SO | 532312 |

| 171 | IDAJEEDIMETLA SO | 500055 |

| 172 | IE NACHARAM | 500076 |

| 173 | IEMOULAALI | 500040 |

| 174 | IICT SO | 500007 |

| 175 | INDRAPALEM SO | 533006 |

| 176 | INDURSTRIAL ESTATE (ELR) | 534007 |

| 177 | INDUSTRIAL ESTATE S.O | 530007 |

| 178 | IRRUM MANZIL COLONY PO | 500082 |

| 179 | JAGANNAICKPUR | 533002 |

| 180 | JAGGAMPETA | 533435 |

| 181 | JAGGAYYAPETA | 521175 |

| 182 | JAGTIAL HO | 505327 |

| 183 | JAMA-I-OSMANIA | 500007 |

| 184 | JAMMALAMADUGU | 516434 |

| 185 | JAMMIKUNTA SO | 505122 |

| 186 | JANGAON | 506167 |

| 187 | JANGAREDDYGUDEM HO | 534447 |

| 188 | JOGIPET SO | 502270 |

| 189 | JUBILEE HILLS PO | 500033 |

| 190 | JYOTHINAGAR SO | 505215 |

| 191 | K.M.COLLEGE | 506007 |

| 192 | KADIRI LSG SO | 515591 |

| 193 | KADIYAM SO | 533126 |

| 194 | KAIKALUR SO | 521333 |

| 195 | KAKINADA HPO | 533001 |

| 196 | KALIDINDI SO | 521344 |

| 197 | KALIKIRI SO | 517234 |

| 198 | KALUVOYA | 524343 |

| 199 | KALWAKURTHY SO | 509324 |

| 200 | KALYANDURG | 515761 |

| 201 | KALYANIKHANI SO | 504231 |

| 202 | KAMAKOTINAGAR | 520012 |

| 203 | KAMAREDDY HO | 503111 |

| 204 | KANCHANBAGH SO | 500058 |

| 205 | KANCHARAPALEM S.O | 530008 |

| 206 | KANCHIKACHERLA SO | 521180 |

| 207 | KANCHILI SO | 532290 |

| 208 | KANDUKURHPO | 523105 |

| 209 | KANEKAL | 515871 |

| 210 | KANIGIRI | 523230 |

| 211 | KANKIPADU SO | 521151 |

| 212 | KARIMNAGAR HO | 505001 |

| 213 | KARWAN SAHU PO | 500006 |

| 214 | KASIBUGGA SO | 532222 |

| 215 | KASIMKOTA SO | 531031 |

| 216 | KAVALI HO | 524201 |

| 217 | KAZIPET SO | 506003 |

| 218 | KD COLLECTORATE | 533001 |

| 219 | KD GANDHINAGAR | 533004 |

| 220 | KESHOGIRI SO | 500005 |

| 221 | KHAIRATABAD HO | 500004 |

| 222 | KHAMMAM HO | 507001 |

| 223 | KINGSWAY SO | 500003 |

| 224 | KNL BAZAR | 518001 |

| 225 | KNL BHAGYA NAGAR | 518004 |

| 226 | KNL CAMP B SO | 518002 |

| 227 | KNL CHOWK | 518001 |

| 228 | KODAD SO | 508206 |

| 229 | KODUR SO | 516101 |

| 230 | KOHIR SO | 502210 |

| 231 | KOILKUNTLA | 518134 |

| 232 | KOLLAPUR SO | 509102 |

| 233 | KOLLUR | 522324 |

| 234 | KONDAPALLI | 521228 |

| 235 | KORUKONDA SO | 533289 |

| 236 | KORUTLA SO | 505326 |

| 237 | KOTABOMMALI SO | 532195 |

| 238 | KOTANANDURU | 533407 |

| 239 | KOTHAGUDEM BAZAR | 507101 |

| 240 | KOTHAGUDEM COLLS HO | 507101 |

| 241 | KOTHAPATNAM | 523286 |

| 242 | KOTHAPETA MDG | 533223 |

| 243 | KOTHAPETA(GUNTUR) | 522001 |

| 244 | KOTHAVALASA SO | 535183 |

| 245 | KOVUR SO | 524137 |

| 246 | KOVVUR HO | 534350 |

| 247 | KOYYALAGUDEM SO (JRG) | 534312 |

| 248 | KPHB COLONY SO | 500072 |

| 249 | KUKATPALLY SO | 500072 |

| 250 | KULSUMPURA PO | 500067 |

| 251 | KUPPAM LSG SO | 517425 |

| 252 | KURICHEDU | 523304 |

| 253 | KURNOOL HPO | 518001 |

| 254 | KURNOOL MEDICAL COLLEGE | 518002 |

| 255 | L B COLONY S.O | 530017 |

| 256 | LAKKIREDDYPALLI | 516257 |

| 257 | LALAGUDA SO | 500017 |

| 258 | LAWYERPET | 523002 |

| 259 | LB NAGAR SO | 500074 |

| 260 | LIC DIVISION PO | 500063 |

| 261 | LINGAMPALLY PO | 500019 |

| 262 | LUNGER HOUSE PO | 500008 |

| 263 | M.L.STREET | 515009 |

| 264 | MACHAVARAM S.O | 520004 |

| 265 | MACHERLASO | 522426 |

| 266 | MACHILIPATNAM HO | 521001 |

| 267 | MADAKASIRA SO | 515301 |

| 268 | MADANAPALLE HO | 517325 |

| 269 | MADHIRA SO | 507203 |

| 270 | MADUGULA SO | 531027 |

| 271 | MAHARANIPETA S.O | 530002 |

| 272 | MAHBUBABAD HO | 506101 |

| 273 | MAHBUBNAGAR HO | 509001 |

| 274 | MALAKPET COLONY SO | 500036 |

| 275 | MALKAJGIRI SO | 500047 |

| 276 | MALKAPURAM S.O | 530011 |

| 277 | MANCHERIAL HO | 504208 |

| 278 | MANDAPETA | 533308 |

| 279 | MANDASA SO | 532242 |

| 280 | MANDIBAZAR | 506002 |

| 281 | MANGALAGIRI HO | 522503 |

| 282 | MANOVIKASNAGAR PO | 500009 |

| 283 | MANTHANI SO | 505184 |

| 284 | MANTRALAYAM LSG SO | 518345 |

| 285 | MANUGURU COLLS | 507117 |

| 286 | MARKAPUR | 523316 |

| 287 | MARRIPALEM S.O | 530018 |

| 288 | MARUTERU SO | 534122 |

| 289 | MEDAK HO | 502110 |

| 290 | MGROAD SO | 500003 |

| 291 | MIRYALAGUDA HO | 508207 |

| 292 | MORRISPET SO | 522202 |

| 293 | MUDINEPALLI SO | 521325 |

| 294 | MULUG | 506343 |

| 295 | MUMMIDIVARAM | 533216 |

| 296 | MUSHEERABAD DSO | 500020 |

| 297 | MUSHEERABAD NDSO | 500020 |

| 298 | MYDEKUR | 516172 |

| 299 | MYLAVARAM SO | 521230 |

| 300 | NAD S.O | 530009 |

| 301 | NAGARAM | 533247 |

| 302 | NAGARI SO | 517590 |

| 303 | NAGARKURNOOL SO | 509209 |

| 304 | NAGAYALANKA | 521120 |

| 305 | NAKKAPALLE SO | 531081 |

| 306 | NAKRIKAL SO | 508211 |

| 307 | NALGONDA HO | 508001 |

| 308 | NANDALUR SO | 516150 |

| 309 | NANDIGAMA SO | 521185 |

| 310 | NANDIKOTKUR | 518401 |

| 311 | NANDYAL | 518501 |

| 312 | NANDYAL RS LSG | 518502 |

| 313 | NARASANNAPETA SO | 532421 |

| 314 | NARASARAOPET | 522601 |

| 315 | NARASIMHARAOPETA SO (ELR) | 534006 |

| 316 | NARAYANGUDA PO | 500029 |

| 317 | NARAYANKHED SO | 502286 |

| 318 | NARSAMPET SO | 506132 |

| 319 | NARSAPUR SO | 502313 |

| 320 | NARSAPURAM SO | 534275 |

| 321 | NARSIPATNAM HO | 531116 |

| 322 | NAYUDUPETA | 524126 |

| 323 | NEHRU NAGAR | 500026 |

| 324 | NEKKONDA SO | 506122 |

| 325 | NELLIMARLA | 535217 |

| 326 | NELLORE HO | 524001 |

| 327 | NEW NALLAKUNTA SO | 500044 |

| 328 | NIDADAVOLE SO | 534301 |

| 329 | NIRMAL SO | 504106 |

| 330 | NISA HAKIMPET SO | 500078 |

| 331 | NIZAMABAD HO | 503001 |

| 332 | NIZAMABAD RS SO | 503003 |

| 333 | NRPETA | 518004 |

| 334 | NUZVID HO | 521201 |

| 335 | O.F. YEDDUMAILARAM SO | 502205 |

| 336 | OLD TOWN S.O | 515005 |

| 337 | ONGOLEHO | 523001 |

| 338 | OOTNUR SO | 504311 |

| 339 | P&T COLONY S.O | 530013 |

| 340 | P&T COLONY SO | 500060 |

| 341 | P.S.NILAYAM SO | 515134 |

| 342 | PADEROO SO | 531024 |

| 343 | PADMARAONAGAR | 500025 |

| 344 | PAKALA SO | 517112 |

| 345 | PALAKOL HO | 534260 |

| 346 | PALAKONDASO | 532440 |

| 347 | PALAMANER MDG | 517408 |

| 348 | PALASA SO | 532221 |

| 349 | PALONCHA SO | 507115 |

| 350 | PAMARRU | 521157 |

| 351 | PAMIDI | 515775 |

| 352 | PANAGAL SRIKALAHASTI | 517640 |

| 353 | PARCHURU | 523169 |

| 354 | PARISHRAM BHAVAN PO | 500001 |

| 355 | PARKALHO | 506164 |

| 356 | PARVATHIPURAM HO | 535501 |

| 357 | PATANCHERU SO | 502319 |

| 358 | PATHAPATNAM SO | 532213 |

| 359 | PATHIKONDA | 518380 |

| 360 | PATTABHIPURAM(GUNTUR) | 522006 |

| 361 | PAYAKARAO PETA SO | 531126 |

| 362 | PEDAGANTYADA S.O | 530044 |

| 363 | PEDAKURAPADU | 522402 |

| 364 | PEDANA S.O | 521366 |

| 365 | PEDAPADU SO | 534437 |

| 366 | PEDDAPALLI HO | 505172 |

| 367 | PEDDAPURAM | 533437 |

| 368 | PENDURTHY S.O | 531173 |

| 369 | PENUGONDA SO (TNK) | 534320 |

| 370 | PENUKONDA SO | 515110 |

| 371 | PERALA | 523157 |

| 372 | PIDUGURALLASO | 522413 |

| 373 | PILER SO | 517214 |

| 374 | PITHAPURAM | 533450 |

| 375 | PODALAKUR | 524345 |

| 376 | PODILI | 523240 |

| 377 | POLAVARAM SO | 534315 |

| 378 | PONDURU SO | 532168 |

| 379 | PONNUR | 522124 |

| 380 | PORUMAMILLA S.O | 516193 |

| 381 | PRATHIPADU | 522019 |

| 382 | PRODDATUR | 516360 |

| 383 | PULIVENDLA | 516390 |

| 384 | PUNGANUR LSG SO | 517247 |

| 385 | PURGI SO | 501501 |

| 386 | PUTLIBOWLI PO | 500095 |

| 387 | PUTTUR-CTR SO | 517583 |

| 388 | R.C.PURAM HE MDG | 502032 |

| 389 | RAILNILAYAM SO | 500071 |

| 390 | RAJAHMUNDRY | 533101 |

| 391 | RAJAM SO | 532127 |

| 392 | RAJAMPET HO | 516115 |

| 393 | RAJANAGARAM | 533294 |

| 394 | RAJENDRANAGAR SO | 500030 |

| 395 | RAMACHANDRAPURAM HO | 533255 |

| 396 | RAMAGUNDAM SO | 505208 |

| 397 | RAMAKRISHNAPURAM SO | 504301 |

| 398 | RAMANAGAR | 515008 |

| 399 | RAMKOTE PO | 500095 |

| 400 | RAMPACHODAVARAM SO | 533288 |

| 401 | RAVINDRANAGAR SO | 516003 |

| 402 | RAVULAPALEM | 533238 |

| 403 | RAYACHOTY S.O | 516269 |

| 404 | RAYADURG | 515865 |

| 405 | RAYAVARAM SO | 533346 |

| 406 | RAZOLE HPO | 533242 |

| 407 | REC | 506004 |

| 408 | RENIGUNTA LSGSO | 517520 |

| 409 | REPALLE MDG | 522265 |

| 410 | RKPURAM SO | 500056 |

| 411 | RLY.W.W.SHOP SO | 521241 |

| 412 | S.V.UNIVERSITY SO | 517502 |

| 413 | SADASIVPET SO | 502291 |

| 414 | SAHIFA SO | 500024 |

| 415 | SAIDABAD | 500059 |

| 416 | SAINIKPURI SO | 500094 |

| 417 | SALUR SO | 535591 |

| 418 | SAMALKOT | 533440 |

| 419 | SAMARLKOT | 533440 |

| 420 | SANATHNAGAR IE | 500018 |

| 421 | SANGAREDDY HO | 502001 |

| 422 | SANKARAPURAM S.O | 516002 |

| 423 | SANTHAMAGULUR | 523302 |

| 424 | SAP CAMP | 518003 |

| 425 | SAROORNAGAR SO | 500035 |

| 426 | SATHUPALLI SO | 507303 |

| 427 | SATHYAVEDU SO | 517588 |

| 428 | SATTENAPALLEHO | 522403 |

| 429 | SATYANARAYANAPURAM | 520011 |

| 430 | SBH PO | 500001 |

| 431 | SBI PO | 500095 |

| 432 | SECUNDERABAD HO | 500003 |

| 433 | SHADNAGAR SO | 509216 |

| 434 | SHAKKARNAGAR SO | 503180 |

| 435 | SHAMSHABAD | 501218 |

| 436 | SHREERAMNAGAR SO | 535101 |

| 437 | SIDDIPET HO | 502103 |

| 438 | SIMHACHALAM S.O | 530028 |

| 439 | SINGARAYAKONDA | 523101 |

| 440 | SIRPURKAGAZNAGAR SO | 504296 |

| 441 | SIRSILLA SO | 505301 |

| 442 | SITHAPHALMANDI SO | 500061 |

| 443 | SIVARAOPET | 534202 |

| 444 | SOMAJIGUDA PO | 500082 |

| 445 | SOMPETA SO | 532284 |

| 446 | SOUTH BANJARA HILLS PO | 500033 |

| 447 | SR NAGAR PO | 500038 |

| 448 | SRIHARIKOTA RANGE | 524124 |

| 449 | SRIKAKULAM HO | 532001 |

| 450 | SRIKALAHASTI HPO | 517644 |

| 451 | SRINAGAR COLONY PO | 500073 |

| 452 | SRIRAMNAGAR | 533105 |

| 453 | SRISAILEM | 518101 |

| 454 | SRUNGAVARAPUKOTA | 535145 |

| 455 | SS DAM EAST | 518102 |

| 456 | STN.JADCHERLA HO | 509301 |

| 457 | STN.KACHIGUDA HO | 500027 |

| 458 | STONEHOUSEPETA SO | 524002 |

| 459 | SUBEDARI | 506001 |

| 460 | SUBHASHNAGAR SO | 503002 |

| 461 | SULLURPETA | 524121 |

| 462 | SURYAPET HO | 508213 |

| 463 | SWARAJYANAGAR PO | 500018 |

| 464 | TADEPALLE | 522501 |

| 465 | TADEPALLIGUDEM HO | 534101 |

| 466 | TADPATRI | 515411 |

| 467 | TANDUR | 501141 |

| 468 | TANGUTUR | 523274 |

| 469 | TANUKU HO | 534211 |

| 470 | TEKKALI HO | 532201 |

| 471 | TENALI HO | 522201 |

| 472 | THORRUR SO | 506163 |

| 473 | TIRUMALA SO | 517504 |

| 474 | TIRUPATHI NORTH SO | 517507 |

| 475 | TIRUPATI HO | 517501 |

| 476 | TIRUVURU S.O | 521235 |

| 477 | TRIMULGHERRY HO | 500015 |

| 478 | TRUNK ROAD SO | 524005 |

| 479 | TUNI | 533401 |

| 480 | UDAYAGIRI SO | 524226 |

| 481 | UKKUNAGARAM S.O | 530032 |

| 482 | UNDI SO | 534199 |

| 483 | UPPAL SO | 500039 |

| 484 | URAVAKONDA | 515812 |

| 485 | V.A.PURI | 506009 |

| 486 | VAISHALINAGAR SO | 500079 |

| 487 | VANASTHALIPURAM SO | 500070 |

| 488 | VAYALPAD SO | 517299 |

| 489 | VEERAGHATTAM SO | 532460 |

| 490 | VEMULAWADA SO | 505302 |

| 491 | VENGALRAONAGAR PO | 500038 |

| 492 | VENKATAGIRI TOWN | 524132 |

| 493 | VENKATESWARAPURAM(VJA) | 520010 |

| 494 | VENKATRAOPETA SO (ELR) | 534002 |

| 495 | VIDYANAGAR SO | 500044 |

| 496 | VIJAYANAGAR COLONY PO | 500057 |

| 497 | VIJAYAWADA HPO | 520001 |

| 498 | VIKARABAD HO | 501101 |

| 499 | VINJAMOOR SO | 524228 |

| 500 | VINUKONDASO | 522647 |

| 501 | VISAKHAPATNAM H.O | 530001 |

| 502 | VISALAKSHINAGAR S.O | 530043 |

| 503 | VIZIANAGARAM HO | 535002 |

| 504 | VIZIANAGARAMCANTT SO | 535003 |

| 505 | VIZIANAGARAMCITY | 535001 |

| 506 | VJA POLYTECHNIC | 520008 |

| 507 | VM BUS STATION S.O | 530020 |

| 508 | VM NAVAL BASE S.O | 530014 |

| 509 | VM PORT S.O | 530035 |

| 510 | VM STEEL PROJECT S.O | 530031 |

| 511 | VTPS SO | 521456 |

| 512 | VULLITHOTA | 533101 |

| 513 | VUYYURU | 521165 |

| 514 | WALTAIR RS H.O | 530004 |

| 515 | WANAPARTHY HO | 509103 |

| 516 | WARANGAL HO | 506002 |

| 517 | WCTCHYDRO | 506363 |

| 518 | WCTCRO | 506313 |

| 519 | WPCTC VISAKHAPATNAM | 530013 |

| 520 | YAKUTPURA SO | 500023 |

| 521 | YANAM | 533464 |

| 522 | YELESWARAM | 533429 |

| 523 | YELLAMANCHILI SO | 531055 |

| 524 | YELLANDU SO | 507123 |

| 525 | YELLAREDDY SO | 503122 |

| 526 | YEMMIGANUR | 518360 |

| 527 | YERRAMUKKAPALLE S.O | 516004 |

| 528 | YOUSUFGUDA PO | 500045 |

| 529 | ZAHEERABAD HO | 502220 |

| 530 | ZAMISTANPUR | 500020 |

| ||||

No comments:

Post a Comment