LIST OF BANKS USING FINACLE WORLDWIDE

Finacle is the universal banking solution of choice of all leading banks and large regional banks across the world. Leading universal, retail and corporate banks worldwide leverage the power of Finacle to transform their business.

Banks using Finacle Platform are spread across 78 countries globally from Far East Asia to Middle East and Western Europe as the following stats depicts.

Following Banks are using Finacle , The list is large but we brought you some of leading Banks using this Platform.

- India Post

- ALEXBANK,

- ANZ BANK,

- ARAB NATIONAL BANK,

- BANK DHOFAR,

- CO-OPERATIVE FINANCIAL SERVICES,

- CREDIT SUISSE,

- DBS BANK,

- EMIRATES BANK,

- FIRST BANK OF NIGERIA,

- HATTON NATIONAL BANK,

- ICICI BANK,

- NATIONAL AUSTRALIA GROUP EUROPE,

- NYKREDIT,

- POSTBANK UGANDA LTD,

- RAIFFEISSENBANK,

- SOCIÉTÉ GÉNÉRALE

- ZURICH FINANCIAL SERVICES.

- ABN AMRO

- NATIONAL COMMERCIAL BANK OF SAUDI ARABIA

- MIZUHO CORPORATE BANK

- FEDERAL BANK

- BANK OF INDIA

- BANK OF BARODA

- ANDHRA BANK

- PUNJAB NATIONAL BANK

- UNION BANK OF INDIA

- IDBI BANK

- INDUSIND BANK

- SBI INTERNATIONAL OPERATION

- VIJAYA BANK

- UCO BANK

- ING Vysya Bank Ltd.

- Oriental Bank Of Commerce

Thanks to finaclesolution.blogspot.in

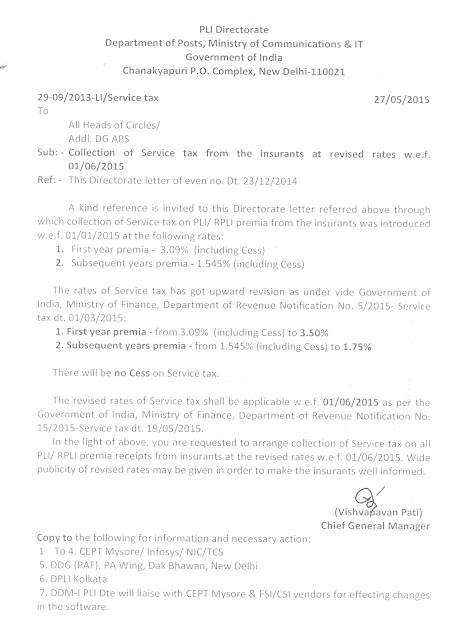

REVISION OF SERVICE TAX ON PLI W.E.F 01.06.2015 - PLI DIRECTORATE ORDER

PLI Directorate decided to increase the service tax on PLI with effect from 01.06.2015. The rates of Service Tax got upward revision as under vide Government of India, Ministry of Finance, Department of Revenue Notification No 5/2015-Service tax dt. 01-03-2015.

- Revised ST For First year Premium is 3.50% (revised from 3.09%)

- Revised ST for Renewal Premium is 1.75% (revised from 1.545%)

There will be no Cess on Service Tax

The revised rates of ST shall be applicable w.e.f 01.06.2015 as per Government of India, Ministry of Finance , Department of Revenue Notification No 15/2015- Service tax dt. 19.05.2015

The order issued by PLI Directorate regarding this subject is given below for reference.