POST SHOPPE AT BANGALORE GPO

The Post Shoppe is basically aimed at bringing various items of selected consumer utility products on sale under one roof at Bangalore GPO. The Post Shoppe is now initially designed for the stationery products, philately frames, books from National Book Trust in Kannada, Hindi and English, coffee mugs with zodiac designs on it, light refreshments, beverages like coffee, tea, boost etc, envelopes, Greeting cards, HMT watches, Delight Solar lamps, Xerox, etc. The Post Shoppe is designed with a capacity for vertical and horizontal expansion.

All products available in the Post Shoppe are for sale on MRP rates only.

It is also proposed to expand on the basis of feedback from the customers on their needs and also to create a platform for various organizations if approached with the approval of Chief Postmaster General, Karnataka Circle, Bangalore 560001.

This is a Karnataka Circle endeavor to provide a shelf for the intellectual, aesthetic and utility products for the customer’s benefit. The Post Shoppe will be operated by Manager Post Shoppe. The primary objective of this Post Shoppe is Customer delight.

ABOUT THE FUNCTION

The Inauguration function was held in the hall of Bangalore GPO on 10.12.13 at 11.00 hours. Welcome address was made by Shri Ashutosh Kumar Hanjura, Chief Postmaster, Bangalore GPO. The Shoppe was inaugurated by Shri Raghavendra H Auradkar, Commissioner of Police, Bangalore City by lighting the lamp to mark the inauguration jointly with Smt Arundhati Ghosh, Postmaster General, South Karnataka Circle and Smt Veena Srinivas Postmaster General, Business Development, Bangalore.

The Post Shoppe is the brain child of Shri M.S.Ramanujan, the Chief Postmaster General, Karnataka Circle, Bangalore 560001.

During the address, the Chief Guest Shri Auradkar commended the new changes being brought into the Post offices. He intimated that he is in habit of using Speed Post until date and expressed his pleasure in continuing the usage. He also intimated his experience in private courier where there were pilferages in a case under his investigation. He assured that his office would procure the stationery items from the Post Shoppe. He wished the Post Shoppe a great success.

Vote of thanks extended by Shri Dinesh Khare, Deputy Chief Postmaster, Bangalore GPO

Transfers/Postings of JAG officers of IPoS, Group'A'.

Click here to view Directorate memo no 2-8/2013-SPG dated 06.12.2013 on the above subject matter.

Declination of Promotion to PS Group B Cadre

It was informed by GS IP/ASP association that the following Inspector Line officials appointed on regular basis in Postal Services Gr. B cadre vide Directorate memo No. 9-33/2013-SPG dated 10.10.2013 are stated to be declined their promotion.

Sl. No.

|

Name of the officer

|

Cast

|

Present Circle

|

Circle of posting on promotion

|

9

|

Shri K. Soorappan

|

ST

|

Tamil Nadu

|

Kerala

|

11

|

Shri T. Amudha Ganesan

|

-

|

Tamil Nadu

|

Maharashtra

|

19

|

Shri N. P.Sampath

|

-

|

Tamil Nadu

|

Maharashtra

|

30

|

Shri S. Subba Rao

|

-

|

Tamil Nadu

|

Delhi

|

34

|

Shri R. Ismail

|

-

|

Tamil Nadu

|

Delhi

|

73

|

Shri S. Sanmugham

|

SC

|

Tamil Nadu

|

Tamil Nadu

|

75

|

Shri D.V. Mahidhar

|

-

|

Andhra Pradesh

|

Delhi

|

140

|

Shri A.N. Sushir

|

ST

|

Maharashtra

|

Maharashtra

|

145

|

Shri G.M. Nandanwar

|

ST

|

Maharashtra

|

Maharashtra

|

146

|

Shri M.R. Sakpal

|

ST

|

Maharashtra

|

Maharashtra

|

LSG Promotions to Sorting Assistants

Transfers & Postings in PS Group B cadre

RO, Vijayawada has ordered the following transfers and postings in PS Group B Cadre vide memo dated 04.12.2013.

Sl no

|

Name of the officer

|

Present post held

|

Posting on Transfer

|

1

|

M.Hari Prasad Sharma

|

SPOs Guntur Dn & apptd SP PSD Vijayawada

|

Dy SP o/o SSPOs Vijayawada

|

2

|

J.Srinivasulu

|

Dy Sp o/o SSPOs Vijayawada

|

SP PSD Vijayawada

|

3

|

D.Satyanarayana

|

SPOs Rajmundry & Apptd SPos Machilipatnam

|

SPOs Guntur Dn

|

4

|

Y.Ramakrishna

|

SPOs Hanumkonda & Apptd SPOs Guntur

|

SPOs Machilipatnam Dn

|

ARITHMETIC SHORT CUT METHODS WITH EXAMPLES

This material compiled by Akula. Praveen Kumar, SPM, Papannapet Sub Office-502 303, Medak Division, Andhra Pradesh (9849636361, 8019549939)

Disclaimer:- Author of blog does not accepts any responsibility in relation to the accuracy, completeness, usefulness or otherwise, of the contents.

Disclaimer:- Author of blog does not accepts any responsibility in relation to the accuracy, completeness, usefulness or otherwise, of the contents.

To download... Pl click below link

Time and Work: Short Cuts

Short Cut 1:

If A and B can do a piece of work in “x” days, B and C in y days and C and A in z days. Then A, B and C can together do the work in:

Example 1:

If A and B can do a piece of work in 12 days, B and C in 15 days and C and A in 20 days. In how many days will, all of them working together would take complete the work?

Solution:

Here x= 12, y= 15 and z= 20,

Putting values in formula:

Answer: 10 days

Short Cut 2:

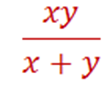

If A can do a work in x days, B can do the same work in y days. Together A and B can do the same work in:

Example:2

If Ram can do a piece of work in 20 days, Shayam can do the same work in 30 days, in how many days Ram and Shayam will together do the work?

Solution: Here x= 20 and y= 30, putting values in formula we get:

Short Cut 3:

If A, B and C respectively can finish a work in x, y and z days, then all of them together would finish the work in following days:

Example 3:

Amar, Akbar and Anthony can finish a work in 10, 15 and 20 days respectively. If they all work together, then in how many days, they will be able to finish the work?

Solution: Here x= 10, y=15 and z= 20 Putting the values in the formula:

Answer= 4.61 days

If a worker takes T units of time to complete a work W, then the rate of work R is given by R = W/T and so T = W/R.

W and R are directly proportional, when T is constant

W and T are directly proportional when R is const

Formulas:

tA = time taken by A to complete the work

tB = time taken by B to complete the work

t(A+B) = time taken by both A and B to complete the work

- t(A+B) = (tA * tB)/(tA+tB)

- tB = (tA * tA+B)/tA – (tA+B)

- tA+B+C =L/[(L/tA) + (L/tB) + (L/tC) ];L =>L.C.M of tA, tB, tC.

- If A+B, B+C, A+C are given then A+B+C=?

§ tA+B+C = 2L/[ (L/tA+B) + (L/tB+C) + (L/tC+A) ]

§ tA = [(tA+B+C)*(tB+C)]/[ (tB+C)- (tA+B+C) ]

§ tB = [(tA+B+C)*(tA+C)]/[ (tA+C)- (tA+B+C) ]

§ tC = [(tA+B+C)*(tA+B)]/[ (tA+B)- (tA+B+C) ]

- (M1*T1) /W1 = (M2*T2)/W2

§ M be the number of men’s

§ T be the number of days/ hours

§ W be the work done by the men

§

- w(A+B = wA*wB /(wA+wB)

Example 1:

If a worker takes 10 hours to complete a work, his rate of work or the work done per hour is 1/10 of the work.

Similarly, if the rate of work is 1/15, it would take 15 hours to complete the work.

Example 2:

Worker A takes 8 hours to do a job. Worker B takes 10 hours to do the same job. How long should it take both A and B, working together but independently, to do the same job?

By formula 1,

t(A+B) = (tA * tB)/(tA+tB) = 8*10/(8+10) = 40/9 hours.

Example 3:

A and B together can complete a piece of work in 4 days. If A alone can complete the same work in 12 days, in how many days can B alone complete that work?

By formula 2,

tB = (12*4 )/(12-4) = 6 days.

Example 4:

A and B can do a piece of work in 18 days: B and C can do it in 24 days; A and C can do it in 36 days. In how many days will A,B and C finish it, working together and separately?

By formula 4,

Working together,

- tA+B+C = 2L/[ (L/tA+B) + (L/tB+C) + (L/tC+A) ]

t(A+B+C) = 2*48/[(48/18)+(48/24)+(48/36)] =16 days

Working separately,

- tA = [(tA+B+C)*(tB+C)]/[ (tB+C)- (tA+B+C) ]

tA = [16*24]/[24-16] = 48 days,

tB = [16*36]/[36-16] = 144/5 days,

tC = [16*18]/[18-16] = 144 days.

Example 5:

The IT giant Tirnop has recently crossed a head count of 150000 and earnings of $7 billion. As one of the forerunners in the technology front, Tirnop continues to lead the way in products and services in India. At Tirnop, all programmers are equal in every respect. They receive identical salaries and also write code at the same rate. Suppose 12 such programmers take 12 minutes to write 12 lines of code in total. How long will it take 72 programmers to write 72 lines of code in total?

By formula : (M1 * T1)/ W1 = (M2 * T2)/ W2

12*12/12 = 72*X/72 :: X = 12

Example 6:

A and B working separately can do a piece of work in 9 and 12 days. If they work for a day alternatively, A beginning, in how many days, the work will be completed?

Explanation:

t(A+B) = (tA * tB)/(tA+tB)

Work done by A in one day, tA= 1/9 day

Work done by B in one day, tB = 1/12 day

They are working alternatively,

Ist day, A’s work is 1/9 and 2nd day, B’s work is 1/12.

In two days work done by A and B , t (A+B) = 7/36.

Every two days work done is increasing evenly, so we can calculate in pair of days.

Work done in 5 pair of days = 5* (7/36) =35/36.

Remaining work = 1-35/36 = 1/36.

On 11th day, A’s turn:

1/ 9 work is done by A in one day.

1/36 work is done by A in (9*1/36)=1/4 day.

Therefore time taken to complete the work =10 ¼ days.

Short Cut: Clocks

Short Cut 1

Between x and (x+1) o’clock, the two hands will be together at :

Example:

At what time between 11 and 12 o’ clock, the minute hand and hour hand would be together?

Solution:

Here x= 4 so putting the formula we get:

The both hands will be together at 60 minutes past 11 o’clock.

Short Cut 2:

Between x and (x+1) O’ clock, the two hands will be ‘t’ minutes apart at

Past x.

Example: At what time between 4 and 5 o’clock the hands are 2 minutes space apart?

Solution: Here x= 4

So, Case 1: = 24 minutes past 11

Case 2: = 19.63 minutes past 11

Short Cut 3

Between x and x+1 o’clock the two hands are at right angle at :

Ratio & Proportion

Ratios :

- Two quantities are in the ratio a : b => if the first quantity is ax, then the second quantity is bx.

- The ratio a : b is the same as a/b.

- If two quantities are in the ratio of a : b, then the first quantity is a/(a + b) times the sum of the two quantities and the second quantity is b/(a + b) times the sum of the two quantities.

Steps in comparison of Ratios:

- Convert the ratios into fractions.

- Compare the fractions by equalizing the denominator.

Proportions:

- Product of means = Product of Extremes.

A: B :: C:D <==> B*C = A*D

- Mean proportional: Mean proportional between a and b is sqrt (ab).

- Third proportional: If a:b = b:c, then c is called the Third Proportional to a,b.

- Fourth Proportional:If a:b = c:d, then d is called the Fourth Proportional to a,b,c.

Componendo and dividendo:

- if (a/b) = (c/d), then [(a+b)/(a-b)] = [(c+d)/(c-d)]

Some other tricks :

(a+b)/b = (c+d)/d

- (a-b)/b = (c-d)/d

- a/c = b/d

Example 1:

The statement, ‘Father’s salary and the son’s salary are in the ratio 5 : 3.’ implies the following:

If father’s salary is Rs.5000, the son’s salary is Rs.3000.

- If father’s salary is Rs.7500, the son’s salary is Rs.4500.

- If father’s salary is 5x, the son’s salary is 3x.

Example 2:

The weights of two rods are in the ratio 9:7. Their total weight is 256g, find the weight of each rod?

Given total weight: 256g

Ratio is 9:7

From the Formula,

Weight of first rod = [9/(9+7)]*(256) = 144

Weight of Second rod = [7/(9+7)]*(256) = 112

So the weight of each rod is 144g and 112g.

Example 3:

Two alloys copper and tin are in the ratio of 5:6 and 7:11.Which of them contain more copper ?

Ratio of copper and tin in 1st alloy 5:6 = 5/6

Ratio of copper and tin in 2nd alloy 7:11 = 7/11

The denominator values of the two ratios are 6,11 respectively. Now we have to wquate the denominator value in both the ratios.

(5/6) * (11/11) = 55/66

(7/11)*(6/6) = 42/66

So 5/6 >7/11.

Hence , I alloy contains more copper than II alloy.

Example 3:

If x:y = 2:3, y:z = 4:3, then find x:y:z ?

Here. Y is common to both the ratios. So we have to make equal value of y in both the ratios. In the first and second ratio the values of y are 3 and 4 respectively. Multiply the first ratio by 4 and second ratio by 2. i.e.,

x:y = 2*4 : 3:4 = 8:12

y:z = 4*3 : 3*3 = 12:9

hence x:y:z = 8:12:9

Example 4:

If two numbers are in the ratio 3:5,when 6 is added to each term of the ratio , it becomes 2:3, then the numbers are ?

Let the numbers be a,b respectively. Given that a:b = 3:5

a=3k,b=5k , where k is a common factor of both a,b.

(3k + 6)/(5k+6) = 2/3

9k+18 = 10k + 12==> k= 6

Hence the numbers are (3*6) = 18 and (5*6) = 30 respectively.

Short Cut 1

If the sum of two numbers is A and their difference is a, then the ratio of the numbers is given by:

A+a:A-a

Example 1

The sum of two numbers is 36 and their difference is 6. What is the ratio of the numbers?

Solution 1

Here, A= 36 and a = 6,

Putting the value in equation:

A+a:A-a

Answer: 7:5

Short Cut 2:

A number which when added to the terms of the ratio a:b makes it equal to the ratio c:d is:

Find the number which when added to the terms of the ratio 13:28 makes it equal to the ratio 1:2.

Solution 2

Here a: b= 13:28 and c:d= 1:2

Putting the values in the equation:

Short Cut: 1

The number which when multiplied by x is increased by “y” is given by:

Example: 1

Find the number which when multiplied by 10 is increased by 261?

Solution Here, x= 10 and y= 261. Putting the values in equation:

Short Cut 2:

In case of partnership, if investment of three partners are in ratio a:b:c and the timings are in ratio x:y:z then the profit are in the ratio:

ax: by: cz

Example 2:

A,B and C invested capitals in the ratio 5:6:8. The investment timing is in ratio 2:3:4. Find the ratio of the profits?

Solution:

Here, a=5, b=6, c=8 and x=2, y=3, z=4. Putting the values in equation:

ax: by: cz

Answer: 10: 18: 32

Averages

Short Cut 1

Example 1:

The average marks obtained by 90 candidates in a certain examination is 38, if the average marks of passed candidates is 40 and that of the failed candidates is 30, what is the number of candidates who passed the exam?

Solution:

Answer= 72

Short Cut 2

The average of marks obtained by ‘n’ candidates in a certain examination is ‘T’. If the average marks of passed candidates is “P” and that of failed candidates is “F”. Then the number of candidates who passed the exam is given by:

Example 2:

The average marks obtained by 90 candidates in a certain examination is 38, if the average marks of passed candidates is 40 and that of the failed candidates is 30, what is the number of candidates who failed the exam?

Solution:

Answer: 18

Short Cut 1:

If the average age/weight/height etc of “n” objects is “x” and the average of “m” objects is “y” then the average of all of them put together in a single group is:

Example 1:

The average age of 20 girls in a college is 21 years while the average age of 25 boys of the same same college is 22 years. Find the combine average of the group.

Solution:

n= 20, m= 25, x= 21 and y = 22

Answer = 21.56

Short Cut 2:

In a group if the average age/weight/height etc of “n” objects is “x”, and the average age/weight/height etc of “m” objects out them in the group is “y”, then the average age/weight/height etc of remaining “n-m” objects is::

Example 2:

A group of 20 girls has average age of 12 years. Average age of first 12 from the same group is 13 years. What is the average age of remaining 8 girls in the group.

Solution:

where n= 20, m= 12, x= 12, y = 13.

Answer= 10.5

If the average age/weight/height etc of “n” objects in a group is “x” and out of them 1 object is added, as a result of this addition the average of the group becomes “y”. Then the age/weight/height etc of the new entrant is:

Example 3:

The average age of 30 boys in a class is equal to 13 years. When the age of the class teacher is included the average become 15 years. Find the age of the teacher.

Solution:

The age of the entrant is given by:

(30(15-13) + 15) = 75

Example 4:

In an old age home the average age of 10 inmates is 65 years. On Sunday the grandson of an inmate visited the old age home. The average age with the arrival of grandson becomes 60 years. What was the age of the grandson?

Solution:

The age of the entrant is given by:

Here, n=10; y= 60; x= 65

(10(60-65) + 60) = 10

Average = (Sum of observations / Number of observations)

Some important formulas to remember :

- Average of first ‘n’ natural numbers = (n+1)/2

- Average of the squares of the first ‘n’ natural numbers = [(n+1)(2n+1)]/6

- Average of the cubes of the first ‘n’ natural numbers = [n2(n+1)2]/4

- Average of the first ‘n’ even natural numbers = n

- Average of the first ‘n’ odd natural numbers = (n+1)

- A man travels a certain distance at ‘x’ kmph and an equal distance at ‘y’ kmph. Then the average speed during whole journey = (2xy/(x+y))kmph.

- Average of ‘n’ average is not equal to the { (sum of ‘n’ averages )/ ‘n’ }.

Properties :

- If all values are increased or decreased by a certain quantity, the average also increases or decreases by the same quantity.

- If all values are multiplied or divided by a certain quantity, the average also gets multiplied or divided by the same quantity.

- When a new value X is added to a set of B values with average A, if the average increases by Y, then the added value X = A + (B + 1)Y.

- When a new value X is added to a set of B values with average A, if the average decreases by Y, then the added value X = A – (B + 1)Y.

- When a value X is removed from a set of B values with average A, if the average increases by Y, then the the deleted value X = A – (B – 1)Y.

- When a value X is removed from a set of B values with average A, if the average decreases by Y, then the deleted value X = A + (B – 1)Y.

Example 1:Find the average of first 20 natural numbers ?

By formula 1, Average of first 20 natural numbers = 21/2 = 10.5

Example 2:A batsman makes a score of 87 runs in the 17th inning and thus increases his average by 3. Find his average after 17th innings?

Hints: These type of problems , we need to find the sum values and then we have to do the calculation.

Initially batsman average be X i.e., average of 16 innings. After he scores 87 runs in 17th innings , the average increases to X+3.

Score obtained by batsman in 16 innings = 16X ………1

Score obtained by batsman in 17 innings = 17(X+3) ………2

or Score obtained by batsman in 17 innings = 16X + 87 ………3

Equating 2 and 3 , we get : 17(X+3) = 16X + 87

X = 36; Average after 17th innings (X+3) = 39

Shortcut : By property 4: X = A + (B + 1)Y

X be the added value = 87

A be the average before adding value = C

B be the number of innings before his average gets increased = 16

Y be the value which the average increases = 3

we get A = 36 ,then the final value (C+3) is 39.

Profit & Loss

Short Cut 1:

If a seller by selling N articles, gains or losses the cost price of n articles, then the gain or loss percentage is calculated as:

Example 1:

By selling 240 mangoes a fruit seller gains the cost price of 40 mangoes. What is the profit percentage?

Solution:

Answer: 16.67%

Short Cut 2:

If a seller sells an article at Rs “A” after giving x% discount on the mark price. Had he not given the discount, he would have earned a profit of y% on the cost price. The cost price is given by:

Example 2:

A shopkeeper sold certain articles at Rs 425 each after giving a discount of 15% on the marked price. Had he not given the discount, he would have earned a profit of 25% on the cost price, find the Cost Price of each article?

Solution:

Here A= 425, x= 15, y= 25

Short Cut 1:

If the cost price of x articles is equal to the selling price of y articles, then the profit percentage is given by:

Example 1:

If Sudha sells 18 articles at the cost price of 24 articles. Find her profit percentage?

Solution:

Here, x= 24 and y= 18

Answer= 33.3%

Short Cut 2:

A man purchases a certain number of articles at x a rupee and the same number at y a rupee. He mixes them together and sells them at z per rupee. Then his gain or loss percentage is given by:

Example 2:

A man purchases a certain number of oranges at 7 per rupee and the same number at 15 per rupee. He mixes them together and sells them at 12 per rupee. Determine his profit or loss percentage.

Solution:

Answer: 20.45% at Loss

By selling an article for Rs A, a dealer makes a profit of x%. If he wants to make profit of y%, then he must increase his selling price by Rs:

Short Cut 1

If a shopkeeper wants to earn x% profit on an article after offering y% discount to the customer, to arrive at label price, the marketed price should be increased by following percentage:

Example

If a dealer wants to earn 20% profit on an article after offering 50% discount to the customer, by what percentage should he increase his marked price to arrive at a label price?

Solution:

Here, x=20%, y=50%

Answer= 140%

Short Cut-2

If a seller uses “X” gm in place of 1000 gm to sell his goods and gains a profit of y% on cost price, then his actual gain or less percentage is:

According as the sign is negative or positive.

Example:

A seller uses 840 gm in place of 1 kg to sell his goods. Find his actual % profit or loss, when he sells his article on 4% gain on cost price.

Solution:

X = 840 gm, y=4

We get= 18.6%

Short Cut 3

A dishonest seller sells the goods at x% loss on the cost price but uses y% less weight to weigh the goods, than his percentage profit or loss is:

Example:

A dishonest dealer sells the goods at 10% loss on cost price but uses 20% less weight. What is the percentage profit or loss?

Solution:

Here x= 10%, y= 20%

We get= 12.5%

Formulas such as ,

- Profit = S.P – C.P :: S.P >C.P

- Loss = C.P – S.P :: C.P > S.P

- Profit % = (Profit / C.P )*100 or

- Profit % = {(S.P – C.P)/C.P }*100

- Loss % = (Loss / C.P )*100 or

- Loss % = {(C.P – S.P)/C.P }*100

- S.P = {(100+Gain % )/100}*C.P or

- C.P = {100 / (100+gain %)}*S.P

- S.P = {(100-Loss % )/100}*C.P or

- C.P = {100 / (100-Loss %)}*S.P

- When a Person sells two similar items, one at a gain of x% and the other at a loss of x%, then the seller always incurs a loss of is :

Loss % = {(Common Loss and Gain %)/ 10 }2 = (x/10)2

- When a Person buys two similar items, sells one at a gain of x% and the other at a loss of x%, then the seller incurs no gain no loss

- If a trader profess to sell his goods at cost Price, But uses false weights, then

Gain % = {(error)/ ((True Value)-(Error))}*100 %

Important Points to remember that :

- Profit % and Loss % is fully based on Cost Price alone .

Profit =10% i.e. 10% of Cost Price is Profit .This is the meaning of 10% Profit.

- Discount is fully based on the Market Price/Retail Price/List Price.

Discount = 10% i.e. 10% on Market Price is Discount .This is the meaning of 10% Discount.

- Doubling the price and then reducing it by 50% does not yield 50% profit – the net effect is no-profit-no-loss.

- Successive discounts of 10%, 20% and 30% does not yield an overall 60% discount –the actual total is only 49.6%.

- Successive discounts of 25%, 10% and 5% is not the same as successive discounts of 20%, 15% and 5% although both add up to 40%. The actual total discounts are 35.875% and 35.4% respectively.

- A is 200% of B => A = 2B. But A is 200% more of B = >A = 3B. Similarly, P is twice as old as Q => P’s age = 2 × Q’s age, but A is twice older than B = >A’s age = 3 × B’s age.

Example:

1.A man buys an article for Rs.27.50 and sells it for Rs.28.60.Find his gain percent ?

Buys denotes the cost price , c.p = 27.50

Sells denotes the selling price, s.p = 28.60

For finding the profit % by two methods.

- find the profit and apply on (3) profit % formula

- Directly apply in 7 th formula.

Decide which is easy for you .

First method

Profit = 28.60 – 27.50 = 1.10

Profit % = (1.10 / 27.50)*100 = 4%

Second Method

60. = ((100 + gain% )/100 }27.50

(28.60*100 )/27.50 = 100 + gain %

Gain % = 104-100 = 4%

2.John bought a satellite radio for rs 4,000 and sold it at a loss of 5% due to unavoidable circumstances.Find his Selling Price ?

Cost Price = 4000

Loss = 5 %

From the formula 7 ,we can get it directly ,

Selling Price = rs3800.

3.If the cost Price of two articles is 1000 each, one of them is sold at 10% profit and the other at 10% loss. Find the percentage of profit or loss on the whole transaction ?

From formula 12 ,we can say directly No Loss No Gain .Lets Check out,

Total Cost Price = Rs.2000.

Need to find the total Selling Price ,

By the Formula 7,

Selling Price of one article (10% profit) = 1100

By the Formula 8,

Selling Price of another article (10% loss) = 900

So the total selling price = 1100+900 = Rs.2000.

Selling Price = Cost Price .So No Loss No Gain in whole transaction.

4.If the Selling Price of two articles is 1000 each, sold one at 10% profit and the other at 10% loss. Find the percentage of profit or loss on the whole transaction ?

From formula 11, we can say that loss % = (10/10)2= 1%

Lets check out in another way ,

Total Selling Price = Rs.2000

By the Formula 7,

Cost Price of one article (sold at 10% profit) = 909.09

By the Formula 8,

Cost Price of another article (sold at 10% loss) = 1111.11

Total Cost Price = 909.09+1111.11 = Rs.2020.20

here C.P > S.P . So loss incurs in whole transaction.

Loss % = {(2020.20 – 2000 )/ 2020.20 }*100 = 1.00%

We have verified the answer in both the way. So we can use formula directly

5.The selling price of 15 chairs is equals to the cost price of 20 chairs. Find the Profit or Loss % ?

Given , S.P of 15 chairs = C.P of 20 chairs.

From the above eqn we can conclude that we can get profit. Because Selling 15 chair itself we will get the total cost of the 20 chairs. So we get the profit of selling 5 chairs.

First method,

Using Profit% formula we can find the answer,

Profit% = (Profit/ Cost Price )*100

Profit % = {(S.P of 5 chairs)/(S.P of 15 chairs or C.P of 20 chairs) }*100

Profit % = (5/15)* 100 = 33.33%

Second method,

Let we take cost price be Rs 1,selling price be Rs x.

from the eqn, we can write 15x = 20 ; x = Rs. 1.3333

S.P > C.P , So we will get profit only. Profit = 1.3333 – 1.00 = Rs. 0.3333

Profit % = (0.3333/1 )*100 =33.33%

Third method,

Let we take cost price be ‘rs x’ and selling price be ‘rs y’. We can do this way also. Try this method

Simple Interest

Short Cut 1:

If a sum of money become “x” times in “t” years, at Simple Interest, then the rate of interest is given by:

Example 1:

A scheme in Muthoot Finance claim to double any amount in 5 years at simple interest. What is the rate of effective rate of interest?

Answer= 20%

Short Cut 2:

A certain sum of money amounts to Rs A1 in t years at r% per annum, then the time in which it will amount to Rs A2 at the same rate of interest is given by:

Example 2:

A certain sum of money amounts to Rs 4800 in 5 years at 4% per annum. In how many years it will amount to Rs 5120 at the same rate.

Solution 2:

Here, A2= 5120, A1= 4800, t= 5 and r= 4

Answer: 7 years

Short Cut 3:

If a sum of money becomes “n” times in “t” years at Simple Interest, then the time in which it will amount to “m” times is given by:

Example 3:

If a sum of money doubles itself in 4 years at simple interest. How long will it take for the amount to be 10 times?

Solution 3:

Here, n= 2, t= 4 and m= 10

Answer= 36 years.

In simple Interest,

P be the Principal/Sum,

R be the Interest,(denotes in %)

N Number of Years,

SI Simple Interest.( Interest amount of certain sum for certain period)

SI = [P*N*R]/ 100

Note:

1.If a sum of money become “X” times in “T” years, at Simple Interest, then the rate of interest “R%” is given by:

R=100(X-1)/T %

2.Diff. between CI and SI be Rs.X for 2 years for a rate of R%.

To find the Principal Amount,

Y = X (100/R)2

For 3 years , Principal Amount,

Y =X*1003/ [R2 (300+R)]

Ex:

1.Calculate the simple interest amount for principal of rs 10000 on rate of 6% for 5 years.

P = 10000 N = 5 R = 6%

SI = [10000*5*6]/100

= 3000

Interest amount is Rs 3000.

Compound Interest

Let

P be the Principal/Sum,

R be the Interest,(denotes in %)

N be the Number of Years,

A be the Amount,

CI be the Compound Interest.

Compound Interest = Amount – Principal

1.When the interest is calculated Annually,

Amount = P{ 1 + R/100}N

Example:

1.Find the compound Interest on Rs.7500 at 4% per annum for 2 years compounded Annually?

A = 7500 { 1+ 4/100 }2

A= Rs.8112

CI = A – P

= 8112 – 7500

= Rs.612

2.When the interest is calculated Half-Yearly,

Amount = P{ 1 + (R/2)/100}2N

Example:

1.Find the compound Interest on Rs.7500 at 4% per annum for 2 years compounded Half-Yearly?

A = 7500 { 1+ (4/2)/100 }2*2

= 7500 { (102/100)4 }

= Rs.8118.24

CI = A – P

= 8118.24 – 7500

= Rs.618.24

3.When the interest is calculated Quarterly,

Amount = P{ 1 + (R/4)/100}4N

Example:

1.Find the compound Interest on Rs.7500 at 4% per annum for 2 years compounded Quarterly?

A = 7500 { 1+ (4/4)/100 }2*4

= 7500 {(101/100)8}

A= Rs.8121.43

CI = A – P

= 8121.43 – 7500

= Rs.621.43

4.When the Rates R1,R2,R3… are different for different years N1,N2,N3,……

Amount = P{ 1 + R1/100} { 1 + R2/100} { 1 + R3/100}……….

Example:

1.Find the compound Interest on Rs.7500 at 4%,5%,6% per annum for 1,2,3 year respectively compounded Annually?

A = 7500 { 1+ 4/100 }{ 1+ 5/100 }{ 1+ 6/100 }

A= Rs.8681.4

CI = A – P

= 8681.4 – 7500

= Rs.1181.4

Points to Remember:

If the interest of R% and a sum of Rs P and no of years N , the interest for SI is same for every year .But differ for every year in CI. Bcoz In CI, (Suppose we compounded annually) The amount obtain after first year becomes principal for second year,the amount obtain after second year becomes principal for third year and so on…

Simple Shortcuts:

If Sn and Cn represent the simple and the compound interest respectively for the nth year, then

1. Sn is the same for all values of n. i.e. simple interest is the same for all years.

2. C1 = S1

3. Cn = Cn – 1(1 + i). i.e. compound interest for any year is (1+ i) times the previous year’s compound interest.

4. Cn = Cn – 1(1 + i) = Cn – 2(1 + i)2 = Cn – 3(1 + i)3………..

5. Cn – Cn – 1 = Cn – 1 × i. i.e. extra compound interest for any year is i times the previous year’s compound interest.

i represents the interest (not in percentage)

Example:

A sum invested for two years yields an interest of Rs.1200 under simple interest

and Rs.1260 under compound interest. What is the rate of interest?

From 1: SI for 2 years is Rs.1200;

For 1 year 1200/2 = Rs.600.

From 2: CI for 2 years is Rs.1260;

For 1 year Rs.600 Bcoz C1 = SI1=600

C2 = 1260-600 = 660.

Use 5 : Cn – Cn – 1 = Cn – 1 × i.

Here n = 2,

C2 – C2-1= C2-1 * i

C2 – C1 =C1 *i

660 – 600= 600 * i

60 = 600*i

i = 60/600

i = 0.1

So the interest is 0.1*100 = 10%

Streams

Short Cut 1:

If the speed of boat in still water is x km/hr and the speed of stream is y km/hr. If the boat travels for “T” hours, then distance covered is given by:

Distance travelled upstream in time “T” is given by:

(x-y)*T

Distance travelled downstream in Time “T” is given by:

(x+y)*T

Example 1:

If the speed of boat in still water is 10 km/hr and the speed of stream is 5 km/hr. If the boat travels for 3 hours upstream and 2 hours downstream, what is the total distance covered?

Solution 1:

Here, x= 10, y=5 and T= 2

Distance travelled upstream is:

(x-y)*T

Distance travelled upstream is: 10 km

Distance travelled downstream is:

(x+y)*T

Distance travelled upstream is: 30 km

Answer: Total distance travelled is: 40 km

Short Cut 2:

A man can row x km/hr in still water. If in a stream which is flowing at y km/hr, it takes him T hrs to row to a place and back. The distance between two places is given by:

Example 2:

A man can row 5km/hr in still water. If the river is running at 1.5 km/hr, it takes him 1 hour to row to a place and back. How far is the place?

Solution 2:

Here x= 5, y= 1.5, T= 1

Answer= 2.275 km

Short Cut 3:

A man rows a certain distance downstream x hours and returns the same distance in y hours. If the stream flows at the rate of z km/hr then the speed of man in still water is given by:

Example 3:

Ram can row a certain distance downstream in 6 hours and return the same distance in 9 hours. If the stream flows at the rate of 3 km/hr find the speed of Ram in still water.

Solution 3:

Answer: 15 km/hr

Downstream (along the current) speed (D) = Boat speed (B) + current (stream) speed (C). D=B+C

Speed of the boat = average of downstream and upstream speeds B = (D + U)/2

Speed of the current = half the difference of downstream and upstream speeds C = (D – U)/2

Example:

1.A boat takes 5 hours to go from A to B and 8 hours to return to A. If AB distance is 40 km, find the speed of (a) the boat and (b) the current.

Since B to A takes more time, it is upstream and hence AB is downstream. Downstream speed = 40/5 = 8 kmph.

Upstream speed= 40/8 = 5 kmph.

Boat speed = (8 + 5)/2 = 6.5 kmph.

Current speed = (8 – 5)/2 = 1.5 kmph.

2.A man cn row a boat at 20 kmph in still water.If the speed of the stream is 6 kmph, what is the time taken to row a distance of 60 km downstream ?

Speed of downstream = boat speed + stream speed = 20 + 6 = 26 kmph

Time required to cover 60 km downstream = d/s = 60/26 = (30/13) hours.

3.The time taken by a man to row his boat upstream is twice the time taken by him to row the same distance downstream. If the speed of the boat in still water is 42 kmph, find the speed of the stream ?

The time taken to row his boat upstream is twice the time taken by him to row the same distance downstream. Therefore, the ratio of the time taken is (2:1). So, the ratio of the speed of the boat in still water to the speed of the stream = (2+1)/(2-1) = 3:1 .Thus, Speed of the stream = (42)/3 = 14 kmph.

Boats and Streams problems are very easy. If you having any difficult questions, we will discuss on that. Plz post here:)

Escalator Problem

The escalator problem is identical to the boat stream problem, escalator replacing the stream and person replacing the boat. The speed and distance are expressed in terms of the number of steps of the escalator.

Example:

1.A couple and their son get into an escalator going up. The father reaches the top in 15 seconds taking 4 steps, but the son reaches 5 seconds ahead of his father. The mother who did not take any step of her own reaches the top 5 seconds after her husband reached.

Determine (a) the number of steps taken by the son, (b) the distance between the two points and (c) the speed of the escalator.

Let e be the speed of the escalator in steps per second, s the number of steps climbed by the son and n the number of steps between the points. Father takes 15 seconds to reach the top and during this time he climbs 4 steps and the escalator moves by 15e steps. So, the total number of steps is (4 + 15e) which by the above assumption is n.

Thus, n = 4 + 15e………. (1)

By the same logic for the son,

n = s + 10e……….. (2)

Since the mother does not take any steps of her own, n = 20e ………….. (3)

From (2) and (3), s = 10e…………… (4)

From (1) and (2), s = 5e + 4………… (5)

From (4) and (5), 5e = 4 or e = 0.8……………. (6)

(6) in (4): s = 10 × 0.8 = 8 and

(6) in (3): n = 20 × 0.8 = 16.

Thus, the number of steps taken by the son = 8

the distance between the points = 16

the speed of the escalator = 0.8 step per second.

Percentage

Short Cut 1:

If the value of a number is first increased by x% and later decreased by x% then the resultant value is always less than the original value. The percent decrease is given by:

Example 1:

The salary of a worker is first increased by 10% and thereafter it was reduced by 10%. What was the net change in the salary?

Solution:

The net effect on the salary is decrease in following percentage:

Answer= 1% decrease

Short Cut 2:

If first value is r% more then the second value, then the second value is lesser by first by following percentage:

Example 2:

If the salary of Manish is 25% greater than Abhishek, than by how much percentage in the salary of Abhishek less then Manish?

Solution 2:

Here r= 25

Answer= 20%

Short Cut 3:

If first value is r% less then the second value, then the second value is lesser by first by following percentage:

Example 3:

If the salary of Manish is 20% lesser than Summit, than by how much percentage in the salary of Abhishek less then Manish?

Solution: Putting r= 20

Answer= 25%

Sign Conventions:

For increase in percentage on a number or an amount put +ve Sign.

For increase in percentage on a number or an amount put -ve Sign

Where:

x% and y% are the successive increase or decrease in the percentage on a number or account, follow the sign conventions for the increase or decreaseto get the result.

Case 2:

The negative sign indicates net decrease in the orignal amount or number

Case 3:

If a number is first decrease by a% and then increase by b% the net effect on the original number is:

The sign of result in such case would indicate that if the original number was increased or decreased.

Example 1:

The tax on a commodity was reduced by 20% as a result its consumption increase by 15%. Find the net effect on the revenue.

Solution:

It is the case of decrease in percentage followed by an increase.

Applying the formula here x= -20, y= 15

Answer: Decrease by 8%

Example 2:

Peter England a well know brand of Clothes offer 30% and 70% discounts successively on Christmas on Men Shirt. What is the actual discount offered by Peter England?

Solution:

The formula for successive discount comes under the category of succesive decrease. The following in the formula

Thus the net discount in this case is 79%.

- To convert the given fraction into percentage we have to multiply it by 100.To express a/b as a percent : a/b = {(a/b)*100 }%

- Example 1: 1/4 or 0.25 = (1/4)*100 or 0.25*100 =25%

- To convert the given percentage into fraction we have to divide it by 100. To express x% as a fraction : a% = a/100.

- Example 2: 20% = 20/100 = 1/5

- If the price of a commodity increases by R%, then the reduction in consumption so as not to increase the expenditure is {(R/(100+R))*100}%

- If the price of a commodity decreases by R%, then the increase in consumption so as not to decrease the expenditure is {(R/(100-R))*100}%

- If A is R% more than B, then B is less than A by {R/(100+R))*100}%

- If A is R% less than B, then B is more than A by { (R/(100-R))*100}%

- If the value or price of an item goes up/down by p%, then the percentage reduction/increment to be made to bring it back to the original level is given by, [(100p)/(100+p)]% or [(100p)/(100-p)]%

- If the value or price of an item goes up/down by p%, then the quantity consumed should be reduced/increased by [(100p)/(100+p)]% or [(100p)/(100-p)]% so that the total expenditure remains the same.

Example 3: In a class of 75 students 32% are girls.Find the number of boys in that class ?

The total number of students in the class is 75. In which, 32% are girls.

Therefore the remaining 68% of students are boys.

Hence, the number of boys in the class = (68/100)*75 = 51

Population:

Let the population of a town be P now and suppose it increases at the rate of R% per annum, then:

Population after n years = P(1+R/100)n

Population n years ago = P/(1+R/100)n

Depreciation :

Let the present value of a machine be P.Suppose it depreciates at the rate of R% per annum. Then:

Value of the machine after n years = P(1-R/100)n

Value of the machine n years ago = P/(1-R/100)n

Percentage Increase:

If the final value is more than the initial value, then there is an increase. i.e., Increased value = Final value – Initial Value

Percentage increase = {Increased Value / Initial Value }*100

Percentage Decrease:

If the final value is more than the initial value, then there is an decrease. i.e., Decreased value = Final value – Initial Value

Percentage decrease = {Decreased Value / Initial Value }*100

Example 4:If in an examination Prabhu got 80% of marks and Sathish got 90% of marks , then find the percentage by which Sathish got more than Prabhu ?

Given that Sathish = 90%, Prabhu got = 80%

In Question, the initial value (referred value) is Prabhu’s score and the final value is Sathish’s score. By using the formula we get,

% increase = (Increase value/ Initial Value)*100

={(90-80)/80}*100

=12.5%

Therefore , the Sathish got 12.5% of marks more than Prabhu.

Successive Increase:

If there are two successive increases of p%,q% then the effective percentage increase is [{(100+p)/100}{(100+q)/100}-1]*100

Successive Decrease:

If there are two successive decreases of p%,q% then the effective percentage increase is

[1-{(100+p)/100}{(100+q)/100}]*100

Increase followed by Decrease :

If there is an increase of P% and followed by a decrease q%, then the effective percentage increase/decrease is

[{(100+p)/100}{(100-q)/100}-1]*100

Decrease followed by Increase :

If there is an Decrease of P% and followed by a Increase q%, then the effective percentage increase/decrease is

[1-{(100+p)/100}{(100-q)/100}]*100

Example 5:

Raman’s salary was decreased by 50% and subsequently increased by 50% .How much Percentage does he lose ?

By formula , p= 50, q=50,

Percentage, he lose = [1-{(150/100)}{(50/100)}]*100

= (1-75/100)*100 =25%

Pipes and Cisterns

Short Cut: 1

If a pipe fills the tank in x hours, and another fills the same tank in y hours and the third fills the tank in z hour. Then the time required, if all the three pipes are open together to fill the tank is:

Example:

Solution

Here; x= 20, y= 30 and z= 40 hours

We get answer= 17.14 hours

Short Cut: 2

If pipe A can fill a tank in x minutes, pipe B can fill the same in y minutes, there is also an outlet C in the Tank. All these are opened simultaneously and the tank takes “T” minutes to get filled. The time in which C can empty the tank in minutes is given by:

Two pipes can fill a cistern in 60 minutes and 75 minutes respectively. There is also an outlet C, if all the three pipes are opened together, the tanks get filled in 50 minutes. Find the time taken by C to empty the full tank?

Answer:

Answer= 100 minutes

Short Cut 3

Example

A tap can empty the tank in 10 minutes; another tap can do the same in 5 minutes. Find the time required by both the taps to empty the tank simultaneously?

Solution

Answer= 3.33 minutes

Inlet :

Outlet:

A pipe connected with a tank or a cistern or a reservoir, emptying it,is known as an outlet.

Properties:

- If a pipe can fill a tank in x hours, then:

part filled in 1 hour = 1/x

- If a pipe can empty a tank in y hours, then:

part filled in 1 hour = 1/y

- If a pipe can fill a tank in x hours and another pipe can empty the tank the full tank in y hours ( where y>x), there on opening both the pipes, the net part filled in 1 hour = { 1/x – 1/y }

- If a pipe can fill a tank in x hours and another pipe can empty the tank the full tank in y hours ( where y

E represents Total time taken to empty the tank

F represents Total time taken to fill the tank

L represents the L.C.M

e represents time taken to empty the tank

f represents time taken to fill the tank

- Time for emptying , (emptying pipe is bigger in size.)

E = (f * e)/(f – e)

- Time for filling , (Filling pipe is bigger in size.)

F = (e * f)/(e – f)

- Pipes ‘A’ & ‘B’ can fill a tank in f1 hrs & f2 hrs respectively. Another pipe ‘C’ can empty the full tank in ‘e’ hrs. If the three pipes are opened simultaneously then the tank is filled in ,

F = L/[(L/f1) + (L/f2) - (L/e)]

- Two taps ‘A’ & ‘B’ can fill a tank in ‘t1′ & ‘t2′ hrs respectively. Another pipe ‘C’ can empty the full tank in ‘e’ hrs. If the tank is full & all the three pipes are opened simultaneously . Then the tank will be emptied in,

E = L/[(L/e) - (L/f1) - (L/f2)]

- Capacity of the tank is , F = (f * e)/(e – f)

- A filling tap can fill a tank in ‘f’ hrs. But it takes ‘e’ hrs longer due to a leak at the bottom. The leak will empty the full tank in ,

E = [ t(f + e) * tf ] / [ t(f + e) – tf ]

TCS pattern:

Example :

If a pipe can fill the tank in 6 hrs but unfortunately there was a leak in the tank due to which it took 30 more minutes .Now if the tank was full how much time will it take to get emptied through the leak?

(a) 39 hrs (b) 78 hrs (c) 72 hrs (d) 70 hrs

By last property,

t(f+e) = 6+0.5 =6.5hrs

tf = 6 hrs

E = 6.5*6 / (6.5 – 6)

= 78 hrs .

Number System

Short Cut 1:

To find the greatest number that will divide given numbers say x1, x2, x3…….xn so as to leave the same remainder in each case, we find the HCF of the positive difference of numbers i.e. HCF of:

Ix1-x2I, Ix2-x3I, Ix3-x4I and……

Example 1:

Find the greatest number which when divide 55, 127 and 175 leaves the same remainder in each case?

Solution 1:

Here x1= 55, x2= 127 and x3= 175

The values of: Ix1-x2I, Ix2-x3I, Ix3-x1I are 72, 48, 120

HCF of 72, 48 and 120 is 24

Answer= 24

Short Cut 2:

To find the greatest number which will divide x, y and z leaving remainders a, b and c respectively is given by:

H.C.F of (x-a), (y-b) and (z-c).

Example 2:

What is the greatest number that will divide 29, 60 and 103 and will leave remainders 5, 12 and 7 respectively?

Solution 2:

Here, x= 29, y= 60 and z=103

Also, a= 5, b=12 and c=7

Thus, (x-a), (y-b) and (z-c) are 24, 48 and 96. HCF of these numbers is 24.

Answer= 24

Short Cut 3:

To find the least number which, when divided by “x”, “y” and “z” leaves the same remainder “r” in each case is given by:

L.C.M of (x,y,z) + r

Example 3:

Find the least number which when divided by 2, 3, 5 and 7 leaves the remainder 1.

Solution 3:

The least number is given by L.C.M of (2,3,5,7) + 1

Answer= 211

Short Cut 1:

Example:

If the sum of a number and its square is 156, find the number

Solution:

Here x= 156

Answer= 12

Short Cut 2:

If the sum of two numbers is “s” and their difference is “d”. Then the product of the number is given by:

Example:

Solution:

We get: Answer= 357

Short Cut 3

If the ratio of the sum and the difference of two number is a:b, then the ratio of these two numbers is given by:

Example 3:

Solution:

Here, a=13 and b=3

Answer= 8:5

For Calculating Squares

To Square a Number Ending in 1

Example : 41 x 41

Solution by steps:

(a) Square the next lower number (always ends with zero) 40 x 40 = 1,600

(b) Obtain the sum of the next lower number and the number being squared: 40 + 41 = 81

(c ) Add (a) and (b): 1,600 + 81 = 1,681, answer

Short way: 40 x 40 = 1,600; 40 + 41 = 81; answer 1,681

To Square a Number Ending in 9

Example : 39 x 39

Solution by steps :

(a) Square the next higher number 40 x 40 = 1,600

(b) Obtain the sum of the number being squared and the next higher number: 39 + 40 = 79

(c ) Subtract (a) and (b): 1,600 - 79 = 1,521, Answer

Short way: 40 x 40 = 1,600; -(39 + 40) = 1,521

To Square a number Ending in 5

Example : 35 x 35

Solution by steps :

(a) Multiply the first digit by the digit plus 1 : 3 x 4 = 12

(b) Attach 25 : 1,225,answer

Short way : 3 x 4 = 12;answer 1,225

Population

Short Cut 1

If the present population of a place is P, and it annually increases at the rate r%. The population at the end of “n” years is given by:

Short Cut 2

If the population of a place in the current year is P, it increases at a rate of x% for the first year, increases at the rate of y% for the second year and z% for the third year. The population after third is given by:

Short Cut 3

If the population of a place in the current year is P, it decreases at a rate of x% for the first year, increases at the rate of y% for the second year and z% for the third year. The population after third is given by:

If the population of a place in the current year is P, it increases at a rate of x% for the first year, decreases at the rate of y% for the second year and again increases at z% for the third year. The population after third is given by:

Distance and Speed

Short Cut 1

If a person travels half a distance in a journey at x km/hr and remaining half at the speed of y km/hr, the average speed of the whole journey is given by:

Example 1

A person travels half of journey at the speed of 30 km/hr and the next half at a speed of 15 km/hr. What is the average speed of the person during the whole journey?

Solution:

Here; x= 30 and y= 15

Answer= 20 km/hr

Short Cut 2

If a person travels three equal distances in a journey at a speed of x km/hr, y km/hr and z km/hr. The average speed is given by:

Example 2

Ravi starts from Delhi to Agra a distance of about 300 kms. He divided his journey into a distance of thee equal parts in terms of distance and covered them with the speed of 30 km/hr, 60 km/hr and 90 km/hr, calculate his average speed during the journey:

Solution:

Putting the values we get:

Answer= 49.09 km/hr

Short Cut 3

If a person travels Mth part of a distance at x km/hr, Nth part at y km/hr and the remaining Pth part at z km/hr, then his average speed in km/hr is given by:

If instead of proportion, the parts of the distance are given in percentage i.e. M%, N% and P% respectively, then the formula becomes:

Example 3

Hari travels 20% of a distance at an average speed of 20 km/hr, next 30% distance at an average speed of 30 km/hr and the remaining 50% of distance at the average speed of 50 km/hr. Find his average speed during the whole journey.

Solution:

Putting the values we get:

Answer = 33.33 km/hr

Train problems broadly center around the following three types.

- Time taken by a train to cross a stationary point

- Time taken by a train to cross a stationary length

- Time taken by a train to cross a moving length

- Time taken by a train to cross a stationary point = train length/train speed

- Time taken by a train to cross a stationary length = (train length + stationary length)/train speed

- Time taken by a train to cross another train moving in the same direction = sum of length of the two trains/difference in their speeds

- Time taken by a train to cross another train moving towards it = sum of length of the two trains/sum of their speeds

Example:

1.If a train going at 90 kmph takes 28 seconds to go past a lamp post, but 80seconds to cross a platform, what is the length of (a) the train and (b) the platform?

90 kmph= (90 × 5/18) = 25 m/s.

Solution for (a):

Given the time to cross the lamp post as 28 seconds,

Formula:

(train length/25 )= 28 or train length = 700 m.

Solution for (b):

Given the time to cross the platform as 80 seconds,

Formula:

{(train length + platform length)/25 } = 80

or (train length + platform length) = 2000 m.

Since train length is 700 m, platform length = 1300 m or 1.3 km.

2.How long does it take for a train of length 800 m moving at 80 kmph to cross a train of length 1200 m coming at a speed of 100 kmph from the opposite direction?

The relative speed = 80 + 100 (Moving opposite direction)

= 180 kmph = 50 m/s.

The distance to be covered = 800 + 1200 ( Sum of the train length)

= 2000 m.

Formula:

Time taken for crossing = 2000/50 (Time = Sum of the train length / Relative Speed) = 40 seconds.

Above two example problems are basic type. Here i will give three more examples with little bit different.

Example 3:

Two trains of length 100m and 200m are 100m apart.They start moving towards each other on parallel tracks, at speed 54 kmph and 72 kmph.After how much time will the trains meet ?

In this problem, we need to find the time taken by trains to meet each other. So no need to consider the train length.

Distance between the trains = 100m

Relative speed = 54+72 kmph (Trains are in opposite direction)

= 126 kmph = 35mps

Time taken = Distance/ Relative speed

= 100/35 = 20/7 seconds

Example 4:

Two trains of length 100m and 200m are 100m apart.They start moving towards each other on parallel tracks, at speed 54 kmph and 72 kmph.After how much time will the trains cross each other ?

In this problem, we need to find the time taken by trains to cross each other. So we need to consider the train length and also distance between the trains.

Distance to be covered = 100+200 +100 (Train length 1 + Train length 2 +distance between them)

Relative Speed = 35 mps

Time taken = Distance/ Relative speed

= 400/35 = 80/7 seconds

Example 5:

Two trains of length 100m and 200m are 100m apart.They start moving towards each other on parallel tracks, at speed 54 kmph and 72 kmph.After how much time will the trains be 100m apart again ?

In this problem, Trains have to cross each other and then be at 100m apart.

For distance , we need to consider initial distance , train length and their final distance between them.

Relative Speed = 35 mps

Distance to be covered = 100+100+200+100 = 500m

Time taken = 500/35 = 100/7 seconds.

Consumption and Cost

In a number of questions the increase or decrease in Consumption or cost is given in percentage and its effect on decrease or increase in Cost or Consumption is asked in percentage. The two cases are as:

Case 1 : Increase in Cost leading to decrease in Consumption

If the price of a commodity is increased by x%, then reduction in consumption so as not to increase the expenditure is:

Example:

The price of cooking oil has increased by 25%. The percentage change of reduction that a family should effect in the use of cooking oil so as not to increase the expenditure is:

Applying the formula, here x% = 25%

So,

Case 2: Decrease in Cost leading to increase in Consumption

If the price of a commodity is decreased by x%, then increase in consumption so as not to increase the expenditure is:

Example:

The price of cooking oil has decreased by 25%. The percentage change of increase in consumption so that a family should effect in the use of cooking oil so as not to decrease the expenditure is:

Solution:

Applying the formula, here x% = 25%

Ages :

The basic principle involved in age problems is the age difference between any two persons remains the same at all points of time.

Example 1:

My present age is 25 and my brothers age is 30 . The age difference between us is 5. Ten years before, my age is 15 and my brothers age is 20. At that time also, Age difference between us is 5 only.

Example 2: The ages of two persons differ by 16 years.If 6 years ago, the elder one be 3 times as old as the younger one, Find their present ages?

Let the age of younger be x years.Then the age of elder be x+16 years.

(x+16)-6 = 3(x-6) :: solving this equation we get x = 14 .

Then their present ages are 14 years and 30 years.

Example 3: Sachin is younger than Rahul by 4 years. If their ages are in the respective ratio of 7:9, how old is Sachin ?

Given: R= S+4; R:S = 7:9

To find Sachin age, R/S = (S+4)/S = 7/9

solving above equation we get , S =18years.

Example 4:The sum of the ages of father and his son is 60 years. Six years ago, fathers age was five times the age of the son. After 6 years, son’s age will be :

Given:

f+s = 60; (f-6)= 5(s-6) <==> f-5s = -24;

solving above eqn we get , f=46 , s=14 ;

After 6 years, son’s age will be : 20years.

Administrative Functioning of CGHS Unani

Press Information Bureau

Government of India

Ministry of Health and Family Welfare

10-December-2013 15:22 IST

Administrative Functioning of Cghs Unani

Central Government Health Scheme provides the healthcare facilities to its beneficiaries predominantly in the Allopathic system of medicine as per their demand. AYUSH system of medicine is a very small component under CGHS. The Unani system is an even smaller component of AYUSH. There are 10 small units of Unani system consisting of one or two Unani doctors and pharmacists attached to main CGHS Wellness Centres in Delhi, Kolkata, Lucknow, Hyderabad and Bangalore.

Keeping in view the size and strength of Unani component, it is not considered feasible and financially viable to create separate administrative set up for different systems of medicine. Since the infrastructural facilities of Wellness Centre are common for all systems, the administrative control of Wellness Centre is vested in the CMO In-charge. The Unani doctors enjoy professional freedom in exercise of their duties as doctors. However, they are under the overall administrative control of the Additional Director (CGHS) of the city concerned.

This was stated by Shri. Ghulam Nabi Azad, Union Minister for Heath and Family Welfare, in a written reply to the Rajya Sabha today.

16 Useful Keyboard Shortcuts for Word 2010

Keyboard shortcuts can be boon for typists and here are 16 shortcuts for Word 2010 users that you may not be aware of:

CTRL + ALT + H

|

Applies highlighting to selected text

|

CTRL + Alt + C

|

Inserts copyright symbol

|

CTRL + Alt + R

|

Inserts Registered symbol

|

CTRL + alt + T

|

Inserts Trademark symbol

|

CTRL + ALT + F

|

Inserts footnote

|

CTRL + SHIFT + A

|

Applies all caps

|

CTRL + Shift + K

|

Applies the SMALL CAPS font attribute

|

CTRL + Shift + D

|

Applies double underlining

|

CTRL + Spacebar

|

Removes character formatting

|

CTRL + ALT + P

|

Switches to Print Layout View

|

CTRL + ALT + N

|

Switches to Draft View

|

CTRL + ALT + O

|

Switches to Outline View

|

F7

|

Launches Spell-Checker

|

Shift + F7

|

Launches the Thesaurus

|

ALT + Shift + F7

|

Launches the Dictionary/Translator

|

Shift + F5

|

Moves your cursor to the previous edit position

|

Agent Report Software - An extension for RD Customer Package

AGENT REPORT SOFTWARE

Version 1.0.0 Released on 10/12/2013

This software is an extension for RD Customer Package software developed by SDC Chennai. Only RD schedule in ASLASS 6 form can be prepared in the RD Customer package, no other reports can be taken from RD Customer Package. By using the Agent Report software along with RD Customer Package, an agent can prepare monthly application to be submitted for getting incentive from State Government or respective authorities. Monthly report can be taken in malayalam or in english format. Pay in Slip (SB-103) and Commission voucher (ACG 17) for each RD schedule can be printed from Agent Report software. This tool makes report from RD Customer Package Database, so there is no need for further data entry.

Download : Click Here

Thanks & Regards

SIVAKUMAR N.

SYSTEM ADMINISTRATOR

O/O POSTMASTER, KARUNAGAPPALLY

KOLLAM DIVISION PIN 690518

AIPEDEU CHQ DELHI PROGRAMME ON 12TH &13TH DEC,2013

INDWF published III Level JCM Meeting discussion points

INDWF published III Level JCM Meeting discussion points

The complete discussion points and the progress of the issues are published in the official blog of INDWF... we reproduced the same and given for your information...

PROGRESS ON ISSUES OF JCM III MEETING WITH DGOF

INTUC

INDIAN NATIONAL DEFENCE WORKERS FEDERATIONES

JCM III LEVEL COUNCIL MEETING OF BOARD (14th MEETING OF 11th TERM) HELD ON

27th AND 28th NOVEMBER, 2013 AT KOLKATTA.

The following issue were discussed and some of the progresses on the issues are given below for the information of all our affiliated unions.

1. Ex-gratia payment of Rs.10 Iakhs to each family of the employees who lost lives while performing their bonafide duties has been cleared by M of D and sanction was issued by OFB for Rs. 3 crores in respect of 30 families.

2. Necessary clarification was issued by Department of Defence Production on the entitlement of 30 days of Earned leave for Piece workers opted leave under Factories Act but a doubt arised to PC of Fys about the date of effect for which necessary clarification will be obtained from M of D to give effect from July 2008.

3. Departmental Overtime for piece workers was abruptly stopped by OFB from the year 2006 which was not approved by M of D. orders are under issue.

4. For Clerical and Para Medical staff the cadre Review proposals now at OFB level, for Para Medical Staff, OFB finance has cleared and it would be processed further.

5. Cadre Review for Artisan Staff under M of D is to be done which is due. Now Indian Railways have revised the Cadre Review w.e.f. 01.11.2013. It was requested OFB should propose on this line for Ordnance Factory Artisan Staff on receipt of the letters from M of D.

6. The III MACP Rs.4600I- which was granted to MCM and Chargeman was now reviewed by DOP&T and M of D was directed to consider on its own, if the MCM is not the feeder grade to Chargeman. On this basis M of D convened a meeting on 21.11.2013 of Federations and Directors of all Directorates and confirmed that the MCM is not the Feeder grade to Chargeman and only HS Grade I, MCM to Chargeman is only by transfer. Now M of D has submitted the proposal to Defence (Finance) for approval. Therefore, the issue is likely to be settled Hence, it was demanded that PC of A Fys should not affect the reversion of Grade Pay from Rs.4600/- to Rs.4200/- for the serving employees till the orders are issued by M of D. It will be delayed till 31.12.2013.

7. Release of HRA for those who vacated the Quarters and not allotted the quarters has been raised to decide the matter at OFB level.

8. One time relaxation to clerical staff is a permanent demand which was forwarded to M Of D.

9. The following Cadre Review proposals have been submitted to Government through M of D.

MTS, Fire Staff, Canteen Staff, Storekeeping staff, Hindi Typist, Jr Hindi Translators, Teachers, Lab Asst, FED, Durwan, female Searcher etc.

10. Single instructions to all Factones in respect of granting ACP to Durwans will be issued on the basis of promotional hierarchy upto 30.08.2008.

11. All MCMs are now declared as Group B category employees as was demanded in last JCM meeting. They are now entitled to travel by Air on LTC 80 from the nearest Airport to North East Region and J & K. Also their contribution is increased to Rs.60/- towards Central Government Employees Insurance Scheme (CGIES).

12. Further it was demanded that for MCM Promotion, only Departmental Screening committee is held not DPC, therefore, they should be granted promotions twice in a year and not once.

13. Family pensions granted to widow daughters and unmarried daughters on the basis of DOP&T orders.

14. Piece work Co-relation is being processed.

15. It was agreed by PC of A Fys to sanction food bills while on duty to remote areas on self certification basis where registered hotels are not available necessary orders will be issued.

16. Electrical Supervisory Competency test for Chargeman, Theoretical training will be held at OFIL, Ambajhari.

17. Estate Co-ordination committee’s functioning’s will be strengthened to settle the HRA problem.

18. Chairman/OFB agreed to consider and dispose the pending requests of JWMs for transfers.

19. JWM/AWM 76 posts cleared 183 posts proposal sent for promotion 50% promotion to AWM. 50% DR Proposed.

20. Escort duty to which employees is detailed; they will be allowed to compensate the loss of Overtime by giving 75 Hours during the Quarter by which they can recover the loss. 54 Hours ceiling per week should be withdrawn. This has been agreed to consider and to issue necessary instructions to Factories.

21. In order to remove the prevailing stagnation for the Storekeepers and Supervisor NT Stores, a Joint proposal was submitted by the Staff side proposing to grand about 269 posts of Chargeman from Chargeman (T) which will relieve the stagnation. At the same time through Cadre Review, the proposed additional posts will be taken back. The proposal submitted would be agreed to consider by OFB.

Yours Sincerely,

sd/-

(R.SRINIVASAN)

General Secretary.

Source: www.indwf.blogspot.in

[http://indwf.blogspot.in/2013/12/progress-on-issues-of-jcm-iii-meeting.html]

Reservation to Disabled

As per Section 33 of the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995, every appropriate Government shall appoint in every establishment such percentage of vacancies not less than three per cent for persons or class of persons with disability of which one per cent each shall be reserved for persons suffering from-

(i) blindness or low vision;

(ii) hearing impairment;

(iii) loco motor disability or cerebral palsy, in the posts identified for each disability.

The Supreme Court in its judgment dated 18.10.2013 in the matter of SLP (7541 of 2009) titled Union of India & Anr. Vs. National Federation of the Blind & Ors has, inter alia, held that the computation of reservation for persons with disabilities has to be computed in case of Group A, B, C and D posts in an identical manner viz., computing 3% reservation on total number of vacancies in the cadre strength.

The Supreme Court has also directed to modify the O.M. 29.12.2005 issued by Department of Personnel and Training consistent with its order.

In pursuance with order of the Supreme Court, Department of Personnel and Training has issued an O.M. dated 3.12.2013 requesting all concerned to take necessary action for implementing the order. The State Government/Union Territories have also been appraised by Department of Personnel and training in this regard.

This information was given by the Minister of State for Social Justice and Empowerment, Shri P. Balram Naik in a written reply to a question in Lok Sabha today.

Source : PIB

Dopt Orders - Fundamental (Amendment) Rules, 2013

Dopt Orders - Fundamental (Amendment) Rules, 2013

These rules may be called the Fundamental (Amendment) Rules, 2013.

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(Department of Personnel and Training)

New Delhi, the 27th October, 2013

G.S.R. 263 :-In exercise of the powers conferred by the proviso to article 309 of the Constitution, the President hereby makes the following rules further to amend the Fundamental Rules, 1922, namely:-

1. (1) These rules may be called the Fundamental (Amendment) Rules, 2013.

(2) They shall come into force on the date of their publication in the Official Gazette. In the Fundamental Rules, 1922 in rule 29, for clause (2), the following clauses shall be substituted, namely :-

"(2) If a Government servant is reduced as a measure of penalty to a lower service, grade or post or to a lower scale, the authority ordering the reduction shall specify -

(a) the period for which the reduction shall be effective; and

(b) whether, on restoration, the period of reduction shall operate to postpone future increments and, if so, to what extent.

(3) The Government servant shall regain his original seniority in the higher service, grade or post on his restoration to the service, grade or post from which he was reduced".

[F. No. 6/2/2013-Estt. (Pay-1)]

MUKESH CHATURVEDI, Dy. Secy.

Source : www.persmin.gov.in

[http://ccis.nic.in/WriteReadData/CircularPortal/D2/D02est/6_2_2013-Estt.Pay-I-27102013.pdf]

Amendment of Clause (2) of Fundamental Rules 29 - Penalty to a lower service, grade or post or to a lower time scale

F.No.6/2/2013-Estt. (Pay-I) -

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

New Delhi, the 10th December, 2013

OFFICE MEMORANDUM

Sub: Notification for amendment of clause (2) of FR 29

The undersigned is directed to say that the FR 29(2) provided that if a Government servant is reduced as ameasure of penalty to a lower service, grade or post or to a lower time scale, the authority ordering the reduction may or may not specify, the period for which the reduction shall be effective. The Rule 11(vi) of the CCS (CCA) Rules, 1965 relating to this penalty was earlier amended vide the Notification No. F.11012/2/2005-Estt (A) dated the 2" February, 2010. Vide the Notification No.G.S.R. 263 dated 27 th October, 2013 published in the Gazette of India the FR 29(2) has now been amended, in line with the amended CCS (CCA) Rules, 1965, as follows:

"(2) If a Government servant is reduced as a measure of penalty to a lower service, grade or post or to a lower scale, the authority ordering the reduction shall specify —

(a) the period for which the reduction shall be effective; and

(b) whether, on restoration, the period of reduction shall operate to postpone future increments and, if so, to what extent.

(3) The Government servant shall regain his original seniority in the higher service, grade or post on his restoration to the service, grade or post from which he was reduced".

2. All the Ministries / Departments are requested to bring the contents of the aforementioned amendment to the notice of all concerned for information and compliance.

3. Any existing provisions in Disciplinary Rules not in consonance with the above may be amended so that they are not in conflict with the Fundamental Rules.

Encl: As above

sd/-

(Mukesh Chaturvedi)

Deputy Secretary to the Government of India

Source /View/Download: www.persmin.nic.in

Shortage of Officers in the Army - Implementation of AV Singh Committee Report

Press Information Bureau

The held strength of officers in the Army is 38574 (as on 1st July 2013) as against sanctioned strength of 47762 (excluding Army Medical Corps, Army Dental Corps and Military Nursing Service).

Steps have been taken on a continuous and an ongoing basis to address the issue of shortage of officers in the Army. All officers including those in Short Service Commission (SSC) are now eligible to hold substantive rank of Captain, Major and Lieutenant Colonel after 2, 6 and 13 years of reckonable service respectively. The tenure of SSC officers has been increased from 10 years to 14 years. A total number of 750 posts of Lt. Colonel have been upgraded to Colonel towards implementation of AV Singh Committee Report (Phase-I). Further, 1896 additional posts in the ranks of Colonel, Brigadier, Major General and Lieutenant General and their equivalents in the other two Services have been upgraded towards implementation of AV Singh Committee Report (Phase-II).

The implementation of recommendations of the VI Central Pay Commission with substantial improvement in the pay structure of officers of Armed Forces has made the Services more attractive.

The Armed Forces have undertaken sustained image projection and publicity campaign to create awareness among the youth on the advantages of taking up a challenging and satisfying career. Awareness campaigns, participation in career fairs and exhibitions, advertisements in print and electronic media, motivational lectures in schools, colleges are some of the other measures in this direction.

This information was given by Defence Minister Shri AK Antony in a written reply to Shri Arjun Meghwal and Kumari Saroj Pandey in Lok Sabha today.

Source: PIB

Source: PIB

National Pension System (NPS) - Abbreviations and Definitions

National Pension System (NPS) - Abbreviations and Definitions

Abbreviations and Definitions of National Pension System compiled here under for your information. The key words are frequently used among the employees working in Central and State Governments...

The following words and expressions shall have the meaning specified below, unless the context otherwise requires:

Abbreviations and Definitions of National Pension System compiled here under for your information. The key words are frequently used among the employees working in Central and State Governments...

The following words and expressions shall have the meaning specified below, unless the context otherwise requires:

Abbreviations

| |

ASP

|

Annuity Service Provider

|

CGMS

|

Centralised Grievance Management System

|

CRA

|

Central Recordkeeping Agency

|

DC

|

Defined Contribution

|

GRC

|

Grievance Redressal Cell

|

GRM

|

Grievance Redressal Mechanism

|

IMA

|

Investment Management Agreement

|

IPO

|

Initial Public Offer

|

KYC

|

Know your Customer

|

NPS

|

National Pension System

|

NRA

|

Normal Retirement Age

|

PFs/PFMs

|

Pension Funds/Pension Fund Managers

|

PFRDA

|

Pension Fund Regulatory and Development Authority

|

POP

|

Point of Presence

|

POP-SP

|

Point of Presence – Service Provider (Authorized branches of POP for NPS)

|

PRA

|

Permanent Retirement Account

|

PRAN

|

Permanent Retirement Account Number

|

TB

|

Trustee Bank

|

FEMA

|

Foreign Exchange Management Act

|

Definitions

| |

Applicable NAV

|

Unless stated otherwise in the Offer Document, 'Applicable NAV' is the Net Asset Value at the close of a Working Day.

|

Applicant

|

An individual who has expressed interest in joining NPS and has duly completed all formalities.

|

Custodian

|

Agency responsible for holding assets of the NPS Trust. Refers to the Stockholding Corporation of India Limited (SHCIL)

|

IMA

|

Investment Management Agreement, entered into between NPS Trust and the Pension Funds.

|

Offer Document

|

This document, issued by PFRDA, making an offer to potential applicants to subscribe to NPS.

|

RBI