RBI grants in-principle nod for 11 payments banks

Payment banks allow mobile firms, supermarket chains, and others to cater to individuals and small businesses.

The Reserve Bank on Wednesday granted ‘in-principle’ approval to 11 entities, including Reliance Industries, Aditya Birla Nuvo, Vodafone and Airtel, to set up payments banks and proposed such licences ‘on tap’ in future.

The other entities which have been given ‘in-principle’ approval are Department of Posts, Cholamandalam Distribution Services, Tech Mahindra, National Securities Depository Limited (NSDL), Fino PayTech, Sun Pharma’s Dilip Shantilal Shanghvi and PayTM’s Vijay Shekhar Sharma.

“The ‘in-principle’ approval granted will be valid for a period of 18 months, during which time the applicants have to comply with the requirements under the guidelines and fulfil the other conditions as may be stipulated by the Reserve Bank,” RBI said in a statement.

Going forward, RBI said the central bank would use the learning from this licensing round to appropriately revise the guidelines and move to give licences more regularly, virtually “on tap”.

Payment banks allow mobile firms, supermarket chains, and others to cater to individuals and small businesses.

The Payments Bank will be set up as a differentiated bank and shall confine its activities to acceptance of demand deposits, remittance services, Internet banking and other specified services.

Payments Banks will initially be restricted to holding a maximum balance of Rs. 1 lakh per individual customer.

They will be allowed to issue ATM/debit cards as also other prepaid payment instruments, but not the credit cards.

These banks can also distribute non-risk sharing simple financial products like mutual funds and insurance products.

They will not be allowed to undertake lending services and non resident Indians will not be allowed to open accounts.

RBI further said that on being satisfied that the 11 applicants have complied with the requisite conditions as part of ‘in-principle’ approval, it would consider granting to them a licence for commencement of banking business.

Until a regular licence is issued, the applicants can not undertake any banking business, the central bank added.

Draft guidelines for licencing of payments banks were released for public comments and the final guidelines were issued on November 27, 2014.

A total of 41 applicants had applied for payments banks.

Differentiated banking entails going beyond the current universal banking framework to serve specific purposes.

The move to allow such differentiated banks came after RBI had found just two entities — infra player IDFC and micro-lender Bandhan from among over two dozen applicants — eligible for setting up commercial banks.

The central bank issued this limited set of licences on April 1, 2014, after a decade. Both applicants are yet to begin operations even after a year as they have time till October.

Commercial banks comprise 27 public sector banks, 20 private, 44 foreign, 4 local area banks and 56 regional rural banks.

On the selection process, RBI said a detailed scrutiny was undertaken by an External Advisory Committee (EAC) under the chairmanship of Nachiket Mor, Director, Central Board of the Reserve Bank of India.

The recommendations of the EAC were an input to an Internal Screening Committee (ISC), consisting of the Governor and four Deputy Governors.

Source : http://www.thehindu.com/business/Industry/rbi-grants-inprinciple-nod-for-11-payments-banks/article7557908.ece

Indumatee Media Essay Competition 2016

Indumatee Media Essay Competition 2016

Indumatee Media is conducting Indumatee Media Essay Competition for School and College Students and it is an annual competition. Indumatee Media Essay Competition is an initiative of Indumatee Media which provides services of Publication of Books, Anthologies, Magazines, Online Portals and other services. Indumatee Media operates three Web Portals www.odishabook.com (Online Portal), www.odishakatha.com (Bilingual Online Portal) and www.indiajobsbook.com (Online Job Portal) respectively.

The best essays are published in an anthology with an ISBN No. Top Winners are selected and receive prize (Cash/gift hampers), award certificate and free copy of the anthology.

Indumatee Media Essay Competition invites School and College Students to send essays.

Guidelines & Rules of Essay Competition:

1. Contest is open to Students of India.

2. Entries must be in English language and the original work of the Student.

3. No registration and no entry fee.

4. Competition will be for School & College Students.

5. Qualification is School Students of Classes 8th to 12th / Students pursuing ITI or Diploma/ College Students pursuing Graduate, B.E or B. Tech, MBBS, LLB.

6. The Essay must be between 700 and 1000 words.

7. Essays may be about any topic and in any form and unpublished work.

8. Essays should not be a translation of another writer’s work.

9. The essay should be sent in the word format with 12 font size or hand written, single-sided with pages numbered and title as a header on first page. It should carry the name of the author, date of birth, qualification, Father/ Guardian’s name, Address, Mobile number/Telephone number (along with STD code) and e mail ID.

10. The author will be solely responsible for any violation of the Copyright Act where the material submitted for the competition is not original.

11. Entry should be an individual effort and not a combined work.

12. The Judges decision is final and no correspondence will be entered into.

13. We hold the rights to cancel any entry without any prior information and clarification.

14. The Anthology publication will include 15 to 20 Essays. If your essay published in that year's anthology, you will be notified and we will ask you to send a photo of yourself and a brief biography.

15. Last date of receipt of entries is 20th October, 2015. Entries received after this date will not be considered.

16. Winners will be notified via e-mail or by phone/ post.

17. Please send your Essays by Post and mark your envelope “Indumatee Media Essay Competition 2016” and send it to Akshaya Sahoo, C/o- Indumatee Media, Gajendrapur, KalashreeGopalpur, Jajpur-754292, Odisha.

18. Online submissions will be accepted also, may send submissions by e-mail to indumateemediacompetitions@gmail.com

19. Winners will be announced within two months after the deadline for competition.

21. Cash Prizes will be Pay through Cheque/Draft/Money order and Gift Hampers, certificate which will be sent via Regd. post or courier.

22. Comments or questions about the Indumatee Media Essay competition are welcome. Please write to indumateemediastudentawards@gmail.com

Official Link:

Central Industrial Security Force (CISF) Recruitment for Constable / DCPO Posts 2015

Central Industrial Security Force (CISF) has published a Advertisement for below mentioned Posts 2015. Check below for more details.

Posts : Constable / DCPO

Total No. of Posts : 156 Posts

Educational Qualification :

Age Limit : 21 to 27 years

Pay Scale: Rs.5200-20200 + Grade Pay Rs.2000/-

Selection Process : Candidates will be selected based on interview.

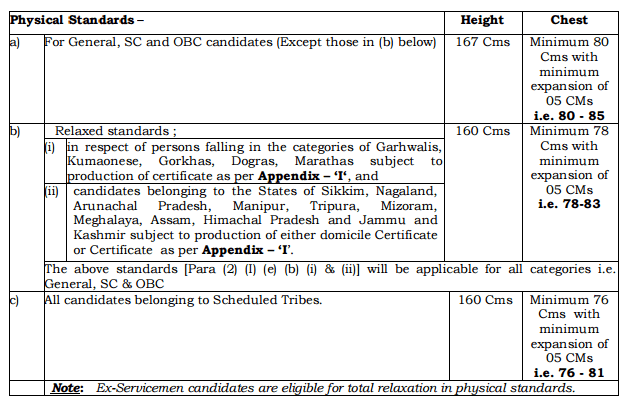

Physical Standards:

Advertisement : Click Here

Application Form : Click Here

Last Date : 03-10-2015

Source : moneycontrol.com

Posts : Constable / DCPO

Total No. of Posts : 156 Posts

Educational Qualification :

- The candidate should have passed Matriculation or equivalent qualification from a recognized Board.

- Educational certificate other than State Board/Central Board should be accompanied with Government of India notification declaring that such qualification is equivalent to Matric / 10th class pass for service under Central Government.

Age Limit : 21 to 27 years

Pay Scale: Rs.5200-20200 + Grade Pay Rs.2000/-

Selection Process : Candidates will be selected based on interview.

Physical Standards:

Advertisement : Click Here

Application Form : Click Here

Last Date : 03-10-2015

Filed your income tax returns? Go ahead and e-verify I-T

There seems to be a general aversion towards e-verification of returns, a process introduced this year by the Income Tax Department that makes tax-filing fully paperless.

Till last year, if you did not have a digital signature, you had to send a copy of the ITR V to the Central Processing Centre in Bengaluru.From this year, the tax department has introduced an alternate way of paperless e-filing via Electronic Verification Code (EVC). The 10-digit EVC code can be generated through your net banking account, linking your Aadhaar card, using ATMs or even by registering your email or mobile number on the income tax website. However, there seems to be a general aversion to e-verifying among taxpayers.

According to the income tax department's website, among the total 62.19 lakh returns files, only 12.8 lakh taxpayers have used the e-verification route so far. "The method is not complicated and most of the taxpayers who e-file are tech-savvy. So, there seems to be a lack of awareness," says Sudhir Kaushik, Cofounder and CFO of Taxspanner.com.

Here are the various ways in which you can generate the EVC.

REGISTER E-MAIL

The taxpayer can generate an EVC by login into the income tax e-filing website--http:www.incometaxindiaefiling.gov.in. However, this mode can be used only if the total income, that is before applying any deductions, is Rs 5 lakh or below and there is no refund claim. After you log in and opt for e-filing, you can request for the code by clicking on the "Generate EVC" option. The site will ask you to choose between--e-filing OTP or EVC through Net banking. Click on the former and a one-time-password (OTP) will be sent to your mobile number or registered e-mail ID. Use this code under the e-verify option given on the site and complete your tax-return process.

NET BANKING

If your total income is more than rs 5 lakhs or if there is refund, you have only one option--EVC through net banking. When you select this options, you'll be redirected to a page with the list of banks available for net banking Login. If your bank has authorised by the income tax department for providing direct access to the government's e-filing website, the name should be here and you should be able to log in using your internet-banking ID and password.Also, your PAN must have been validated via KYC. The EVC will be sent to your bank-registered mobile number. "This will be a big relief to NRIs who do not have digital signatures and faced a lot of problem with mailing physical ITR-Vs," says Preeti Khurana, Chief Content Editor, ClearTax.in.

Some banks have been registered for generating EVC using your debit or credit card via ATM machines.However, the channel seems to be not working. This is also not the best way and the net banking route is much simpler.

AADHAAR NUMBER

For this, your Aadhaar card and PAN should be linked. If the two are not linked income tax department's website show a pop-up and you simply have to fill in your Aadhaar number on the redirected page to link the two. Once linked, an OTP will be sent to your registered mobile number which is valid for next 10 minutes.

Till last year, if you did not have a digital signature, you had to send a copy of the ITR V to the Central Processing Centre in Bengaluru.From this year, the tax department has introduced an alternate way of paperless e-filing via Electronic Verification Code (EVC). The 10-digit EVC code can be generated through your net banking account, linking your Aadhaar card, using ATMs or even by registering your email or mobile number on the income tax website. However, there seems to be a general aversion to e-verifying among taxpayers.

According to the income tax department's website, among the total 62.19 lakh returns files, only 12.8 lakh taxpayers have used the e-verification route so far. "The method is not complicated and most of the taxpayers who e-file are tech-savvy. So, there seems to be a lack of awareness," says Sudhir Kaushik, Cofounder and CFO of Taxspanner.com.

Here are the various ways in which you can generate the EVC.

REGISTER E-MAIL

The taxpayer can generate an EVC by login into the income tax e-filing website--http:www.incometaxindiaefiling.gov.in. However, this mode can be used only if the total income, that is before applying any deductions, is Rs 5 lakh or below and there is no refund claim. After you log in and opt for e-filing, you can request for the code by clicking on the "Generate EVC" option. The site will ask you to choose between--e-filing OTP or EVC through Net banking. Click on the former and a one-time-password (OTP) will be sent to your mobile number or registered e-mail ID. Use this code under the e-verify option given on the site and complete your tax-return process.

NET BANKING

If your total income is more than rs 5 lakhs or if there is refund, you have only one option--EVC through net banking. When you select this options, you'll be redirected to a page with the list of banks available for net banking Login. If your bank has authorised by the income tax department for providing direct access to the government's e-filing website, the name should be here and you should be able to log in using your internet-banking ID and password.Also, your PAN must have been validated via KYC. The EVC will be sent to your bank-registered mobile number. "This will be a big relief to NRIs who do not have digital signatures and faced a lot of problem with mailing physical ITR-Vs," says Preeti Khurana, Chief Content Editor, ClearTax.in.

Some banks have been registered for generating EVC using your debit or credit card via ATM machines.However, the channel seems to be not working. This is also not the best way and the net banking route is much simpler.

AADHAAR NUMBER

For this, your Aadhaar card and PAN should be linked. If the two are not linked income tax department's website show a pop-up and you simply have to fill in your Aadhaar number on the redirected page to link the two. Once linked, an OTP will be sent to your registered mobile number which is valid for next 10 minutes.

Source:-The Economic Times

Master Guide for all Postal Dept Exams ( IPOs exam / PM Gr I / LGOs / PS Gr B )

All books are published by Nellikkal Publisher, Sidhasamajam PO, Vadakara -673104 Dist, Kozhikode, Kerala.

Books are also available in the following address; 1) BOOK CENTRE, 32, Payappa Garden Street, Queens Road Cross, Shivaji Nagar, BANGALORE- 560051 PHONE: (080) 41464152 & 22862152, email: swamybookcentre@gmail.com VISIT : http://bookcentrebangalore.blogspot.in 2) Kairali Book syndicate, 251 Baba Faridpuri West Patel nagar New Delhi 110008 ( Mobile: 09868790657.) 3) R.K.Traders Computer service and Sale of Publications, Aniyartholu - PO, Kattapana - 685 515. (Phone 04868-270707) NB: Those who need guides may send SMS to 09947414885 or email to vkbk_ani@yahoo.com. also they can contact the above addresses; Address : V.K. Balan Retired SSPOs Nellikal House, Anniyartholu PO Kattappana South, Idukki 685515 Phone : 04868-270707 & 09947414885 |

S

‘Jeevan Pramaan’, the Aadhaar-based Digital Life Certification system, for Pensioners

Press Information Bureau

Government of India

Ministry of Personnel, Public Grievances & Pensions

20-August-2015 13:35 IST

The Government has asked banks to achieve weekly targets set for the purpose of enabling “Jeevan Pramaan” – an “Aadhaar-based Digital Life Certification system for Pensioners so as to cover at least 50% in next 2-3 weeks. Pensioners can approach their paying branches with the PPO, Aadhaar card and bank pass book for trouble-free seeding of Pensioners’ Aadhaar number in their bank account.

Various steps are being taken by the Government to sensitize pensioners and bank branches to link up the Aadhaar number, PPO number and bank account number. All pension disbursing banks observed 1st to 7th August, 2015 as ‘Aadhaar Seeding Week for Pensioners.’ All through the week, priority was given to pensioners visiting the bank branches for seeding Aadhaar number in their bank account. Besides, five camps were organised from 13th to 17th July, 2015 at different locations covering Delhi, NOIDA and Faridabad to facilitate seeding of Aadhaar number in the bank accounts of pensioners. All banks participated in these camps. Facility was also provided by UIDAI for on-the-spot registration for Aadhaar numbers.

Conventionally, pensioners are required to give a Life Certificate to the pension disbursing authority in November, every year – either by presenting themselves before the Branch Manager or by means of a Certificate issued by a Gazetted Officer or other designated authorities.

The “Jeevan Pramaan” – an “Aadhaar-based Digital Life Certification system with an objective to facilitate on-line submission of Life Certificate by pensioners, was launched by the Prime Minister Shri Narendra Modi on 10th November, 2014. This facility is in addition to the other existing methods of submitting Life Certificates. It is hoped that all pensioners who have Aadhaar numbers will make use of this additional facility of biometric life certification.

With “Jeevan Pramaan” the pensioners and family pensioners need not visit the pension disbursing agency or Gazetted/designated authority for submission of Life Certificates. The Life Certificates may be submitted from personal computers and laptops at home or by visiting a conveniently located Common Service Centre or the nearest branch of any pension disbursing bank. There are about 55,000 branches of pension disbursing banks and 40,000 Common Service Centres throughout the country. Submission of Digital Life Certificate also ensures authenticity of pension payments.

CSD facilities for Retired employees – MoD Order with Application Forms

CSD facilities for Retired employees – MoD Order with Application Forms

1. Refer Army Order 02/2006/QMG

2. Government of India has decided to extend the CSD Canteen facilities to the Retired Defence Civilian Employees vide MoD letter No. F.No.8(14)/2015-D(Mov) dated 31 Jul 2015.

3. Eligibility : Retired Defence Civilian Employees of following departments who were not entitled to avail CSD facilities will now be entitled for CSD facilities:

(a) Ministry of Defence including those working in their respective attached offices and those working in lower military formations.

(b) Defence Audit Departments.

(c) Executive Officer Cantonment Board

(d) Hindutan Aeronautics Ltd personnel retired from Air Force Station Hyderabad, Jorhat, Air Force Academy, Dundigal (Hyderabad) and Air Force Station Yelahanka(Bangalore)

(e) Indian Defence Accounts Services.

(f) Secretariat Border Roads Development Board and HQ Director General Border Roads.

(g) Retired employees of Canteen Stores Departments who are getting pension from CSD Fund.

(h) MES Employees.

4. Entitlement : They will be entitled for only Grocery Stores. No Liquor will be authorised.

5. Validity : The cards will have a validity of 10 years, from the date of issue and will be renewed every year.

6. Process for applying for Retired Defence Civilian Employees Card : All Retired Defence Civilian Employees will apply for the Smart Card to the URC through which they want to avail the Canteen facilities after authentication of the application.

7. Authentication : The application form will be authenticated for its correctness by the Department from which the employees has retired. The form will be countersigned by an officer not below the Rank of Under Secretary or equivalent.

8. Documents to be submitted to Department URC : The following attested documents will be submitted to the URC :

(a) Application for Canteen Smart card duly countersigned by the competent authority.

(b) Govt order for Retirement.

(c) Copy of Pension Payment Order (PPO)

(d) Address Proof and Copy of PAN card.

(e) Payment of Rs.135 to the URC.

9. Guidelines for Authenticating Authority:

(a) Each concerned department shoud appoint officer authorised to countersigned and promulgate orders and forward details to this office.

(b) Countersigned officer will verify that all columns are filled correctly prior to countersigned.

10. Guidelines for URC : Vetting of application will be done at URC for correctness. The following will be checked :

(a) That application is filled in all respect and no column is left blank.

(b) Signature of Countersiging authority.

(c) All personal particulars are checked for correctness with PPO and other supporting documents.

(d) In case an application is rejected the same will be informed to the applicant.

(e) New card will be sent by M/s. Smart Chip Ltd to the URC for issue to applicant. URC will check details with individuals Departmental retired identity Card prior to issue of new Canteen Smart Card.

(f) Since large number of applications are likely to be received intially at the URCs, the URC Manager must exercise due diligence while scrutinising and verifying the applications.

11. Guidelines for SCL : The following will be ensured ;

(a) All applications are sent by CCTS to M/s. Smart Chip Ltd, at the earliest.

(b) On receipt of application check for correctness with existing records through old Grocery Card Number.

(c) Verify applicants personal details through PAN No. on www.verifypan.in

(d) Ensure previous card of applicatin is hotlised prior to handing over of new card for Retired Defence Civilian Employees.

12. The application form (Blue Color) for Retired Defence Civilian Employees attached as Appendix will be made available in the URCs at the earliest by M/s. Smart Chip Ltd.

13. This letter be given vide publicity by displaying at prominent places like URSs, Station HQs, CAO and other controlling HQs.

Source: INDWF

A Web-Based Portal VIZ. Vidya Lakshmi (www.vidyalakshmi.co.in) Launched for Students Seeking Educational Loans

A Web-Based Portal VIZ. Vidya Lakshmi (www.vidyalakshmi.co.in) Launched for Students Seeking Educational Loans;

First Portal of Its Kind Providing Single Window for Students to Access Information and Make Application for Educational Loans Provided by Banks as well as for Government Scholarships

A web-based portal viz. Vidya Lakshmi (www.vidyalakshmi.co.in) was launched on the occasion of Independence Day i.e. 15th August, 2015 for the benefit of students seeking Educational Loans. The Portal has been developed and maintained by NSDL e-Governance Infrastructure Limited (NSDL e-Gov) under the guidance of Department of Financial Services, Ministry of Finance, Department of Higher Education, Ministry of Human Resource Development and Indian Banks’ Association (IBA).

Earlier the Union Finance Minister Shri Arun Jaitley in the Union Budget for 2015-16inter-alia had proposed to set-up a fully IT based Student Financial Aid Authority to administer and monitor Scholarship as well as Educational Loan Schemes, through the Pradhan Mantri Vidya Lakshmi Karyakram (PMVLK) to ensure that no student misses out on higher education for lack of funds. The launch of the aforesaid Portal is a first step towards achieving this objective,

Vidya Lakshmi Portal is a first of its kind portal providing single window for Students to access information and make application for Educational Loans provided by Banks as also Government Scholarships. The Portal has the following features:

- Information about Educational Loan Schemes of Banks;

- Common Educational Loan Application Form for Students;

- Facility to apply to multiple Banks for Educational Loans;

- Facility for Banks to download Students’ Loan Applications;

- Facility for Banks to upload loan processing status;

- Facility for Students to email grievances/queries relating to Educational

- Loans to Banks;

- Dashboard facility for Students to view status of their loan application and

- Linkage to National Scholarship Portal for information and application for

- Government Scholarships.

So far, 13 Banks have registered 22 Educational Loan Schemes on the Vidya Lakshmi Portal and 5 Banks viz; SBI, IDBI Bank, Bank of India, Canara Bank & Union Bank of India have integrated their system with the Portal for providing loan processing status to students. This initiative aims to bring on board all Banks providing Educational Loans. It is expected that students throughout the country will be benefited by this initiative of the Government by making available a single window for access to various Educational Loan Schemes of all Banks.

Source : PIB Release, 20.08.2015

Payment banks and the opportunity at the bottom of pyramid

The Reserve Bank of India yesterday announced it was granting 11 licences for setting up of payment banks.

The central bank last year had mooted the idea of a payment bank, an entity that would serve functions such as allowing customers to open small savings accounts (up to Rs 1 lakh deposit limit), have debit cards issued against them, make transfers and carry out internet banking transactions.

The RBI yesterday granted licences to a clutch of companies and individuals of various backgrounds: ranging from telecom firms (Airtel, Vodafone, AB Nuvo, which runs Idea Cellular, and Reliance Industries, which is to launch Reliance Jio this year) to financial services companies (Chola, micro lender Fino Paytech, depository NSDL) and tech startups (Paytm) to the Indian postal service.

Calling it "one of the most exciting spaces" for the banking system, RBI Governor Raghuram Rajan today said payments bank would complement the core banking sector by improving last-mile connectivity services and help push financial inclusion.

(Payment banks will differ from traditional banks in three ways: they cannot lend or issue credit cards and customer deposits will have to be necessarily kept in safe SLR securities.)

But very clearly, the most exciting part of the development is no one knows how business models of payment banks will evolve. Governor Rajan was the first one to admit that and it shows in the central bank's thinking when it gave away licences to companies and individuals belong to diverse fields.

For instance, stats available till before the Pradhan Mantri Jan Dhan Yojana rollout showed more than half the country's residents did not have access to formal banking services, but nearly everyone today has a mobile phone.

The reason for the above situation is simple: wieldy banks found it unprofitable to foray into the hinterland in a big way (imagine the cost of putting up even a small bank branch) butnimbler telecom companies -- through their mom-and-pop retail channel -- did.

That's exactly where payment banks come in: a cross between technology and financial services. The tens of millions of telecom customers in the country, with their KYC requirements already cleared, may automatically qualify to become an account owner.

Telecom companies have already expressed a desire of tying with traditional banks in order to expedite rollout of services.

Paytm, which started off as a payment service before rolling out an ecommerce service, has about 100 million registered users, with many turning into a potential payment bank customer.

The joker in the pack is India Post, with its 1.5 lakh branches almost entirely spread across rural India, which could adopt technology in a big way and make a financial services foray into areas where banks have feared to tread.

But one thing is clear: the idea of a payment bank will have to be led primarily by a technology push rather than a banking push. (Since payment banks cannot lend, their profit margins will also be low, making it even more necessary for the need to use greater technology.)

"I believe technology companies find it easier to learn other about other business than other business can learn about technology," Paytm co-founder and CEO Vijay Shekhar Sharma told CNBC-TV18, adding that such companies will help make a resolute push towards reaching out to the unbanked.

Sharma also said traditional banks had been slow to adopt to changing customer preferences.

His argument is borne out by the fact that banks have shied away from rolling out services to those at the bottom of the pyramid.

It shows in the fact that almost all staple savings account services, especially from private banks, have hefty balance maintenance requirements. The KYC process, too, remains cumbersome with only a handful opting for use of greatertechnology.

"Consumers are readily adopting mobile as a way to transact. So consumers are changing. Maybe it is the banks that need to catch up," he said.

Perhaps it will be innovations such as payment banks that will force them to change.

Source : moneycontrol.com

No comments:

Post a Comment