Appointment of Secretary to Gramina Dak Sevak Committee

Dept of Posts has constituted Gramina

Dak Sewak Committee to go through the issues relating to Gramina Dak

Sewaks and submit a report to Department. Now the Postal Directorate has

appointed Sri T.Q.Mohammad (IPoS 1994), PMG, Agra region UP Circle as

Secretary of the said Gramina Dak Sewak Committee vide Order dated

09.11.2015.

Click here to view the Postal Directorate order dated 09.11.2015.

NJCA

National Joint Council of Action

4, State Entry Road, New Delhi – 110055

No. NJCA/2015 November 10, 2015

All Members of NJCA

Sub:- Observance of All India protest day on 19th November 2015

Dear Comrade,

All of you may recall that the NJCA in its meeting held on 30th September

2015 in Delhi after considering the delay in submission of the report

of the 7th CPC as also broadly taking stock the speculating and detail

deliberations, unanimously decided to defer the proposed Indefinite

General Strike of the Central Government Employees till next Budget

Session and symmetrically it was also resolve to observe 19th November

2015 as Joint Nation wise protest day to all the country to press upon

the Government of India to resolve the long pending

legitimate demands of all the Government Employees.

All of you are therefore accordingly requested to take all necessary

steps to jointly observe protest day on 19th November 2015. As per

decision taken by the NJCA in the said meeting the member of the NJCA

shall stage one day Dharna at Jantar Mantar in New Delhi on the said

day.

Charter of Demands

1.

Effect wage revision of Central Government employees from 1.12014

accepting the memorandum of the staff side JCM; ensure 5-year wage

revision in future; grant interim relief and merger of 100% of DA.

Ensure submission of the 7th CPC report with the stipulated time frame

of 18 months; include Grameen Dak Sewaks within the ambit of the 7th CPC. Settle all anomalies of the 6th CPC.

2. No privatisation, PPP or FDI in Railways and Defence Establishments and no corporatisation of postal services;

3. No Ban on recruitment/creation of post.

4. Scrap PFRDA Act and re-introduce the defined benefit statutory

pension scheme.

5.

No outsourcing; contractorisation, privatization of governmental

functions; withdraw the proposed move to close down the Printing

Presses; the publication, form store and stationery departments and

Medical Stores Depots; regularise the existing daily rated/casual and

contract workers and absorption of trained apprentices;

6. Revive the JCM functioning at all levels as an effective negotiating forum for settlement of the demands of the CGEs.

7. Remove the arbitrary ceiling on compassionate appointments.

8. No labour reforms which are inimical to the interest of the workers.

9. Remove the Bonus ceiling;

10. Ensure five promotions in the service career.

Report of the protest may be forwarded to this office accordingly.

With best wishes for Diwali, Chat, Bhai Duj and Guru Parv.

Comradely yours,

(Shiva Gopal Mishra)

Convener

7th Pay Commission report – estimated pay scales and multiplication factor

7th Pay Commission Pay Scales and 7th CPC Pay Calculator – Revisit by GConnect

After taking in to account the expected DA of 125% from January 2016,

esimated 7th Pay CommissionPay Scales, 7th CPC pay and 7CPC Grade Pay as

follows:

| 7th Pay Commission Pay Scales, and 7th CPC pay | Using the multiplication factor of 2.25 |

| 7th Pay Commission Grade Pay | By Providing 40% fitment Benefit |

7th Pay Commission Pay Scales and Fitment Benefit (7th CPC Grade Pay Structure)

| PB | 6 CPCPay bands | 7th CPC Pay Band | 6th CPC GradePay | 7th CPCGradePay | 6CPC Minimum Basic pay | 7CPC Minimum Basic pay |

| 1 | 5200-20200 | 13880-47480 | 1800 | 7380 | 7000 | 21240 |

| 1 | 5200-20200 | 14010-47610 | 1900 | 7540 | 7100 | 21520 |

| 1 | 5200-20200 | 14130-47730 | 2000 | 7680 | 7200 | 21790 |

| 1 | 5200-20200 | 14630-48230 | 2400 | 8280 | 7600 | 22890 |

| 1 | 5200-20200 | 15120-48720 | 2800 | 8880 | 8000 | 23970 |

| 2 | 9300-34800 | 26040-83160 | 4200 | 14680 | 13500 | 40660 |

| 2 | 9300-34800 | 26540-83660 | 4600 | 15280 | 13900 | 41760 |

| 2 | 9300-34800 | 26790-83910 | 4800 | 15580 | 14100 | 42310 |

| 2 | 9300-34800 | 27530-84650 | 5400 | 16480 | 14700 | 43950 |

| 3 | 15600-39100 | 41640-94250 | 5400 | 22140 | 21000 | 63700 |

| 3 | 15600-39100 | 43130-95770 | 6600 | 23940 | 22200 | 66990 |

| 3 | 15600-39100 | 44370-97010 | 7600 | 25440 | 23200 | 69720 |

| 4 | 37400-67000 | 94570-160870 | 8700 | 46720 | 46100 | 141100 |

| 4 | 37400-67000 | 94820-161120 | 8900 | 47020 | 46300 | 141650 |

| 4 | 37400-67000 | 96180-162480 | 10000 | 48660 | 47400 | 144660 |

| 4 | 37400-67000 | 98660-164960 | 12000 | 51660 | 49400 | 150130 |

Meanwhile, we have also made a comparison of 7th Pay Commission Pay

estimated by GConnect by adopting 6th CPC methods and 7CPC Pay proposed

by National Council, Staff Side JCM and Confederation of Central

Government Employees and Workers.

In this comparison, we have arrived at the Net increase in pay out of

7CPC Pay for employees in each grade pay which is calculated on the

basis of present 6CPC pay along with DA as on January 2016 (125%).

This increase in Percentage has been calculated for 7th Pay Commission

Pay estimated by GConnect and also for 7th CPC Pay proposed by JCM

Seperately.

| Present PB and GP | 6CPC Minimum Basic pay | 7th PayCommissionPay estimated by GConnect | JCM / Confederation proposed 7CPC Basic Pay | % increase in 7cpc pay estimated by GConnect | % increase in 7cpc pay as proposed by JCM |

| PB-1 GP 1800 | 7000 | 21240 | 26000 | 35% | 65% |

| PB-1 GP 1900 | 7100 | 21520 | 31000 | 35% | 94% |

| PB-1 GP 2000 | 7200 | 21790 | 33000 | 35% | 104% |

| PB-1 GP 2400 | 7600 | 22890 | 41000 | 34% | 140% |

| PB-1 GP 2800 | 8000 | 23970 | 46000 | 33% | 156% |

| PB-2 GP 4200 | 13500 | 40660 | 56000 | 34% | 84% |

| PB-2 GP 4600 |

| 41760 | 66000 | 34% | 111% | ||

| PB-2 GP 4800 | 14100 | 42310 | 74000 | 33% | 133% |

| PB-2 GP 5400 | 14700 | 43950 | 78000 | 33% | 136% |

| PB-3 GP 5400 | 21000 | 63700 | 88000 | 35% | 86% |

| PB-3 GP 6600 | 22200 | 66990 | 102000 | 34% | 104% |

| PB-3 GP 7600 | 23200 | 69720 | 120000 | 34% | 130% |

| PB-4 GP 8700 | 46100 | 141100 | 139000 | 36% | 34% |

| PB-4 GP 8900 | 46300 | 141650 | 148000 | 36% | 42% |

| PB-4 GP 10000 | 47400 | 144660 | 162000 | 36% | 52% |

| PB-4 GP 12000 | 49400 | 150130 | 193000 | 35% | 74% |

Expected DA Jan 2016 in 7th Central Pay Commission

Expected DA Jan 2016 – Gets carefully scrutinized by the 7th Central Pay Commission: 90paisa Article

“This time, it is not just the employees, but the members of the 7th Pay Commission too who are very eager to know about the Dearness Allowance from January 2016. “

‘Expected DA January 2016‘ has the honour of making not just the

Central Government employees and pensioners curious; it has even got the

7th Pay Commission on the list of eagerly waiting audience.

It is a well-known fact that Central Government employees love to read

all kinds of information, analyses, orders, and predictions about the

Dearness Allowance. Here are our fact- and trend-based predictions for

the additional Dearness Allowance which will be announced from

01.01.2016.

Calculation of DA : The Government of India presently calculates

the level of inflation for purposes of grant of dearness allowance to

Central Government Employees on the basis of the All India Consumer

Price index Number for Industrial Workers (2001=100) (AICPI). The twelve

monthly average of the AICPI (2001 base) as on 1st January and 1st July

of each year is used for calculating the Dearness Allowance (DA).

Each month, the Central Government’s Labour Bureau releases

price-related data called the CPI (IW) on Base Year 2001=100. 78

important cities and towns from all over the country were selected and

the fluctuations in prices of essential commodities in all these places

are noted. Based on these data, the points, abbreviated as AICPIN, are

calculated. The Pay Commission will, in its report, explain in detail

how the DA is calculated based on these statistics, known as the ‘DA

Determination Formula.’

The Dearness Allowance of not just the Central Government employees, but

also the state government employees, is being paid as per the method

prescribed by the 6th Pay Commission. The DA calculation method was

implemented from January 2006 and will continue to be in effect for ten

years, until December 2015. This DA determination method comes to an end

now due to the constitution of the 7th Pay Commission.

Implementation of 7th CPC : The 7th Pay Commission is expected to submit

its recommendations to the government before December 2015. Its

recommendations are expected to be implemented from January 2016

onwards.

Dearness Allowance after 1.1.2016 : After 01.01.2016, Dearness

Allowance will be issued based on the prices of essential commodities,

as per the method recommended by the 7th Pay Commission. For example,

the 6th Pay Commission’s recommendations were implemented from January

2006 onwards. The DA for the months of January 2006 to June 2006 was not

paid. DA was issued only from the month of June 2006.

DA Calculation Method of the 7th Pay Commission : Successive Pay

Commissions have made changes to the DA formula, suggesting their own

methodology for determining the quantum and frequency. The 7th Pay

Commission will also expected to recommend a different methodology to

determine the DA.

One cannot say for sure that the 7th Pay Commission will follow the

method that was recommended by the 6th Pay Commission. It could modify

the current CPI(IW) BY 2001-100 statistics index. It could also change

the current “Linking Factor 115.76” method. It is difficult to predict

how these factors would differ in the recommendations of the 7th Pay

Commission report.

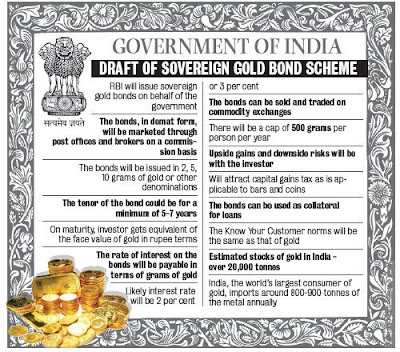

FAQ : ALL ABOUT SOVEREIGN GOLD BOND

SGBs are government securities denominated in grams of gold. They are

substitutes for holding physical gold. Investors have to pay the issue

price in cash and the bonds will be redeemed in cash on maturity. The

Bond is issued by Reserve Bank on behalf of Government of India.

2. Why should I buy SGB rather than physical gold? What are the benefits?

The quantity of gold for which the investor pays is protected, since he

receives the ongoing market price at the time of redemption/ premature

redemption. The SGB offers a superior alternative to holding gold in

physical form. The risks and costs of storage are eliminated. Investors

are assured of the market value of gold at the time of maturity and

periodical interest. SGB is free from issues like making charges and

purity in the case of gold in jewellery form. The bonds are held in the

books of the RBI or in demat form eliminating risk of loss of scrip etc.

3. Are there any risks in investing in SGBs?

There may be a risk of capital loss if the market price of gold

declines. However, the investor does not lose in terms of the units of

gold which he has paid for.

4. Who is eligible to invest in the SGBs?

Persons resident in India as defined under Foreign Exchange Management

Act, 1999 are eligible to invest in SGB. Eligible investors include

individuals, HUFs, trusts, universities, charitable institutions, etc.

5. Whether joint holding will be allowed?

Yes, joint holding is allowed.

6. Can a Minor invest in SGB?

Yes. The application on behalf of the minor has to be made by his / her guardian.

7. Where can investors get the application form?

The application form will be provided by the issuing banks/designated

Post Offices/agents. It can also be downloaded from the RBI’s website.

Banks may also provide online application facility.

8. What are the Know-Your-Customer (KYC) norms?

Know-Your-Customer (KYC) norms will be the same as that for purchase of

physical form of gold. Identification documents such as Aadhaar card/PAN

or TAN /Passport / Voter ID card will be required. KYC will be done by

the issuing banks/Post Offices/agents.

9. What is the minimum and maximum limit for investment?

The Bonds are issued in denominations of one gram of gold and in

multiples thereof. Minimum investment in the Bond shall be two grams

with a maximum buying limit of 500 grams per person per fiscal year

(April – March). In case of joint holding, the limit applies to the

first applicant.

10. Can I buy 500 grams in the name of each of my family members?

Yes, each family member can hold the bond if they satisfy the eligibility criteria as defined at Q No.4.

11. Can I buy 500 grams worth of SGB every v year?

Yes. One can buy 500 grams worth of gold every year as the ceiling has been fixed on a fiscal year (April-March) basis.

12. Is the limit of 500 grams of gold applicable if I buy on the Exchanges?

The limit of 500 grams per financial year is applicable even if the bond is bought on the exchanges.

13 What is the rate of interest and how will the interest be paid?

The Bonds bear interest at the rate of 2.75 per cent (fixed rate) per

annum on the amount of initial investment. Interest will be credited

semiannually to the bank account of the investor and the last interest

will be payable on maturity along with the principal.

14. Who are the authorized agencies selling the SGBs?

Bonds are sold through scheduled commercial banks and designated Post

Offices either directly or through their agents like NBFCs, NSC agents,

etc.

15 Is it necessary for me to apply through my bank?

It is not necessary for the customer to apply through the bank where

he/she has his/ her account. A customer can apply through another bank

or Post Office.

16. If I apply, am I assured of allotment?

If the customer meets the eligibility criteria, produces a valid

identification document and remits the application money on time, he/she

will receive the allotment.

17. When will the customers be issued Holding Certificate?

The customers will be issued Certificate of Holding on the date of

issuance of the SGB. Certificate of Holding can be collected from the

issuing banks/Post Offices/agents or obtained directly from RBI on

email, if email address is provided in the application form.

18. Can I apply online?

Yes. A customer can apply online through the website of the listed scheduled commercial banks.

19. At what price the bonds are sold?

Price of bond will be fixed in Indian Rupees on the basis of the

previous week’s (Monday – Friday) simple average price for gold of 999

purity published by the India Bullion and Jewellers Association Ltd.

(IBJA). The issue price will be disseminated by the Reserve Bank of

India

20. Will RBI publish the rate of gold applicable every day?

The price of gold for the relevant tranche will be published on RBI website two days before the issue opens.

21. What will I get on redemption?

On maturity, the redemption proceeds will be equivalent to the

prevailing market value of grams of gold originally invested in Indian

Rupees. The redemption price will be based on simple average of previous

week’s (Monday-Friday) price of closing gold price for 999 purity

published by the IBJA.

22. How will I get the redemption amount?

Both interest and redemption proceeds will be credited to the bank

account furnished by the customer at the time of buying the bond.

23. What are the procedures involved during redemption?

The investor will be advised one month before maturity regarding the ensuing maturity of the bond.

On the date of maturity, the maturity proceeds will be credited to the bank account as per the details on record.

In case there are changes in any details, such as, account number, email

ids, then the investor must intimate the bank/PO promptly.

24. Can I encash the bond anytime I want? Is premature redemption allowed?

Though the tenor of the bond is 8 years, early encashment/redemption of

the bond is allowed after fifth year from the date of issue on coupon

payment dates. The bond will be tradable on Exchanges, if held in demat

form. It can also be transferred to any other eligible investor.

25. What do I have to do if I want to exit my investment?

In case of premature redemption, investors can approach the concerned

bank/Post Office/agent thirty days before the coupon payment date.

Request for premature redemption can only be entertained if the investor

approaches the concerned bank/post office at least one day before the

coupon payment date. The proceeds will be credited to the customer’s

bank account provided at the time of applying for the bond.

26. Can I gift the bonds to a relative or friend on some occasion?

The bond can be gifted/transferable to a relative/friend/anybody who

fulfills the eligibility criteria (as mentioned at Q. no. 4). The Bonds

shall be transferable in accordance with the provisions of the

Government Securities Act 2006 and the Government Securities Regulations

2007 before maturity by execution of an instrument of transfer which is

available with the issuing agents.

27. Can I use these securities as collateral for loans?

Yes, these securities are eligible to be used as collateral for loans

from banks, financial Institutions and Non-Banking Financial Companies

(NBFC). The Loan to Value ratio will be same as applicable to ordinary

gold loan mandated by the RBI from time to time.

28. What are the tax implications on i) interest and ii) capital gain?

Interest on the Bonds will be taxable as per the provisions of the

Income-tax Act, 1961(43 of 1961). Capital gains tax treatment will be

the same as that for physical gold.

29. Is tax deducted at source (TDS) applicable on the bond?

TDS is not applicable on the bond. However, it is the responsibility of the bond holder to comply with the tax laws.

30. Who will provide other customer services to the investors after issuance of the bonds?

The issuing banks/Post Offices/agents through which these securities

have been purchased will provide other customer services such as change

of address, early redemption, nomination, etc.

31. What are the payment options for investing in the Sovereign Gold Bonds?

Payment can be made through cash/cheques/demand draft/electronic fund transfer.

32. Whether nomination facility is available for these investments?

Yes, nomination facility is available as per the provisions of the

Government Securities Act 2006 and Government Securities Regulations,

2007. A nomination form is available along with Application form.

33. Is the maximum limit of 500 gms applicable in case of joint holding?

The maximum limit will be applicable for the first applicant in case of a joint holding for the specific application.

34. Are institutions like banks allowed to invest in Sovereign Gold Bonds?

There is no bar on investment by banks in Sovereign Gold Bonds. These will qualify for SLR.

35. Can I get the bonds in demat form?

The bonds can be held in demat account.

36. Can I trade these bonds?

The bonds are tradable on stock exchanges from the date to be notified

by RBI. The bonds can also be sold and transferred as per provisions of

Government Securities Act.

37. Can I get part repayment of these bonds at the time of exercising put option?

Yes, part holdings can be redeemed in multiples of one gm.

All budgetary announcements fulfilled by Railway: Suresh Prabhu

MUMBAI: Claiming that all budgetary announcements made in the Railway

Budget this year have been fulfilled, Railway Minister Suresh Prabhu

today listed a slew of projects currently in the pipeline for the

country’s biggest employer.

Addressing a gathering of public representatives and railway staffers at

Borivali train station here, Prabhu said, “Earlier, only announcements

were being made. But I made 103 budgetary announcements in our first

full-fledged budget this year and I am happy to tell you that we have

fulfilled all of them.”

“Since I took over as Railway Minister, we have upgraded the website of

IRCTC, launched paperless ticketing, allowed hygienic and cheaper water

at stations, allowed private caterers in running trains, (undertaken)

cleaning of toilets and railway premises, mechanised washing of linen,

(initiated) changing the internal design of coaches, expanded the

railway network, etc,” the minister said.

He was in the city to inaugurate a new Foot Over Bridge (FOB) and

escalator at Borivali station. He also performed ‘bhoomi pujan’ of a

proposed deck at Borivali.

“We have selected 400 major stations across the country to be developed

on Public-Private Partnership (PPP) model that would have facilities

such as double decker entry-exit and food courts, like the airports,” he

said.

“Proposal for Mumbai Urban Transport Project-3 (MUTP-3), in which we are

slated to invest a mammoth (sum of) Rs 10,000 crore and which would

include elevated corridor on PPP model, has been sent to Niti Aayog for

final approval,” Prabhu said.

Referring to the Memorandum of Understanding (MoU) signed between the

Railway Ministry and Maharashtra government to create a Special Purpose

Vehicle (SPV), the minister said the Centre, with active help of the

state government, is committed to ease the hardships of the commuters.

“With the contribution of the state government, we can invest up to Rs

70,000-80,000 crore by setting up a joint company that would give the

commuters a big respite,” he said.

Prabhu also said that work on integrated transport system is underway.

“I have asked the senior officers of the both Central Railway (CR) and

Western Railway (WR) to chalk out an action plan for Mumbai by the end

of November to ease the hardships of Mumbaikars,” he said.

The minister also advocated increasing working hours of the (railway) employees in order to solve the peak hour problems.

“Normally from 8 AM to 10 AM and in the evening also, commuters face

peak hour troubles. If we increase the office hours, it would have an

immediate impact on the ease of commute,” he said, adding that he has

written to the state government on the same.

RBI Governor Raghuram Rajan first Indian to be appointed BIS Vice Chairman

|

| “And,

I think it’s a problem for the world. It’s not just a problem for the

industrial countries or emerging markets, now it’s a broader game.’’ |

MUMBAI: Raghuram Rajan, the governor of the Reserve Bank of India,

became the first Indian to be elected the vice-chairman of the Bank for

International Settlements, the bank for global central banks which works

to improve the financial stability and prescribes rules for banks

across the globe. The 52-year-old Rajan who has been critical of central

banks of the West for their excessive printing of money to bring back

growth, would assist Jens Weidmann, chairman of BIS, who is also the

head of Bundesbank, the German banking regulator.

"Raghuram Rajan was elected as the vice-chairman, the board of

directors of the Bank for International Settlements (BIS), at its

meeting in Basel held on Monday for a period of three years from

November 10, 2015," the RBI said in a release on its website.

Rajan, a former chief economist at the International Monetary Fund,

saw his stature as an economist get a boost when he warned of the

dangers of risks building up in the system in a symposium in 2005. He

was prescient. The global financial markets were hobbled during the

credit crisis. Indeed, he criticises western central banks for their

easy monetary policies, which may lead to next crisis. "I do worry that

we are slowly slipping into the kind of problems that we had in the

thirties in attempts to activate growth," Rajan told an audience at the

London Business School in June.

"And, I think it's a problem for the world. It's not just a problem

for the industrial countries or emerging markets, now it's a broader

game.''

As the vice-chairman of BIS, he could attempt to influence rule

making better than as a member. BIS, established in 1930 in Basel,

Switzerland, is an international organisation consisting of central

banks and monetary authorities of various countries. It was created

through an international treaty (The Hague Agreements of 1930). Rajan

who took over as the RBI governor in September 2013, joined the BIS

board in December 2013. His current term as RBI governor ends next

year.

"The board is responsible for determining the strategic and policy

direction of the BIS, supervising BIS Management, and fulfilling the

specific tasks given to it by the Bank's Statutes. It meets at least six

times a year," BIS said on its website.

Military veterans return medals to protest OROP notification

Chandigarh, November 10, 2015

Military

veterans returned their war and other medals at various places in

Haryana and Punjab on Tuesday to register their protest against the

“diluted” notification of the One Rank One Pension scheme.

In

Panchkula near Chandigarh, the veterans returned their medals to the

Panchkula deputy commissioner to protest against the OROP notification

issued by the central government.

There

were reports of veterans returning their medals in Jalandhar, Amritsar,

Patiala in Punjab and Rohtak, Hisar and Ambala in Haryana.

The veterans said that they had rejected the OROP notified by the Narendra Modi government.

The

defence veterans said that they will observe a ‘Black Diwali’ this time

to protest against the Modi government going back on its assurances.

Source : http://www.thehindu.com/

Government plans tax benefits for house owners, tenants

In a move to push rental housing in

urban areas to meet the growing need of migrant population on the lines

of other countries, the government has proposed to give both direct and

indirect tax relief to house owners and tenants as well by Centre,

states and local governments.

The draft Rental Housing Policy has proposed this based on the fact that

renting of homes is treated as a "commercial" activity which increases

property tax for individuals and service taxes for institutional rental

housing operators such hostels/ PGs and dormitories wherein electricity

and utility rates are calculated at par with commercial properties and

thereby reducing the rental yield. "Higher outflow due to commercial

treatment deters the growth of rental housing," the report says, which

has been circulated to states for their feedback.

The report also mentions that the Income Tax Act provides exemption of

tax deduction for house rent allowance (HRA) for an employee, which is

around 40% on the basic salary. "It is estimated that the urban poor

might be paying monthly 30% of their income as house rent without any

incentives. The share is much higher in the case of people with less

salary in comparison to those who are better paid," a ministry official

said.

Arguing for putting in place a robust Rental Housing Policy, the

document has suggested different "need based rental housing" models to

address diverse housing needs for various segments of the population

such as students, working men/ women, construction workers and migrants.

These can be owned by individuals, private players, companies and

government.

For example, it says that providing housing-to-all on ownership basis is

difficult or may not be feasible despite the fact that for governments

at Centre affordable housing has been a priority area. Even after taking

several initiatives such as subsidies for housing loans and tax

concessions the poor cannot afford to own a house due to low disposable

and irregular income. And hence there is need to have a separate model

for this group.

Considering the fact that poor and those with little income may not be

able to pay rent, the policy recommends that states or urban local

bodies can incentivize poor owners and tenants through subsidies and tax

incentives or rental vouchers. The vouchers provided to urban poor can

be used to top up the rent they are paying to move into a habitable

space.

The draft policy also highlights that while there is huge housing

shortage in urban areas, there are massive stocks of vacant houses.

According to the 2011 Census, 11.09 million houses are vacant in urban

areas. "While exact reasons for the vacant properties are hard to

ascertain it is felt that low rental yield, fear of repossession, lack

of incentives etc. are the possible reasons. If these vacant houses are

made available for rental housing, then some, if not most of the urban

housing shortage, could be addressed."

The policy suggests to states to recognize that many urban households

live in rental and shared housing, and hence they should consider

renting to be one of the various ways to improve housing condition. Some

of the recommendations include estimating the number of rental

households and landlords, setting up of a cheap arbitration and

conciliation service for landlords and tenants that works quickly and

facilitate online registration of rental properties, property dealers

working in informal sector, grievance redressal system.

Waivel of RD Default Fee for Oct.2015 in respect of RD Accounts attached to MPKBY Agents and PRSG Leaders in CBS Offices

A copy of the Postal Directorate Email on the above subject matter is reproduced below.

Copy of Directorate's eMail

Respected Sir/Madam

I am directed to inform that due to problems in accessing Agent Portal, many MPKBY Agents and PRSG Leaders could not prepare their RD LOTs in the portal from last week of Oct. 2015. Relaxations were given to accept their LOTs in the EXCEL sheet for regular deposits and at the counter through CRDP menu for default/rebate/POSB cases on 30th and 31st Oct. 2015.

This office is receiving representations and references for waiving off the default fee for Oct.2015 for those accounts which the agents still not able to present up to 31st Oct. of Post Offices were not able to accept business through EXCEL sheet or at the counter due to paucity of time.

It has been decided by the competent authority that CBS Post Offices may waive default fee in such genuine cases. For this, CBS Post Office has to take following action:-

1. Write Error Book mentioning name and agency number of the agent and amount of default fee not taken.

2. Since, Finacle will charge default fee, the amount to be waived should be noted at the end of the RD Consolidation and only RD Default fee collected at the counter (from general public) should be entered in the SB Cash/CSI System (in Mysore Division only).

3. Copy of agent list of such accounts should be kept in a guard file. (list should have Date, Agent ID, Account number, Default fee waived)

This process can be followed till all the agents are able to deposit their funds for the month of Oct. 2015. For any account being presented or included in the list where system is calculating default fee for Nov. 2015 default fee should not be waived.

Regards,

(Kawal Jit Singh)

Assistant Director (SB-II)

Postal Directorate

New Delhi

Contact No. 011-23036224, 011-23036224, 011-23096108, 011-23096108,

Mob:- 09899998054, 09899998054

One Rank One Pension (OROP) to the Defence Forces Personnel - MoD orders published on 7.11.2015

One Rank One Pension (OROP) to the Defence Forces Personnel - MoD orders published on 7.11.2015

12(1)/2014/D(Pen/Pol)-Part-II

Government of India

Ministry of Defence

Department of Ex-Servicemen Welfare

New Delhi Dated 7th Nov 2015

To

The Chief of the Army Staff

The Chief of the Naval Staff

The Chief of Air Staff

In view of the need of the Defence Forces to maintain physical

fitness, efficiency and effectiveness, as per the extant Rules, Defence

Service personnel retire at an early age compared to other wings in the

Government. Sepoy in Army and equivalent rank in Navy & Air Force

retire after 17/19 years of engagement/service and officers retire

before attaining the age of 60 years i.e. the normal age of retirement

in the Government. Considering these exceptional service conditions and

in the interest of ever vigilant Defence Forces, the pensionary benefits

of Ex-Servicemen have accordingly, over time, been fixed.

2. It has now been decided to implement “One Rank One Pension” (OROP)

for the Ex-Servicemen with effect from 1.07.2014. OROP implies that

uniform pension be paid to the Defence Forces Personnel retiring in the

same rank with the same length of service, regardless of their date of

retirement, which, implies bridging the gap between the rates of pension

of current and past pensioners at periodic intervals.

3. Salient features of the OROP are as follows:

i. To begin with, pension of the past pensioners would be re-fixed on

the basis of pension of retirees of calendar year 2013 and the benefit

will be effective with effect from 1.7.2014.

ii. Pension will be re-fixed for all pensioners on the basis of the

average of minimum and maximum pension of personnel retired in 2013 in

the same rank and with the same length of service.

iii. Pension for those drawing above the average shall be protected.

iv. Arrears will be paid in four equal half yearly instalments.

However, all the family pensioners including those in receipt of

Special/Liberalized family pension and Gallantry award winners shall be

paid arrears in one instalment.

v. In future, the pension would be re-fixed every 5 years.

4. Personnel who opt to get discharged henceforth on their own

request under Rule 13(3)1(i)(b),13(3)1(iv) or Rule 168 of the Army Rule

1954 or equivalent Navy or Air Force Rules will not be entitled to the

benefits of OROP. It will be effective prospectively.

5. The Govt. has decided to appoint a Judicial Committee to look into

anomalies, if any, arising out of implementation of OROP. The Judicial

Committee will submit its report in six months.

6. Detailed instructions relating to implementation of OROP along

with tables indicating revised pension for each rank and each category,

shall be issued separately for updation of pension and payment of

arrears directly by Pension Disbursing Agencies.

7. This issues with concurrence of Finance Division of this Ministry

vide their ID No. MoD (Fin/Pension) lD No.PC to10(11)/2012/Fin/Pen dated

07 November 2015.

8. Hindi version will follow.

sd/-

(K. Damayanthi)

Joint Secretary to the Govt. of India

Authority : http://www.desw.gov.in/