14.04.2015

- THE INNOVATION CHALLENGE FACING POSTAL OPERATORS WORLDWIDE DOMINATED

DISCUSSIONS ON THE FIRST DAY AT THE UNIVERSAL POSTAL UNION’S WORLD

STRATEGY CONFERENCE AS POSTAL EXECUTIVES, GOVERNMENT REPRESENTATIVES AND

PRIVATE COMPANIES DEBATED HOW TO BEST RESPOND AND ADAPT TO THE RAPID

CHANGES THRUST UPON THE SECTOR BY TECHNOLOGICAL CHANGE.

(L.

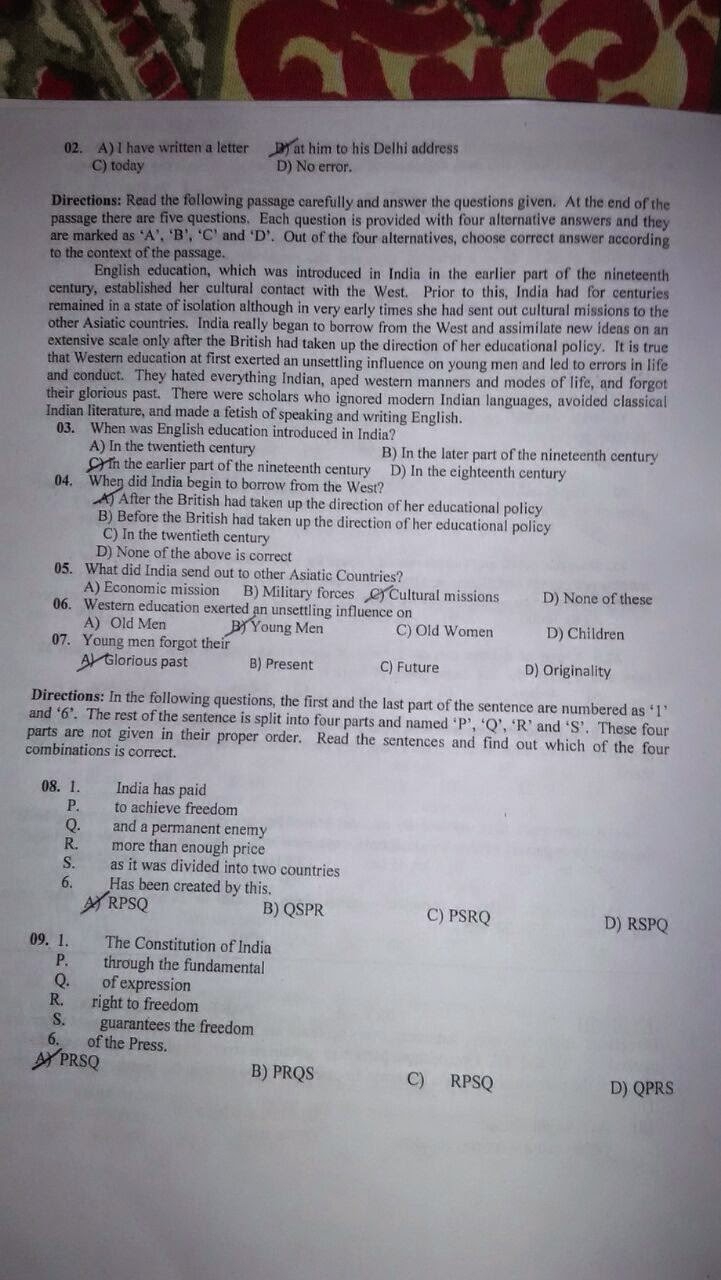

to R.) Dimitry Strashnov, director general, Russian Post; Moulay Hafid

Elalamy, Morocco's minister of industry, trade, investment and digital

economy; Stefan Krawczyk, associate general counsel and head, government

relations, eBay; Lin Hongliang, director, Asian-Pacific Postal Union;

Peter Somers, moderator (Photo: UPU/Pierre Alboui)

“Together

we must take stock of our organizations and the postal sector today,

and shape our future tomorrow,” UPU Director General Bishar Hussein told

the conference.

The

rapidly expanding e-commerce sector was of particular interest during

the opening day of the conference. While this sector promises great

growth for postal operators, it brings many challenges as well. Consumer

demands when it comes to delivery of e-commerce goods, for example, are

changing quickly. As well, it is still unclear whether e-commerce

giants, such as Amazon, are interested in handling last-mile delivery

themselves.

“The

future of commerce is a blurred landscape, where the consumer dictates

how, where and when he will consume,” said Stefan Krawczyk, associate

general counsel and head of government relations at eBay. “That means

the delivery operators will have to adapt to what the consumer

dictates.”

Postal

operators are already changing the way they deliver packages, including

introducing package lockers and sending delivery notifications to

customers via text messages. Krawczyk, however, stressed that consumers

are looking for transparency and predictability when it comes to package

delivery. A seller in Europe needs to feel certain that when they send

an item to a buyer in South America, it will arrive on time. They also

want the service and pricing to be transparent and logical, Krawczyk

added.

Dimitry

Strashnov, director general of Russian Post, seconded that viewpoint.

Postal operators, for example, should analyze what kind of delivery

their customers need and expect. “Do we need to deliver all the parcels

in one day or two days?” Strashnov asked. “Would a customer be satisfied

having three-to-five day delivery but with a high predictability level.

Can we deliver on the promise? This is getting more and more important

today because the cost of five-day delivery is lower than one day.”

Postal

operators must also be efficient to maintain their profitability,

Strashnov said. This, in turn, allows them to invest in their

infrastructure to create new products.

The

development of new products is an important focus for postal operators

worldwide. Take Saudi Post, which is leveraging its established assets

such as its transportation infrastructure, last-mile delivery network,

postal offices and technology to expand its range of products, according

to Mohamed Saleh Ben Taher Benten, the organization’s chairman and

chief executive officer. For example, Saudi Post has transformed its

transportation network into a logistics network. Its NAQEL logistics

joint venture, in which it holds a majority stake, provides services for

many different industries in Saudi Arabia, including fashion retailers

and food processors.

Another

attractive area for expansion is postal financial services. In

Indonesia, the government has asked the Post to conduct a pilot project

called the “post savings account” in six provinces as many people in

that country still store their cash at home, according to Kalamullah

Ramli, Indonesia’s director general of the ministry of communication and

information technology.

The

development of such value-added services is what makes Moulay Hafid

Elalamy, Morocco’s minister of industry, trade, investment and digital

economy, optimistic about the future for his country’s postal operator.

“From my point of view, posts will continue to be profitable in coming years if they modernize,” Elalamy told the conference.

However,

it’s not just the postal operators that have to adapt, but the rules as

well, according to speakers at the conference. Philippe Wahl, president

of France’s La Poste, said work on the development of the UPU’s global

integrated postal programme, known as ECOMPRO, is necessary for the

further development of the e-commerce market.

“We

need to communicate and exchange information with all members from the

UPU,” Wahl said. “It’s the next big step we are taking together.”