7th CPC- Public Notice inviting Views

CLICK HERE

Ready Reckoner on Standardisation of mails

CLICK HERE

Latest Current Affairs Questions: 01 May 2014 for Exams

Friends.. Daily Current Affairs Quiz Question series which will be helpful for all competitive Exams.

1) May 1 was celebrated every year as?

(A) World Diabetes Day

(B) International Labour Day

(C) International Children's Day

2) Which IIT from India was ranked at the 87th position among the top 100 world universities, under 50 years of age, published by London-based Times Higher Eductaion (THE) magazine recently?

(A) IIT Madras

(B) IIT Bhubaneswar

(C) IIT Indore

(D) IIT Guwahati

3) Who has quit as MD and CEO of MCX on 1 May 2014?

(A) Thomas Mathew T

(B) Saurabh Sarkar

(C) Manoj Vaish

(D) Ashima Goyal

4) What was the ranking of India in the ICC Test rankings annual updated list issued on 1 May 2014?

(A) 2nd

(B) 6th

(C) 4th

(D) 5th

5) Which team is at No.1 position in the latest T20 rankings released by ICC?

(A) Srilanka

(B) India

(C) Pakistan

(D) Australia

6) Mahatma Gandhi Pravasi Suraksha Yojana scheme was launched on 1 May 2014 in which foreign country?

(A) UAE

(B) Oman

(C) Britain

(D) USA

7) A woman was killed and at least 14 people were injured in two "low-intensity" explosions that took place on which railway station on 1 May 2014?

(A) Hyderabad

(B) Bengaluru

(D) Pune

8) UAE leg of IPL 2014 ended on 30 April 2014 with which IPL team winning all of its matches played at UAE?

(A) Bangalore Royal Challengers

(B) Rajasthan Royals

(C) Chennai Super Kings

(D) Kings XI Punjab

9) Which player has broken Lionel Messi's all-time record for the most goals in a single Champions League season after notching his 15th score recently?

(A) Luis Suarez

(B) David Villa

(C) Cristiano Ronaldo

(D) Frank Ribery

10) Bharat Heavy Electricals Ltd. (BHEL) has signed an agreement with which country for setting up solar photovoltaic (PV)-based power plants in that country?

(A) Yemen

(B) Libya

(C) Cuba

(D) Brazil

Answers

1) Ans. (B) International Labour Day

2) Ans. (D) IIT Guwahati

3) Ans. (C) Manoj Vaish

4) Ans. (D) 5th

5) Ans. (B) India

6) Ans. (A) UAE

7) Ans. (C) Chennai

8) Ans. (D) Kings XI Punjab

9) Ans. (C) Cristiano Ronaldo

10) Ans. (A) Yemen

Source : http://www.currentaffairs4examz.com/

Daily Current Affairs 05 May 2014

1) Government appointed R V Verma as Whole-Time Member (Finance) in Pension Fund Regulatory and Development Authority: The government has appointed R V Verma as a member of the Pension Fund Regulatory and Development Authority (PFRDA). Verma has been appointed as Whole-Time Member (Finance) in the PFRDA, the Finance Ministry said in a notification. He at present is Chairman and Managing Director of National Housing Bank, the regulator for housing finance companies. Verma is the first Whole-Time Member to be appointed by the government after PFRDA Act was notified last year. The government is yet to decide on the appointment of PFRDA Chairman, a post which has been lying vacant since November last year. The PFRDA consists of a chairperson and at least three whole-time members.

2) Dipika Pallikal back in top-10 after Texas Open high: A final appearance at the Texas Open last month has pushed India's top squash player Dipika Pallikal back to the top-10 of the world rankings. Pallikal gained two places to be number 10 in the Women's Squash Association (WSA) rankings, the spot she has reached for the first time in December 2012.

3) China won Table Tennis World Championships: This year's world champion titles in table tennis have gone to both China men's and women's teams. Germany's men made it to the final round, but were unable to make strong gains on the defending champions. Both the men's and women's teams from China swept the World Team Table Tennis Championships on Monday. Germany's men lost out in the final to the favorites China at the event being held in Tokyo, with the record champions proving formidable opponents. China won 3-1 against Germany.

4) Vodafone, Airtel, Idea resume 3G services: Telecom operators Vodafone and Idea Cellular on Monday said they will resume 3G services in circles where they don't have spectrum through intra-circle roaming (ICR) pacts with other operators. Bharti Airtel has also announced resumption of its 3G services in circles where it don't have spectrum. This announcement by the operators comes post the Telecom Disputes Settlement and Appellate Tribunal (TDSAT) ruling last week. The TDSAT bench headed by Justice Aftab Alam has said 3G ICR agreement signed by Airtel, Vodafone and Idea Cellular was not violative of licence agreement.

5) Honda recalls 31,226 Amaze, Brio cars to check faulty brake: Honda Cars India Ltd (HCIL) on Monday recalled 31,226 units of select variants of the Amaze compact sedan and Brio hatchback to inspect them for a possible defect in the brake system. Prepared by:www.currentaffairs4examz.com

6) Ratan Tata awarded Knight Grand Cross of the Order of the British Empire: Ratan Tata on Monday became the first Indian to be awarded the Knight Grand Cross of the Order of the British Empire (GBE) since India became a Republic in 1950. British high commissioner to India, Sir James Bevan conducted the honours for Ratan Tata, Chairman Emeritus of Tata Sons. The high commissioner presented Tata with the Knight Grand Cross of the Order of the British Empire (GBE) on behalf of Her Majesty Queen Elizabeth II.

7) Ahmed Maiteeg elected New PM of Libya: Businessman Ahmed Maiteeg was elected on Sunday as Libya’s new prime minister after receiving 121 votes in parliament.

8) Juan Carlos Varela to be new President of Panama: The opposition leader Juan Carlos Varela has won the Presidential election in Panama with almost 40 percent of the votes.

9) ING Vysya Life renamed as Exide Life Insurance: More than a year after the ING Group exited the life insurance business in India by selling its 26 per cent stake to Exide Industries, the name of ING Vysya Life Insurance Company Limited has been changed to Exide Life Insurance Company Limited (Exide Life Insurance) with immediate effect. The company received approvals from Insurance Regulatory and Development Authority (Irda) and the Ministry of Corporate Affairs last week.

10) Ahmet Sik won UNESCO Guillermo Cano World Press Freedom Prize 2014: Turkish investigative journalist Ahmet Sik won 2014 UNESCO Guillermo Cano World Press Freedom Prize

Source : http://www.currentaffairs4examz.com/

Odisha Circle PA/SA Exam English Section Answer Key

Friends.. Here is the answers to English Section of PA/SA Exam held in Odisha Postal Circle 2014. These answers have been prepared by us based on the feedback and discussion had with our friends via e-mail & facebook page. This may not be treated as the final answer key and we are not stating that the answers given below are completely correct. If anybody feels that the answers to any question are different, you are welcome to comment your part below as comment with valid points. Hope this helps. Open discussion is welcome...

Question Paper typed and shared by our friend Roshandip Satpathy. Contact us at Currentaffairs4examz@gmail.com & sapost2@gmail.com

PART (C)– ENGLISH

51. Analogies for :

BOTANY : PLANTS ::

(A)Geology : Earth

(B)Stars : Astronomy

(C)Teacher : Class

(D)Disease : Ethilogy

Ans. (A)Geology : Earth

52. Analogies for :

BUCKET : WATER ::

(A)Milk : quart

(B)Eggs : Dozen

(C)Shaker : salt

(d)River : ocean

Ans. (A)Milk : quart

53. Choose the option that describes the meaning of the following idioms and phrases :

To smell a rat :

(a)To suspect foul dealings

(b)To be in a bad mood

(c)Bad smell

(d)Sings of plague epidemic

Ans. (a)To suspect foul dealings

54. Choose the option that describes the meaning of the following idioms and phrases :

Above board :

(a)Friendly

(b)Able to face difficulties

(c)Honestly

(d)Hard working

Ans. (c)Honestly

55. Fill in the blank with appropriate given option :

…………… lion is the beast of prey.

(a)A (B)an (C)the (D)that

Ans. (C)the

56.Fill in the blank with appropriate given option :

My uncle is ……………. S.D.O.

(a)A (B)an (C)the (D)that

Ans. (B)an

57. Choose the most suitable preposition :

He is a slur ……………. his family.

(A)On (B)for (C)into (D)at

Ans. (A)On

58.Find out the error part of the following sentence :

Ajay is the most (A)/succeeded for all (B)/ the businessmen (C)/ in this city today. (D)

Ans. (B)succeeded of/among all

59. Complete the sentence with one of the word or phrase.

…………………. he came to the desert, night had fallen and he found himself alone.

(A)Everywhere (B)Anywhere (C)Whenever (D)By the time

Ans. (D)By the time

60. On the basis of the given sentence pick out the correct sentence converted in Negative from the given options :

You wasted your time

(A)You not wasted your time

(B)You did not waste your time

(C)You wasted not your time

(D)You do not waste your time

Ans. (B)You did not waste your time

61. On the basis of the given sentences pick out the correct sentence converted in Negative from the given options :

A dog barks at a stranger.

(A)A dog will not bark at a stranger

(B)A dog does not bark at a stranger

(C)A dog shall bark at a stranger

(D)Dog is not barking at a stranger

Ans. (B)A dog does not bark at a stranger

62.Antonym for :

HURRY

(A)Worry (B)amble (C)sorry (D)enable

Ans. (B)amble

63. Antonym for :

ACCEPTED

(A) Indisputable (B)controversial (C)accede (D)axiomatic

Ans. (B)controversial

64. Find the synonym of :

FALSE

(A)Defective (B)Untrue (C)incorrect (D)inaccurate

Ans. (C)incorrect

65. Find the synonym of :

MINIMUM

(A)Little (B)Lowest (C)Minimal (D)Meager

Ans. (C)Minimal

66. Find out which part of the sentence has an error. If there is no mistake, the answer is (D)

The famous Dr. Chandra (A)/ is only dentist (B)/ in our village. (C)/ No error (D)

Ans. (B)is the

67. Find out which part of the sentence has an error. If there is no mistake, the answer is (D)

This is not the (A)/ sense which (B)/ concerns us here. (C)/ No error (D)

Ans. (C)Concern us

68. Choose the most suitable preposition :

No one can hinder him …………….. doing this

(A)Into (B)from (C)for (D)of

Ans. (B)from

69. Choose the most suitable preposition :

He took the man ………… hospital.

(A)For (B)towards (C)to (D)at

Ans. (C)to

70. Find out the error part of the following sentence :

It was most (A)/ unfortunate that he (B)/ died at (C)/ early age of 41. (D)

Ans. (D)

71. Find out the error part of the following sentence :

In spite of toiling (A)/ very hardly he (B)/ realized that he had (C)/ not earned anything substantial.(D)

Ans. (B)Very hard

72. Fill in the blank with appropriate conjunction.

………………… six tables in the room.

(A)There is (B)it is (C)they are (D)there are

Ans. (D)there are

73. Fill in the blank with appropriate conjunction.

I …………………………. my sister for breakfast next week.

(A)Meet (B)will meet (C)will have met (D)am meeting

Ans. (B)will meet

74. In the following question identify the correct sentence/s.

(I) I don’t like recorded music, I prefer the real thing.

(II) These items are the genuine articles.

(III) You can give a wide summery of something.

(IV) You can describe something in a minute detail.

(A)I and III (B)I and II (C)II and IV (D)III only

Ans. (D)III only

75. In the following question identify the correct sentence/s.

(I) Since 1996, it has been regularly been winning GM’s “Supplier of the Year” award.

(II) It is on the urging of GM that SFL set up its China operations in may 2004 in Hainan province.

(III) A presence aboard means easier reaches to new markets.

(IV) This explains why TVS group has also set up a motorcycle plant in China.

(A)I and III (B)I, III and IV (C)III and IV (D)I and IV

Ans. (C)III and IV

SC: Govt can't impose mother tongue in primary schools

The Supreme Court on Tuesday held that the government cannot impose mother tongue on linguistic minority for imparting primary education.

"State has no power to compel linguistic minority to impart primary education by compulsorily imposing regional language," a five-judge Constitution Bench headed by chief justice R M Lodha said.

The bench, also comprising justices A K Patnaik, S J Mukhopadhaya, Dipak Misra and F M I Kalifulla, was hearing the issue which had come before the apex court as two Karnataka government orders of 1994 making mother tongue or regional language compulsory for imparting education from class I to IV, had come under challenge.

In July last year, a two-judge bench of the apex court had said its Constitution Bench will examine whether government can impose mother tongue or regional language as the medium of instruction at the primary education stage as it has a far-reaching significance on the development of children.

The court, which was of the opinion that it was a fit case for consideration by a larger bench, had said that the issue involved in this case concerns the fundamental rights of not only the present generation but also the generations yet to be born.

It had said that the issue had to be referred to a larger bench as a two-judge bench of the court in 1993 had refused to interfere with a Karnataka government order specifying mother tongue Kannada as the medium of instruction at the primary school level and making it mandatory for every child.

Grant of Transport Allowance to Orthopaedically handicapped Railway Employees

Grant of Transport Allowance to Orthopaedically handicapped Railway Employees

GOVERNMENT OF INDIA

MINISTRY OF RAILWAYS

(Railway Board)

S.No.PC-VI/337

RBE No. 40/2014

No. PC-V/2014/A/TA/1

New Delhi, dated 29.04.2014

The General Manager/CAOs(R)

All Zonal Railways & PUs

(As per mailing list)

Sub:-Grant of Transport Allowance to Orthopaedically handicapped Railway Employees.

Reference is invited to Railway Board’s letter No. F(E) I-78/AL-7/5, dt.15.01.1980 as amended from time to time andto say that the criteria for orthopaedically handicapped employees to draw Transport Allowance at double the normal rates has been reviewed by Ministry of Finance in consultation with the Ministry of Health & Family Welfare. It has been decided that in partial modification of para-1 of Railway Board’s letter dt. 15.01.1980 referred above, Double Transport Allowance shall be allowed to an orthopaedically Handicapped Railway employee if he or she has a minimum of 40% permanent partial disability of either one or both upper limbs or one or both lower limbs OR 50%permanent partial disability of one or both upper limbs and one or both lower limbs combined. The other conditions of Board’s letter dated 15.01.1980 for granting Double Transport Allowance to orthopaedically handicapped Railway employees shall remain unchanged.

2. This issues with the concurrence of the Finance Directorate of the Ministry of Railways.

3. Hindi version is enclosed.

{Authority: MoF’s OM No.21-1/2011-E.II(B), dt. 5th August, 2013}

sd/-

(N.P.Singh)

Dy.Director, Pay Commission – V

Railway Board.

No. PC-V/2014/A/TA/1

New Delhi, dated 29.04.2014

Source: NFIR/AIRF

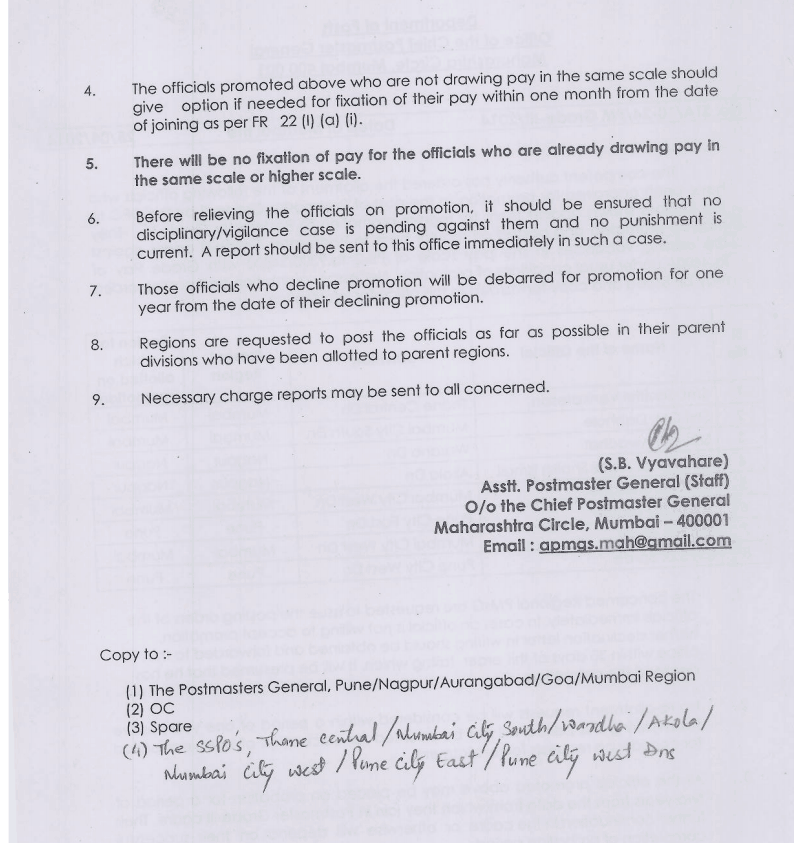

Maharashtra Circle : Postmaster Grade III Regional allotment

Agenda for next meeting of the Standing Committee of the National Council JCM: BPMS

Agenda for next meeting of the Standing Committee of the National Council JCM: Grant of MACP benefit to the eligible employees in the Hierarchy of promotional grade - BPMS

BHARATIYA PRATIRAKSHA MAZDOOR SANGATHAN

(AN ALL INDIA FEDERATION OF DEFENCE WORKERS)

(AN INDUSTRIAL UNIT OF B.M.S.)

(RECOGNISED BY MINISTRY OF DEFENCE, GOVT. OF INDIA)

CENTRAL OFFICE: 2-A, NAVEEN MARKET, KANPUR – 208001, PH & FAX : (0512) 2332222

MOBILE: 09415733686, 09235729390, 09335621629, WEB : www.bpms.org.in

REF: BPMS / MACPS / 64 (7/3/M)

Dated: 05.05.2014

To,

Shri Shiva Gopal Mishra,

Secretary, Staff Side,

National Council JCM,

New Delhi.

Subject: Agenda for next meeting of the Standing Committee of the National Council JCM: Grant of MACP benefit to the eligible employees in the Hierarchy of promotional grade.

Dear Sir,

I have come to know that a meeting of the Standing Committee of the National Council JCM is scheduled to be held on 07.05.2014 under the Chairmanship of Secretary (P). Being a constituent of National Council (JCM) but not of Standing Committee, I would like to submit one of the issues regarding grant of MACP benefit in the hierarchy of promotional grade instead of hierarchy of grade pay.

An affected employee had challenged the Government’s decision on the subject vide his O.A. No. 1038/CH/2010 in CAT Chandigarh and that the Hon’ble CAT Chandigarh vide its order dated 31.05.2011 granted the prayer of the petitioner and directed the authorities to grant MACP benefit in the hierarchy of promotional grade. Thereafter, the Union of India represented by the Secretary, DoP&T appealed to the Hon’ble High Court of Punjab and Haryana vide CWP No. 19387 of 2011. This appeal of the DoP&T was subsequently dismissed vide order dated 19.10.2011. The Government thereafter approached the Hon’ble Supreme Court vide SLP No. 7467/2013, the Hon’ble Supreme Court dismissed the said SLP. In view of the above, the issue now stands settled that eligible employee needs to be given MACP benefits in the promotional hierarchy only.

Recently, CAT Principal Bench has issued direction on 12.03.2014 in OA No. 864/2014 that once an order has been passed by this tribunal and it has also been upheld at the level of the Supreme Court, there is no question of waiting for an approval from any Govt. department for implementation of the same.

Further, your attention is invited to Para 126.5 of 5th Central Pay Commission which reads as under:

Extending judicial decisions in matters of a general nature to all similarly placed employees. - We have observed that frequently, in cases of service litigation involving many similarly placed employees, the benefit of judgement is only extended to those employees who had agitated the matter before the Tribunal/Court. This generates a lot of needless litigation. It also runs contrary to the judgment given by the Full Bench of Central Administrative Tribunal, Bangalore in the case of C.S. Elias Ahmed and others v. UOI & others (O.A. Nos. 451 and 541 of 1991), wherein it was held that the entire class of employees who are similarly situated are required to be given the benefit of the decision whether or not they were parties to the original writ. Incidentally, this principle has been upheld by the Supreme Court in this case as well as in numerous other judgments like G.C. Ghosh v. UOI, [ (1992) 19 ATC 94 (SC) ], dated 20-7-1998; K.I. Shepherd etc. Accordingly, we recommend that decisions taken in one specific case either by the judiciary or the Govt. should be applied to all other identical cases without forcing the other employees to approach the court of law for an identical remedy or relief. We clarify that this decision will apply only in cases where a principle or common issue of general nature applicable to a group or category of Government employees is concerned and not to matters relating to a specific grievance or anomaly of an individual employee.

Contrary to above, DoP&T has replied (letter No. No. P-26012/5/2011-AT, 19.08.2013 & No. P-13025/11/2014-AT, dated 04.04.2014) under RTI Act that the SLP was dismissed on technical grounds and not on merit, hence, the Department had decided to implement the order dated 31.05.2011 of CAT Chandigarh Bench for grant of financial upgradation in the promotional hierarchy under MACP to Shri Rajpal on personal basis not to be treated as a precedent

The stand taken by DoP&T is a matter of great concern for the trade unions as whether Govt of India wants to add 35 Lakh more court cases filed by each and every Central Government Civilian employees where the courts are already overloaded and several lakhs of litigants are waiting for judgment for decades.

You may be agree that the JCM Forum has been evolved for promoting harmonious relations and securing the greatest measure of cooperation between the Government, in its capacity as employer, and the general body of its employees in matters of common concern and increasing the efficiency of the public service. Hence, it is our moral and legal responsibility to protect the rights of our fellow members through JCM forum also.

Therefore, you are requested to add the above agenda point in the meeting and try your level best to prove the worthy of existence of this National Council (JCM) by resolving the issue without further delay and litigations in the interest of employees.

Thanking you.

Yours Sincerely

SADHU SINGH

Member, National Council (JCM) &

Organizing Secretary/BPMS

Source: www.bpms.org.in

[http://bpms.org.in/documents/macp-3-3r71.pdf]

Via : http://90paisa.blogspot.in/

DRAFT REPLY TO THE QUESTIONNAIRE PRESCRIBED BY 7TH CPC BY CENGO ( REVISED DRAFT )

ALL INDIA ASSOCIATION OF CENTRAL EXCISE GAZETTED EXECUTIVE OFFICERS

DRAFT REPLY TO THE QUESTIONNAIRE PRESCRIBED BY 7TH CPC. ( Revised )

1. Salaries

1.1 The considerations on which the minimum salary in case of the lowest Group ‘C’ functionary and the maximum salary in case of a Secretary level officer may be determined and what should be the reasonable ratio between the two.

|

1.2 What should be the considerations for determining salary for various levels of functions falling between the highest level and the lowest level functionaries? ---

GAZETTED OFFICER is a higher level ranked public servant . These officers in the Central Government are entrusted with some supervisory and managerial role, they are the second level of command structure among the broad categories of central civil services. At present while ten different grade pays have been granted in favour of Gr ‘A’ officers, but a single grade pay has been granted to Gr-B Gazetted Officers. Parity is the basic concept of our Constitution of India . The Ministry of Finance has clearly stated that “ in no two organisations, the assigned duties of comparable posts can be totally identical and so in the case with the Gazetted Executive Officers of CBI, IB, Central Police Organisations, Customs, Income Tax and Central Excise. However, the 1st, 2nd , 3rd, 4th and 5th Pay Commissions by assigning identical pay scales to the Gazetted Executive Officers of all these departments have established the comparable nature of the level of responsibilities assigned to the Gazetted Executive Officers of each of the categories mentioned above. This was also upheld by the committee set up by the former Finance Minister on this subject as well as in the judgement dated 22.03.2002 of Jabalpur Bench of CAT.” The pay scale of Dy SP/CBI was upgraded by Govt during 1996 retrospectively from 01.01.86 without upgrading the pay scale of analogous posts and disturbing the traditional parity. Therefore the post of Superintendent of Central Excise which is an analogous post to DySP / CBI as per Dy SP/CBI recruitment Rules is entitled to get the pay scale/grade pay as to be granted to the cadre of DySP/CBI etc. duly classifying such post as Gr-A. While the post of Inspector of Central Excise is the feeder grade for the post of Superintendent of Central Excise, Inspector of CBI is feeder post for the post of Dy SP/CBI. The Govt. has granted similar GP ( i.e. GP 4600 in PB-2) to the Inspectors of both the organisations, hence both the promotional posts are also required to get equal grade pay. As per the Recruitment Rules of CBI framed under article 309 of Constitution of India, the Central Excise and Customs Department is considered as a Central Police Organisation, for which the executive posts of Central Excise department are considered as analogous posts of CBI and therefore executive officers of Central Excise department are being joined in CBI on deputation. The Executive Officers of Central Excise and Customs Department are uniformed Officers and the Central Excise Department has the same structural features, same command and control elements, serve under similar harsh service conditions, , as the army. In spite of the similarities in the duties performed by the Central Excise personnel but they are deprived of privileges extended to defence services and police services. The command structure of Central Excise is similar to the army, and so is its rank structure, except that the ranks in Central Excise have different nomenclature ( Commissioner, Additional Commissioner, Joint Commissioner, Deputy Commissioner, Asst. Commissioner, Superintendent, Inspector ). The command and control system Central Excise is also similar to the Army . The personnel of Central Excise and Customs are deployed on the borders (with Pakistan, Bangladesh, Nepal, and Myanmar), International Airports and Sea Ports and are actively engaged in counter insurgency operations with smugglers and tax evaders etc. within the country. These personnel have suffered heavy casualties while dealing with trans-border crimes. Their duties are akin to the Army, and they are responsible for the guarding Economics borders of the Country, and are also responsible for security of the nation. In fact, in J & K and in the North-eastern states of India, the Central Excise personnel are deployed side by side with the Army, at times, on the same location. They perform their duties in most adverse conditions coupled with threat to their life either by enemy action, insurgents and the climatic hazards in high altitude, deprived of domestic life, which leads to deterioration of the physical and mental ability.

The Central Board of Excise and Customs had declared before the IV CPC that Executive Officers of Central Excise Department are uniformed officers and they are performing more arduous and hazardous nature of duties than executive officers of other departments. The first level of gazetted officers, such as the Superintendent of central excise, are also the first appellate officer the public has to confront while dealing with the department. These officers not only display the stamp of authority of the government to the general public but also present the true face of the government to the people. In fact the government's attributes are measured and tested by the actions and behaviour of these first level gazetted officers who actually creates the image of the government. This means that a happy and contended gazetted officer will positively impact the efficiency, effectiveness and the image of the department and the government and therefore, it will serve the best interests of the government if his remuneration and carrier prospects are augmented and refurbished to an optimum level. Raja Chellia Committee recommended higher pay scales to executive officers of taxation department. In spite of the fact that the service conditions of Central excise & Customs personnel are akin to the Central Police Organisations/ CBI and Defence Armed Force personnel, they are not compensated with any additional incentives or allowances, as in the case of CBI/Police/Army. An Army jawan, posted in Leh or Ladakh gets Military Service Pay, for reasons that he is a part of army, but a Central Excise and Customs personnel , serving under same conditions and in the same location, surviving in sub-zero temperatures is deprived of the same , without any potent reasons. The post of Superintendent of Central Excise is an analogous post to the post of Dy SP/CBI, whereas the higher benefits granted to the post of Dy SP/CBI apart from higher Gr-A salary, such as one month additional pay etc have not been granted to the post of Superintendent of Central Excise. It is the harsh conditions of service, and their performance which should matter, and not the name of the wing of the Force, of which these personnel are part of. Denial of ‘benefits to Superintendent of Central Excise at par with the post of Dy SP/CBI is discriminatory, arbitrary, illegal and unjustified.

2. Comparisons

2.1 Should there be any comparison/parity between pay scales and perquisites between Government and the private sector? If so, why? If not, why not?

In the era of globalisations, there should be a parity in between the pay scale and other emulations of gazetted officials and the similar placed managerial persons of foreign companies engaged in India at least.

2.2 Should there at all be any comparison/parity between pay scales and perquisites between Government and the public sector? If so, why? If not, why not?

Yes. There should be parity in between the pay scale and other emulations of gazetted officials and the similar placed managerial persons of profitable public sector companies.

2.3 The concept of variable pay has been introduced in Central Public Sector Enterprises by the Second Pay Revision Committee. In the case of the Government is there merit in introducing a variable component of pay? Can such variable pay be linked to performance?

The concept of performance related pay structure was actually introduced by foreign companies. Hence if parity in salary will be maintained, then automatically variable pay may be linked to performance however variable pay should be granted in the form of Bonus only .

3. Attracting Talent

3.1 Does the present compensation package attract suitable talent in the All India Services & Group A Services? What are your observations and suggestions in this regard?

There should not be any direct entry in Gr-A post. Direct entry must be in Gazetted Gr-B posts. The top of the cadre post or the top post dealing with HR of the cadre must be an official of another cadre. For example Chairman of Central Board Excise and Customs(CBEC) or Member (P&V) of CBEC should be other than IRS(C&CE) officials.

3.2 To what extent should government compensation be structured to attract special talent?

There should be a provision of direct recruitment in the Gr-B gazetted post and after selection, the selected persons should go further professional study for at least 2 years in reputed institutions including foreign institutions. No one should enter Gr-A directly.

4. Pay Scales

4.1 The 6th Central Pay Commission introduced the system of Pay Bands and Grade Pay as against the system of specific pay scales attached to various posts. What has been the impact of running pay bands post implementation of 6th CPC recommendations?

The Pay Band and Grade Pay system can be continued provided there should not be any same grade pay of lower PB in higher PB. For example GP 5400 is in both PB-2 and PB-3 at present which caused providing no benefit to employees, hence this system should avoided.

4.2 Is there any need to bring about any change?

Yes. The higher posts should have higher GPs and not same Grade Pay having different PBs.

4.3 Did the pay bands recommended by the Sixth CPC help in arresting exodus and attract talent towards the Government?

Talents can be attracted if proper studies in reputed institution can be provided before entering in service after selection.

4.4 Successive Pay Commissions have reduced the number of pay scales by merging one or two pay scales together. Is there a case for the number of pay scales pay band to be rationalized and if so in what manner?

Yes all the Gr.B gazetted officers in general, Superintendents of Central Excise in particular should be granted one Grade pay at par with Dy SP of CBI on the reason as stated vide para-1.2 above.

4.5 Is the “grade pay” concept working? If not, what are your alternative suggestions?

There should not be same GP in different PBs.

5. Increment

5.1 Whether the present system of annual increment on 1 July of every year uniformly in case of all employees has served its purpose or not? Whether any changes are required?

According to us , the commission must recommend, for administrative expediency, two specific dates as increment dates. Viz. 1st April and 1st October.

5.2 What should be the reasonable quantum of annual increment?

The reasonable quantum of increment should not be less than 10% of the GP plus basic pay of PB.

5.3 Whether there should be a provision of variable increments at a rate higher than the normal annual increment in case of high achievers? If so, what should be transparent and objective parameters to assess high achievement, which could be uniformly applied across Central Government?

Higher achievers can be granted 5% more in form of Bonus.

5.4 Under the MACP scheme three financial up-gradations are allowed on completion of 10, 20,30 years of regular service, counted from the direct entry grade. What are the strengths and weaknesses of the scheme?

Is there a perception that a scheme of this nature, in some Departments, actually incentivizes people who do not wish to take the more arduous route of qualifying departmental examinations/ or those obtaining professional degrees?

For a number of years, our Association has been demanding that Inspectors/ Superintendents of Central Excise who had not been given promotions for 10, 20 or 30 years be given promotions or upgradations by MACP (Modified Assured Career Progression Scheme) on the basis of their respective Promotional Hierarchy. The Government refused to oblige by stating very clearly that as per recommendations of 6th CPC , up gradation under MACP will be given only on the basis of Grade Pay Hierarchy. There are no such recommendations in the ACP Scheme (Assured Career Progression Scheme), which was introduced by the 5th CPC. A lot of confusion was created after the introduction of the Grade Pay Structure by the 6th CPC. Two distinct hierarchies were created – Promotional Hierarchy and Grade Pay Hierarchy. Promotional Hierarchy is based on the pay structure depending upon the employee’s grade and department. Two employees with similar designations and ranks, but in different departments, will notice this difference. This is not applicable to everybody. On the other hand, Grade Pay Structure is common for all. This is the reason why there are differences between an employee who gets promotions under the regular system and one who gets promotion under MACP. In order to rectify this discrepancy, a number of employees of other departments had approached the courts and had succeeded. Assured Career Progression scheme was somehow a boon to Inspectors and Superintendents of Central Excise Department who had been suffering without promotions for years. Employees who got their jobs towards the end of 1960s had to face countless hurdles. One of them was the problem with promotions. There were many who didn't get any promotions for 30 years. Countless others retired without getting a single promotion in their careers. To put an end to this, our Association fought and made the Government to implement the ACP (Assured Career Progression) promotion scheme. It enabled the Inspectors/Superintendent , who didn't get any promotion for 12 and 24 years, to get one or two financial upgradation respectively. All most all direct recruit Inspectors benefited from this. The financial upgradations were granted to the direct recruit Inspectors based on the ‘Promotional Hierarchy’. This was introduced in the 5th CPC and continued to be enforced until 31.08.2008. Near about 8000 nos. of Superintendents of Central Excise have completed 30 year of services as Inspectors and Superintendents combinedly at present and waiting for their promotion to Gr-A. The Inspectors who are joining in the department as direct recruit are retiring by getting one promotion to the grade of Superintendent in their service career. Whereas those similar placed employees who are joining in Income Tax department or in CSS or as Examiner in Customs are getting almost 5 to 6 promotions in their service career, While 1992 batch Examiners are being promoted to the grade of Asst. Commissioner Gr-A, the 1975 batch Inspectors are still Superintendents and are being forced to work under the 1992 batch of Examiners who are quite juniors to them in service. The parity is the basic concept of our Constitution, parity in promotion is required to be maintained amongst the similar placed employees of same department, but till date the Govt. of India have not initiated any action to maintain parity in promotion amongst the Examiners/Preventive Officers and Inspectors of CBEC. The educational qualification, mode of recruitment and Grade Pay for these post are similar. The Examiner, Preventive Officers and Inspectors are being recruited by the same examination conducted by SSC. The Honourable Apex Court have decided that one should at least get 3 promotions in his service career. But Govt have not allowed two promotions to the cadre of Inspector of CBEC. Recently the Honourable Apex Court have decided for revision of recruitment Rules and making regularization of pending adhoc promotions since 97 on the basis of such new recruitment rules, but Govt. of India made contempt of the said order dated 03.08.11 by not regularizing the pending adhoc promotions on the basis of said new amended /revised recruitment rules retrospectively. Whereas in past in a similar occasion Govt made adhoc regularization with retrospective effect to allow benefits to the officers of the Customs wing. Major revenue of Govt. of India are being collected through CBEC. Inspectors and Superintendents are basically responsible for collection of such major revenue. But these officers are not being awarded at least two promotions in their service career and are not being granted with appropriate pay as has been granted to similar placed employees of Central Govt.

In the 6th CPC, MACP was introduced instead of ACP. Though both were almost the same, there were some differences. These differences created a lot of confusions. The special feature of MACP was that instead of 12 and 24 years, it ordered promotions for employees who weren't given any career advancements in 10, 20 and 30 years. The promotions given under MACP were not in accordance to the ‘Promotional Hierarchy’. Instead, they followed the ‘Grade Pay Hierarchy’. This was the biggest drawback of MACP. Getting promotions for a raise of Rs 200 or nil remained unacceptable for many. Finally, one could say that MACP earned the anomaly of being dragged to the court the most number of times. The Honourable Supreme Court of India had directed that 3 actual promotions should be granted one officials in his entire service career at least. The Honourable Supreme Court of India vide SLP No. 7467/2013 which was filed by the Governement against the judgement of the Hon’ble High Court Chandigarh in CWP No. 19387/2011 has confirmed the order dated 31.05.2011 of CAT Chandigarh Bench for grant of financial upgradation in the promotional hierarchy under MACP.

There should be a provision to allow minimum actual 5 promotions to Gr-B gazetted Officers like the GR-A pots on time bound manner . The Time Bound promotional scheme should be introduced in all departments particularly in Central Excise Department. If 5 promotions cannot be granted then there should be a provision of 5 in situ promotions in the departmental promotional hierarchy in a time bound manner. ACP/MACP is a time bound promotional scheme, the scheme is required to be continued in the form of in situ promotional scheme ( Higher pay scales with higher designation)to motivate personnel especially in Central Excise and Customs Department , where normal promotional avenues are few . Normal promotions are dependent upon the availability of vacancies at higher levels. The job requirement of higher level in this department is very much capable of creating requisite number of higher level positions whereas by not conducting Cadre restructuring in time the higher level posts could not be created on the basis of functional necessity basis. Time bound promotional scheme in form of in situ scheme is required to be introduced in this department especially. However ACP/ MACP alone can take care of that specific situation provided the beneficiaries are required to be granted with a designation along with financial benefits.. The arduous route of career progression through examination and professional qualification, no doubt will be preferred if and if only such promotions are made available for the eligible candidates within a reasonable period of residency in the feeder cadre. Say two years. The batch wise upgradation granted to Gr-A cadres are required to be introduce in Gr-B gazetted carders.

The financial up gradation granted other than the provisions of ACP/MACP( such as granting of time scale or non-functional grade pay etc) should not upset upgradation under ACP/MACP.

6. Performance

What kind of incentives would you suggest to recognize and reward good performance?

More incentives for good performers in form of annual bonus.

7. Impact on other organizations

Salary structures in the Central and State Governments are broadly similar. The recommendations of the Pay Commission are likely to lead to similar demands from employees of State Governments, municipal bodies, Panchayati raj institutions & autonomous institutions.

To what extent should their paying capacity be considered in devising a reasonable remuneration package for Central Govt. employees?

The Gr-B gazetted officers of State Governments are in better position. Before inducting to all India services, they are being earned at least 5 promotions. Hence the Gr-B gazetted officers at least be granted 5 promotions before entering in to organised Gr-A service by introducing a separate service.

8. Defence Forces

8.1 What should be the considerations for fixing salary In case of Defence personnel and in what manner does the parity with civil services need to be evolved, keeping in view their respective job profiles?

The service conditions of Central excise & Customs personnel are akin to the Central Police Organisations/ CBI and Defence Armed Force personnel; they are not compensated with any additional incentives or allowances, as in the case of CBI/Police/Army. An Army jawan, posted in Leh or Ladakh gets Military Service Pay, for reasons that he is a part of Army, but a Central Excise and Customs personnel , serving under same conditions and in the same location, surviving in sub-zero temperatures is deprived of the same , without any potent reasons. It is the harsh conditions of service, and their performance which should matter, and not the name of the wing of the Force, of which these personnel are part of. The Executive Officers of Central Excise and Customs Department are uniformed Officers and the Central Excise Department has the same structural features, same command and control elements, serve under similar harsh service conditions, , as the Army. In spite of the similarities in the duties performed by the Central Excise personnel but they are deprived of privileges extended to defence services and police services. The command structure of Central Excise is similar to the army, and so is its rank structure, except that the ranks in Central Excise have different nomenclature ( Commissioner, Additional Commissioner, Joint Commissioner, Deputy Commissioner, Asst. Commissioner, Superintendent, Inspector ). The command and control system Central Excise is also similar to the Army . The Central Board of Excise and Customs had declared before the IV CPC that Executive Officers of Central Excise Department are uniformed officers and they are performing more arduous and hazardous nature of duties than executive officers of other departments. Hence the Executive officers of Central excise Department are entitled to all benefits as to be granted to Defence personnel by the 7th CPC.

8.2 In what manner should the concessions and facilities, both in cash and kind, be taken into account for determining salary structure in case of Defence Forces personnel.

The personnel of Central Excise and Customs are deployed on the borders (with Pakistan, Bangladesh, Nepal, and Myanmar), International Airports and Sea Ports and are actively engaged in counter insurgency operations with smugglers and tax evaders etc. within the country. These personnel have suffered heavy casualties while dealing with trans-border crimes. Their duties are akin to the army, which is also responsible for the guarding Economics borders of the Country, and are also responsible for security of the nation. In fact, in J & K and in the North-eastern states of India, the Central Excise personnel are deployed side by side with the Army, at times, on the same location. They perform their duties in most adverse conditions coupled with threat to their life either by enemy action, insurgents and the climatic hazards in high altitude, deprived of domestic life, which leads to deterioration of the physical and mental ability. In spite of the fact that the service conditions of Central Excise personnel are akin to the Defence Armed Force personnel, they are not compensated with any additional incentives or allowances, as in the case of Police/CBI/Army. Therefore 7th CPC is requested to consider extending the grant of all pay benefits to the executive officers of Central Excise Department which will be provided to the personnel of Army.

8.3 As per the November 2008 orders of the Ministry of Defence, there are a total of 45 types of allowances for Personnel Below Officer Rank and 39 types of allowances for Officers. Does a case exist for rationalization/ streamlining of the current variety of allowances?

THE EXECUTIVE OFFICERS OF CENTRAL EXCISE DEPARTMENT ARE ENTITLED FOR ALL BENEFITS TO BE EXTENDED BY 7TH CPC TO DEFENCE PERSONNEL.

8.4 What are the options available for addressing the increasing expenditure on defence

pensions?

The Central Government has decided to introduce ONE RANK ONE PENSION’ to the three wings of the defence service personnel. The Executive Officers of Central Excise and Customs Department are uniformed Officers and the Central Excise Department has the same structural features, same command and control elements, serve under similar harsh service conditions, , as the army. In spite of the similarities in the duties performed by the Central Excise personnel but they are deprived of privileges extended to defence services and police services. The command structure of Central Excise is similar to the army, and so is its rank structure, except that the ranks in Central Excise have different nomenclature ( Commissioner, Additional Commissioner, Joint Commissioner, Deputy Commissioner, Asst. Commissioner, Superintendent, Inspector ). The command and control system Central Excise is also similar to the army . Under these conditions, when the juniors start getting more pension than the seniors, it violates the hierarchy of command system, as is applicable to all Armed Forces. It is a well establish dictum based on the Supreme Court judgement of 1982 and accepted by the Central Govt, that,” pension is not a bounty nor a matter of grace depending upon the sweet will of the employer. It is not an ex-gratia payment, but a payment for past services rendered”. In another judicial ruling, it has been stated that different criteria for grant of unequal pay / pension for the same rank on the basis of cut-off date of retirement violates Article 14 (equality before law) of the constitution. All pensioners irrespective of rank are entitled to same pension. In the case of defence services, the Govt has, rightfully, realized the truth of this fact, and given succor to the pre-2006 defence pensioners to come up to the level of their post 2006 retirees of equivalent rank and status by granting them ‘One rank one Pension’. However, the personnel of Central Excise and Customs , who have equitable dispositions, command structure, rank system and nature of duties are grossly ignored, discriminated and forced to face the ignominy of far less emoluments vis-à-vis their juniors retiring post-2006. The personnel of Central Excise and Customs are deployed on the borders (with Pakistan, Bangladesh, Nepal, and Myanmar), International Airports and Sea Ports and are actively engaged in counter insurgency operations with smugglers and tax evaders etc. within the country. These personnel have suffered heavy casualties while dealing with trans-border crimes. Their duties are akin to the army, which is also responsible for the guarding Economics borders of the Country, and are also responsible for security of the nation. In fact, in J & K and in the North-eastern states of India, the Central excise personnel are deployed side by side with the army, at times, on the same location. They perform their duties in most adverse conditions coupled with threat to their life either by enemy action, insurgents and the climatic hazards in high altitude, deprived of domestic life, which leads to deterioration of the physical and mental ability. In spite of the fact that the service conditions of Central Excise personnel are akin to the Defence Armed Force personnel, they are not compensated with any additional incentives or allowances, as in the case of Police/CBI/Army. Therefore 7th CPC is requested to consider extending the grant of ‘ONE RANK ONE PENSION’ to the executive officers of Central Excise Department.

8.5 As a measure of special recognition, is there a case to review the present benefits provided

to war widows?

THE EXECUTIVE OFFICERS OF CENTRAL EXCISE DEPARTMENT ARE ENTITLED FOR ALL BENEFITS TO BE EXTENDED BY 7TH CPC TO DEFENCE PERSONNEL.

8.6 As a measure of special recognition, is there a case to review the present benefits provided

to disabled soldiers, commensurate to the nature of their disability?

THE EXECUTIVE OFFICERS OF CENTRAL EXCISE DEPARTMENT ARE ENTITLED FOR ALL BENEFITS TO BE EXTENDED BY 7TH CPC TO DEFENCE PERSONNEL.

9. Allowances

9.1 Whether the existing allowances need to be retained or rationalized in such a manner as to ensure that salary structure takes care not only of the job profile but the situational factors as well, so that the number of allowances could be at a realistic level?

The existing allowances need to be retained. They are at a realistic level having been evolved by successive Pay Commission over detailed deliberations. Whatever more benefits including extra one month salary granted to personnel of CBI/Army , that is required to be granted to the personnel of Central Excise Department who are performing more arduous and hazardous nature of work in comparison to other departments.

9.2 What should be the principles to determine payment of House Rent Allowance?

The house rent allowance will have to be the actual rent payable by an employee in a particular location.

10. Pension

10.1 The retirement benefits of all Central Government employees appointed on or after 1.1.2004 are covered by the New Pension Scheme (NPS). What has been the experience of the NPS in the last decade?

We are of the considered opinion that the new pension scheme which came into existence for the employees recruited after 1.1.2004 must be scrapped.

10.2 As far as pre-1.1.2004 appointees are concerned, what should be the principles that govern the structure of pension and other retirement benefits?

The pay of every retired person must be re-determined notionally as if he is not retired and then his pension to be computed under the revised rules. The Central Government has decided to introduce ONE RANK ONE PENSION’ to the three wings of the defence service personnel . The Executive Officers of Central Excise and Customs Department are uniformed Officers and the Central Excise Department has the same structural features, same command and control elements, serve under similar harsh service conditions, , as the army. In spite of the similarities in the duties performed by the Central Excise personnel but they are deprived of privileges extended to defence services and police services. The command structure of Central Excise is similar to the army, and so is its rank structure, except that the ranks in Central Excise have different nomenclature ( Commissioner, Additional Commissioner, Joint Commissioner, Deputy Commissioner, Asst. Commissioner, Superintendent, Inspector ). The command and control system Central Excise is also similar to the army . Under these conditions, when the juniors start getting more pension than the seniors, it violates the hierarchy of command system, as is applicable to all Armed Forces. It is a well establish dictum based on the Supreme Court judgement of 1982 and accepted by the Central Govt, that,” pension is not a bounty nor a matter of grace depending upon the sweet will of the employer. It is not an ex-gratia payment, but a payment for past services rendered”. In another judicial ruling, it has been stated that different criteria for grant of unequal pay / pension for the same rank on the basis of cut-off date of retirement violates Article 14 (equality before law) of the constitution. All pensioners irrespective of rank are entitled to same pension. In the case of defence services, the govt has, rightfully, realized the truth of this fact, and given succor to the pre-2006 defence pensioners to come up to the level of their post 2006 retirees of equivalent rank and status by granting them ‘One rank one Pension’. However, the personnel of Central Excise and Customs , who have equitable dispositions, command structure, rank system and nature of duties are grossly ignored, discriminated and forced to face the ignominy of far less emoluments vis-à-vis their juniors retiring post-2006. The personnel of Central Excise and Customs are deployed on the borders (with Pakistan, Bangladesh, Nepal, and Myanmar), International Airports and Sea Ports and are actively engaged in counter insurgency operations with smugglers and tax evaders etc within the country. These personnel have suffered heavy casualties while dealing with trans-border crimes. There duties are akin to the army, which is also responsible for the guarding Economics borders of the Country, and are also responsible for security of the nation. In fact, in J & K and in the North-eastern states of India, the Central excise personnel are deployed side by side with the army, at times, on the same location. They perform their duties in most adverse conditions coupled with threat to their life either by enemy action, insurgents and the climatic hazards in high altitude, deprived of domestic life, which leads to deterioration of the physical and mental ability. In spite of the fact that the service conditions of Central Excise personnel are akin to the Defence Armed Force personnel, they are not compensated with any additional incentives or allowances, as in the case of Police/CBI/Army. Therefore 7th CPC is requested to consider extending the grant of ‘ONE RANK ONE PENSION’ to the executive officers of Central Excise Department.

Keeping in view the Socialistic structure of the country , constitutional provisions & to reduce vast inequality between have & have lots, it is proposed: The Ratio between maximum & minimum of Pension be brought down to 6:1. Ensuring uniformly equal rise in Salary/Pension of all employees/pensioners, irrespective of pre- retiral status. By adopting common multiplication factor for revision of Pension/Pay, as raising the ratio between minimum & maximum of salary/pension to 1:12.85 by 6thCPC , instead of reducing it, was unconstitutional .In order to cater to the need of talent attraction in all cadres 7th pay commission is requested to first workout the top most revised salary/pension, divide it by 6 to arrive at the minimum revised salary & then derive a uniform multiplication factor by dividing minimum of revised Salary/Pension by minimum of pre-revised salary/Pension for revision of Pay & Pension with the condition that Pension shall not in any case be less than 65% & family Pension 45% of the last Pay in Pay Band i.e. Pay in Pay Band+ GP /Pay scale or of average of last 10 months emoluments (Whichever is more beneficial) as was worked out & recommended by TECS (Tata Economic Consultancy Services) consultant to Vth CPC (Para 127.9 Vol III 5th CPC report)

One Rank one pension: ‘Justice must be equal for all’. Govt. granted One Rank One Pension (OROP) to Armed forces. One Rank one Pension to all retirees is constitutional requirement to ensure equality.

The Pension of Central Government Pensioners undergo revision only once in 10 years during which period the pension structure gets seriously dis-aligned; 50% increase in price takes place even in less than 5 years. This results in considerable erosion of the financial position of the pensioner. DR does not adequately take care of inflation at this level. Working employees are getting automatic relief by way of 25% increase in their allowances with every 50% rise in Dearness Allowance. As pensioners do not get any allowances, they feel discriminated against. In order to strike a balance, DR may be automatically merged with Pension whenever it goes to 50% . 5% upward enhancement in pension be granted every five years’ after the age of 60 years & up to 80 years & thereafter as per existing dispensation. As in the present scenario of climatic changes, incidence of pesticides and rising pollution old age disabilities/diseases set in by the time an employee retires and go on manifesting very fast, needing additional finances to take care of these disabilities and diseases, especially as the cost of health care has gone very high. The purchase value of pension gets reduced day by day due to continuously high inflation and steep rise in cost of food items and medical facilities. Retired persons/Senior citizens do not enjoy fully public goods and services provided by Government for citizens due to lack of mobility and many other factors. Their ability to pay tax gets reduced from year to year after retirement due to ever-increasing expenditure on food and medicines and other incidentals. Their net worth at year end gets reduced considerably as compared to the beginning of the year. Inflation, for a pensioner is much more than any tax. It erodes the major part of the already inadequate pension. To enable pensioners, at the far end of their lives, to live in minimum comfort and to cater for ever rising cost of living, they may be spared from paying Income Tax. Commutation value in respect of employee superannuating at the age of 60 years between 1.1.1996 and 31.12.2005 and commuting a portion of pension within a period of one year would be equal to 9.81 years Purchase. After adding thereto a further period of two years for recovery of interest, in terms of observation of Supreme Court in their judgment in writ petitions No 395-61 of 1983 decided in December 1986, it would be reasonable to restore commuted portion of pension in 12 years instead of present 15 years. In case of persons superannuating at the age of 60 years after 31.12.2005 and seeking commutation within a year, numbers of purchase years have been further reduced to 8.194. Also, the mortality rate of 60 plus Indians has considerably reduced ever since Supreme Court judgment in 1986; the life expectancy stands at 76 years now. Therefore, restoration of commuted value of Pension after 12 years is fully justified.

“Health is not a luxury” and “not be the sole possession of a privileged few”. It is a Fundamental Right of all present & past Employees! To ensure hassle free health care facility to Pensioners/family pensioners, Smart Cards be issued irrespective of departments to all Pensioners and their Dependents for cashless medical facilities across the country. These smart cards should be valid in

• all Govt. hospitals

• all NABH accredited Multi Super Specialty hospitals across the country which have been allotted land at concessional rate or given any aid or concession by the Central or the State govt.

• all CGHS, RELHS & ECHS empanelled hospitals across the country.

No referral should be insisted in case of medical emergencies. For the purpose of reference for hospitalization & reimbursement of expenditure thereon in other than emergency cases Doctors/Medical officers working in different Central/State Govt. department dispensaries/health units should be recognized as Authorized medical attendant. The enjoyment of the highest attainable standard of health is recognized as a fundamental right of all workers in terms of Article 21 read with Article 39(c), 41, 43, 48A and all related Articles as pronounced by the Supreme Court in Consumer Education and Research Centre & Others vs Union of India (AIR 1995 Supreme Court 922) The Supreme court has held that the right to health to a worker is an integral facet of meaningful right to life to have not only a meaningful existence but also robust health and vigour. Therefore, the right to health, medical aid to protect the health and vigour of a worker while in service or post retirement is a fundamental right-to make life of a worker meaningful and purposeful with dignity of person. Thus health care is not only a welfare measure but is a Fundamental Right.

We suggest that, all the pensioners, irrespective of pre-retiral class and status, be treated as same category of citizens and the same homogenous group. There should be no class or category based discrimination and all must be provided Health care services at par . To ensure that the hospitals do not avoid providing reasonable care to smart card holders and other poor citizens, a Hospital Regulatory Authority should be created to bring all NABH-accredited hospitals and NABL-accredited diagnostic Labs under its constant monitoring of quality, rates for different procedures & timely bill payments by Govt. agencies and Insurance companies. CGHS rates be revised keeping in mind the workability and market conditions. As is recorded in Para 5 of the minutes of Committee of Secretaries (COS) held on 15.04.2010 (Reference Cabinet Secretariat, Rashtrapati Bhavan No 502/2/3/2010-C.A.V Doc No. CD (C.A.V) 42/2010 Minutes of COS meeting dated 15.4.2010) which discussed enhancement of FMA: CGHS card estimates for serving Personnel since estimates are not available separately for pensioners M/O Health & Family Welfare had assessed the total cost per card p.a. in 2007-2008 = Rs 16435 i.e. Rs.1369 per month for OPD. Adding to its inflation the figure today is well over Rs 2000/- PM. Ministry of Labour & Employment, Govt. of India vide its letter no. G-25012/2/2011-SSI dated 07.06.2013 has already enhanced FMA to Rs 2000/- PM for EPFO beneficiaries. Thus, to help elderly pensioners to look after their health, Adequate raise in FMA will encourage a good number of pensioners to opt out of OPD facility which will reduce overcrowding in hospitals. OPD through Insurance will cost much more to the Govt. As such the proposal for raising Fixed Medical allowance to Pensioners is fully justified and is financially viable. We suggest that FMA for all C.G. Pensioners be raised to at least Rs 2000/- PM without any distance restriction linking it to Dearness Relief for automatic further increase. We further demand that FMA be exempted from INCOME TAX: Fixed Medical Allowance (FMA) is a compensatory allowance to reimburse the medical expenses. As Medical Reimbursement is not taxable, FMA should also be exempted from Income Tax.

11. Strengthening the public governance system

11.1 The 6th CPC recommended upgrading the skills of the Group D employees and placing them in Group C over a period of time. What has been the experience in this regard?

No Comment.

11.2 In what way can Central Government organizations functioning be improved to make them more efficient, accountable and responsible? Please give specific suggestions with respect to:

a) Rationalisation of staff strength and more productive deployment of available staff;

b) Rationalisation of processes and reduction of paper work; and

c) Economy in expenditure.

In our considered opinion, the 7thCPC must recommend to the Government to set up a Committee in each department with experts from outside the organization, the officials from within the organization and representative of the Unions of the respective department to study the functional changes taken place over the years, especially due to the induction of modern technology the new challenges and the best way to meet those challenges’ reduction in paper work, customer satisfaction and economy in expenditure and make suggestions to the Government for their acceptance and implementation in toto.

12. Training! building competence To ensure that periodical professional training is imparted to all personnel to update the skills.

Meditation cultivates the discipline of sefless attention and allows people to see the bigger picture. Meditation creates a short-term state change and a longer-term trait change. Hence staffs should be encouraged to use meditation apps.

12.1 How would you interpret the concept of “competency based framework”?

Target is required to be fixed reasonable.

12.2 One of the terms of reference suggests that the Commission recommend appropriate training and capacity building through a competency based framework.

a) Is the present level of training at various stages of a person’s career considered adequate?

Are there gaps that need to be filled, and if so, where?

b) Should it be made compulsory that each civil service officer should in his career span acquire a professional qualification? If so, can the nature of the study, time intervals and the Institution(s) whose qualification are acceptable, all be stipulated?

c) What other indicators can best measure training and capacity building for personnel in your organization? Please suggest ways through which capacity building can be further strengthened?

Gr-B gazetted officers should be provided professional education in reputed educational institutions.

13.1 What has been the experience of outsourcing at various levels of Government and is there a case for streamlining it?

All ministerial and supporting works may be outsourcing.

13.2 Is there a clear identification of jobs that can be outsourced?

Yes as stated vide para13.1.

14. Regulatory Bodies

No comments.

14.1 Kindly list out the Regulators set up under Acts of Parliament, related to your Ministry/ Department. The total number of personnel on rolls (Chairperson and members + support personnel) may be indicated.

No comments.

14.2 Regulators that may not qualify in terms of being set up under Acts of Parliament but perform regulatory functions may also be listed. The scale of pay for Chairperson /Members and other personnel of such bodies may be indicated.

No comments.

14.3 Across the Government there are a host of Regulatory bodies set up for various purposes. What are your suggestions regarding emoluments structure for Regulatory bodies?

No comments.

15. Payment of Bonus

Bonus should be granted to all Gazetted officers also like other Central government Employees.

Almost all 1.6 million civilian full-time federal employees of USA received merit bonuses or special time-off awards. The typical bonus amounted to 1.6 percent of salary. This system is evidence of a talented workforce that performs admirably, and often at salary levels inferior to those of the private sector.

Under civil service laws of USA, federal agencies can hand out cash awards or additional time off to reward employees for good annual performance or contributions on specific projects. The law allows for multiple awards throughout the year, and all civil servants are eligible. Apart from merit bonus annual Bonuses are divided up equally across all employees.

Source : http://cengoindia.blogspot.in/

.png)