Postal banks effective globally: Nachiket Mor

Nachiket Mor, head of the Reserve Bank of India (RBI)’s committee on financial inclusion, on Thursday said the postal bank model had been a success globally. In a report by the committee, Mor had advocated differentiated banks and a new structure for priority sector lending

A former deputy managing director of ICICI Bank, Mor is also a member of an advisory committee under former RBI governor Bimal Jalan that is vetting the applications of 25 applicants for bank licences. The committee has been mandated to communicate its suggestions to the banking regulator.

While India Post has applied for a bank licence, there are differences within the government on whether the entity should be allowed to enter the sector. While the communications and information technologyministry is pushing the idea, the finance ministry is opposed to the move.

“I don’t want to comment anything about India Post. What I am saying is worldwide, postal banks have been very effective as payment banks,” Mor said at the sidelines of a seminar of financial inclusion.

The finance ministry is not keen on letting India Post convert itself into a bank, citing practical difficulties. This is despite the fact that about 90 per cent of its 155,000 post offices are located in villages. As of March 2013, postal savings stood at Rs 6.05 lakh crore, half the total deposits of State Bank of India, India’s largest lender.

Last week, Minister for Communications & Information Technology Kapil Sibal said his ministry would ensure India Post got a banking licence.

The Mor panel has recommended setting up two kind of banks — payment banks and wholesale ones. It emphasises the need to move away from the universal banking model in which a bank offers all financial products and services and has to meet all regulatory mandates and priority sector obligations to specialised banks in a differentiated bank licence framework.

“We need to be lot more flexible and not frown on collaborations. Let the regulator be a referee, and not a captain,” Mor said.

Several experts and industry players feel financial sector regulations are stiff, with high entry barriers, particularly for banking. While giving bank licences, RBI follows a conservative approach. For about a decade, no new players have been allowed into the sector.

In 2010, following a Budget announcement by former finance minister Pranab Mukherjee in this regard, a process to allow new banks into the sector was started. But four years since the announcement, bank aspirants are yet to be secure approval. Raghuram Rajan, who took charge as RBI chief in September 2013, has, however, expedited the process and is likely to announce the entry of new banks in the next few months.

SANCHAY POST 7.5 PATCH 1 DATED 28.01.2014 BY INFOSYS

Patch 1 For Sanchay Post 7.5

Download

Download

Steps For Installation

a) Close/Exit all screens in SanchayPost 7.5 application. Make sure that application is not running.

b) Click on “Patch 1 for SanchayPost 7.5.msp” file.

Click on “Next” button.

c)

Click the “Update” button.

d)

Click on “Yes” button.

e)

Click on “Finish” button.

Your “Patch 1 for SanchayPost 7.5” installation is complete now.

Source : http://potools.blogspot.in

SANCHAY POST VERSION 7.5 ISSUES AND SOLUTION DATED 30.01.14

Sanchay Post 7.5 Solutions Dated 30.01.2014

Before going for installation of Sanchay Post version 7.5, latest backup of all the databases should be taken and kept in safe. If the execution of "Upgrade_DB" completes with error and forgot to click 'Restore to Previous version', no solution is available with SDC.

S.No 1

Issue

Issue is due to missing tables or database : While Upgarding DB, Error " one or more tables are missing.check table_list_log.txt for more errors.kindly contact SDC chennai to fix these errors before running the tool" occurs

Solution

Pl check for missing tables of all databases using latest DBAnalyser. (Solution for missing tables is available in SDC site under 'known issues - patches'). Pl check name of all the SO databases with corresponding entry in 'SOdb_name' table .If any irrelevant entry in that table, pl remove the same after obtaining prior permission from concerned authority.

Download(Missing table)

S.No 2

Issue

Invalid object name 'dcl.misc' / table missing : 'dcl.misc'

Solution

"update_report" ( available in SDC site under known issues - patches)

Download (Update Report)

S.No 3

Issue

Problems in Intialisation in the DE certificates/ working in DE Module

Solution

Detailed Procedure Document is available in SDC site. Ensure that the blocks assigned in DE Module does not overlap with the one in Online Module.

S.No 4

Issue

Error while running Upgrade DB: Invalid object name 'dcl.temp_scs_ledger' . The object 'PK__accountopen_thro__2077C861' is dependent on column 'scheme'.

Solution

Click on "Restore to Previous Version" and contact SDC . If forgot to do this, Uninstall Sanchay Post version7.5 & install Sanchay Post version 7.0. Restore the latest backup available with you (before going to 7.5) and make dataentry for remaining days. Then, contact SDC.

S.No 5

Issue

Error While Upgrading DB : But forgot to click "Restore to Previous version" and continued with Sanchay Post Version 7.5.

Solution

Uninstall Sanchay Post version7.5 & install Sanchay Post version 7.0. Restore the latest backup available with you (before going to 7.5) and make dataentry for remaining days. Then, contact SDC with log files created.

S.No 6

Issue

Error while running Upgrade DB: post : Cannot resolve the collation conflict between "SQL_Latin1_General_CP1_CI_AS" and "Latin1_General_CI_AI" in the equal to operation.

Solution

This issue was due to user database having different collation settings in databases. The below query needs to be executed in databases having collation issue using SQL Query Analyzer.

ALTER DATABASE [POST] COLLATE SQL_Latin1_General_CP1_CI_AS

S.No 7

Issue

Rs. 50000 denomination is not available in KVP DE Module

Solution

Pl run the patch (1) released on 28.01.2014 in our SDC site

Download (Patch 1)

S.No 8

Issue

Error : "Amount doesn't tally" while issuing NSC IX through cheque in Online module

Solution

Pl run the patch (1) released on 28.01.2014 in our SDC site

S.No 9

Issue

In certificate Data Entry Module, KVP & NSC is not working.

Solution

Pl run the patch (1) released on 28.01.2014 in our SDC site

S.No 10

Issue

While runnning "upgrade_DB" tool, error: Processing XXXX….

XXXX: Database changes related to NSC IX deployed sucessfully

XXXX: Database changes related to NSC IX not deployed sucessfully

Solution

Click "Restore to Previous Version" button. Then check whether you are having more than one entry for this sub office in "sodb_name" table of POST database. If so, remove one of the entry after obtaining prior permission from concerned authority. Try to run the tool again.

S.No 11

Issue

While runnning "upgrade_DB" tool, error: Processing POST

POST: Database changes related to NSC IX deployed sucessfully

POST: Database changes related to NSC IX not deployed sucessfully

Solution

Click "Restore to Previous Version" button. Then check whether you are having any entry like'POST' in "sodb_name" table of POST database. If so, remove that entry after obtaining prior permission from concerned authority. Try to run the tool again.

S.No 12

Issue

Error: "You are not authorised to login" in Certificate DE Module

Solution

This issue was due to unsuccessful upgradation of one or more databases . Follow the instructions given at Sl.No:4.

S.No 13

Issue

NSC IX Agent Commission , TDS - not shown while generating Agent Commission Report

Solution

Initialize the commission details -- through Initialization >>>Init comisn ,TDS amt (Form no 0412) by logging in as SUPER and then try to generate reports.

S.No 14

Issue

Multiple user in Data Entry Module(Error: Invalid Regn No). For Ex: You are having 15000 KVP regn numbers to enter and ready to deploy 5 persons to complete this work by allotting regn no as 1 to 3000 for user1, 3001 to 6000 for user2 and so on.

Solution

Login as DESUPER>>> Certificates Single Entry>>> Initialisation >>>Account Number>>> Add ; Enter the details as 'Starting-1' , 'Ending-3000', 'Latest -0' . Then, add one more row and enter the details as 'Starting - 3001', 'Ending-6000', 'Latest-3000' and so on. This will solve your problem.

Source : http://potools.blogspot.in/

Sanchaya Post 7.5 ; Solutions

Solution for various issues which will be happened while upgrading to Sachaya Post Version 7.5 has been published by SDC Chennai. Following are the solutions for various issues

Dopt Orders - Action Taken on 62nd Report of the Department Related Parliamentary Standing Committee on Personnel, Public Grievances, Law and Justice on the Status of Women Government Employees, Service Conditions, Protection against exploitation, Incentives and other related issues...

No.41034/1/2014-Estt(D)

Government of India

Ministry of Personnel, Public Grievances and Pensions

(Department of Personnel and Training)

North Block, New Delhi - 110001

Dated-30-01-2014

OFFICE MEMORANDUM

Subject:- Action Taken on 62nd Report of the Department Related Parliamentary Standing Committee on Personnel, Public Grievances, Law and Justice on the Status of Women Government Employees, Service Conditions, Protection against exploitation, Incentives and other related issues -regarding.

The undersigned is directed to refer to Para 20.1 and Para 20.2 of the 62nd Report of the Department Related Parliamentary Standing Committee on Personnel, Public Grievances, Law and Justice wherein, the Committee has drawn attention to extant instructions of the Government on age relaxation for appointment of widows, divorced woman and woman judicially separated from their husbands and who were not remarried allowing age concession up to the age of 35 years (40 years for member of SCs/STs) for the post of Group 'C'and erstwhile Group 'D' filled through SSC/Employment Exchange and has directed scrupulous compliance of these instructions by all administrative authorities.

2. The Department of Personnel and Training's O.M. No. 15012/13/79- Estt.(D) dated 19.1.1980 provides that for purposes of appointment to Group C and D posts under the Central Govt. filled through the SSC and the Employment Exchange, the upper age limit in the case of widows, divorced women and women judicially separated from their husbands who are not remarried shall be relaxed upto the age of 35 years (upto 40 years for members of Scheduled Castes/Schedules Tribes) by invoking the provisions in the relevant recruitment rules, subject to production of a certified copy of the judgement/decree of the appropriate court to prove the fact of divorce or the judicial separation, as the case may be (provided through DoP&T O.M. No. 15012/1/82-Estt.(D) dated 06.09.1983). Further, this relaxation has been extended to Group 'A' & 'B' posts except where recruitment is made through open competitive examination vide DoP&T O.M. No. 15012/1/87-Estt.(D) dated 05.10.1990.

3. All Ministries/Departments are requested to bring these instructions to the notice of all concerned including attached and subordinate offices for strict compliance.

sd/-

(Arunoday Goswami)

Under Secretary to the Govt. of lndia

Source: www.persmin.nic.in

[http://ccis.nic.in/WriteReadData/CircularPortal/D2/D02est/41034_1_2014-Estt_D.pdf]

Do's and Dont's for Pensioners

DOs

1. A copy of every communication regarding pension is required to be endorsed to the pensioner by each node of pension delivery. Please ensure that your full contact postal address (preferably with PIN code) is always updated. Promptly intimate any changes of address to: -

a. Your Bank Branchb. The Head of Office and the PAO in the Ministry from where you retired;c. Central Pension Accounting Office

2. There should be proper nomination for pension account. Please retain the acknowledgement received from the bank carefully. It is advisable to open a joint accountwith your spouse if you are pensioners so that she/he does not hardship later.

3. Please direct your bank branch with proof establishing your Identity for first appearanceat Paying Branch alongwith the copy of the special seal authority.

4. CPAO has sent two halves of PPO - the pensioner's and the Bank's. Your half of the PPO is to be handed over to you by your Bank branch when they call you for verification. Your signature will be obtained on their half for their record.

5. Please produce proper and acceptable evidence of eligible savings from time to time for the purpose of Income Tax calculation by the Bank.

6. Please collect Certificate of Income from pension from bank at the close of financial year, even if income tax is not deducted from the pension. Please collect form-16- income tax was deducted.

7. Please furnish Life Certificate early in the month of November every year.

8. A pensioner who produces a life certificate in the prescribed form in Annexure -XVII signed by any person specified hereunder, however, is exempted from personal appearance- :-

(i). A person exercising the powers of a Magistrate under the Criminal Procedure code;(ii). A Registrar or Sub-Registrar appointed under Indian Registration Act;(iii). A Gazetted Government servant;(iv). A Police Officer not below the rank of Sub-Inspector in -charge of a Police Station; Offices;(vi). A Class-I officer of the Reserve Bank of India, an officer (including Grade II officer) of the State Bank of India or of its subsidiary;(vii). A pensioned Officer who, before retirement, exercised the powers of a magistrate;(viii). A Justice of Peace;(ix). A Block Development Officer, Munsif, Tehsildar or Naib Tehsildar;(x). A Head of Village Panchayat, Gram Panchayat, Gaon Panchayat or an Executive Committee of a Village;(xi). A Member of Parliament, of State legislatures or of legislatures of Union Territory Governments /Administrations.(xii). Treasury Officer.

In the case of a pensioner drawing his pension through a Public Sector Bank the life certificate may be signed by an officer of a Public Sector Bank. In the case of a pensioner residing abroad and drawing his pension through any other bank included in the Second Schedule to the Reserve Bank of India Act, 1934, the life certificate may be signed by an officer of the Bank, A pensioner get exemption from personal appearance subject to production of Life Certificate signed by the above mentioned officer of the bank.

A pensioner not resident in India in respect of whom his duly authorized agent produces a life certificate signed by a Magistrate, a Notary, a Banker or a Diplomatic Representative of India is exempted from special appearance.

9. Non-employment Certificate/Re-employment Certificate should also be furnished every year in the month of November/May & November in case of retired Group 'A' officer.

10. Please apply in a prescribed proforma to the paying branch for restoration of commuted portion of pension on completing 14 years and 11 months in case your bank does not have a CPPC.

11. Please provide the Pensioner's half of the PPO to your paying Bank Branch in the case of revision of pension for entry of enhanced pension with break up in this half.

12. Please ask for a due and drawn statement from your bank branch in case you have received any arrears in a lump sum.

13. Please ask for a pension slip with break up of in case of any doubt from bank branch

14. If Pensioner's half is lost, worn or torn, a written request is to be immediately made to your paying Bank branch alongwith Pensioner's half of PPO (if available).

15. Please keep all your Pension related documents including Pensioner's half of PPO, safely, as these are important documents.

16. For any clarification on pension payments, contact your bank branch grievance officer of the Bank or CPAO Toll Free /Call Centre 1800 11 7788.

DON'Ts

1. Do not delay in submitting the Pension Papers before retirement as it ultimately effects the time schedule to be followed by the various offices as under: -

(i). Pay & Accounts Officer issuing PPO - Despatch of PPO by PAO to the CPAO on the last working day of the month preceding the month of retirement

(ii). Central Pension Accounting Office (CPAO) - Despatch of PPO by CPAO to Link Branch of PSB by 20th of the month of retirement

(iii). Link Branch - Despatch of PPO by Link Branch to paying branch by 23rd of the month of retirement.

(iv). Paying Branch- Paying Branch will complete all formalities and ensure that the pension has been credited to the pensioner's account on the last date of the month.

2. Please do not provide address and contact number which is likely to change in immediate near future. Please update your address by informing your bank branch, PAO, CPAO and DDO of the ministry you retired from.

3. In case you wish to change your bank or bank branch for pension disbursement, do not close your pension account unless new account is confirmed for pension disbursement.

4. Please do not fail to check whether you are receiving full pension/family pension authorized by the Govt. of India to you including is related pension with Dearness Relief if you are aged 80 and above.

5. Please do not forget that under the scheme of pension department through authorized banks, banks are required to pay pension to each pensioner by the last day of the month and the Govt. of India fully

Dearness Allowance from January 2014 will be 100%

The rate of Dearness Allowance from January 2014 has been now confirmed by just released AICPIN for the month of December 2013. Labour bureau has released the All India Consumer Price Index Number for Industrial workers for the month of December 2013 in its website www.Labour bureau.nic.in to day. The AICPIN for the month of December is very much required to finalize the percentage of DA to be increased for central government employees from January 2014.

The CPI for Industrial workers is the only factor to determine the additional installment of DA to be released with effect from 01.01.2014, so we need to know the 12 months average of AICPIN from January 2013 to December 2013 to calculate the percentage of Dearness Allowance to be paid from January 2014. Gservants, in its article published on 30th August 2013, told that the Percentage of DA to be paid from January 2014 will be from 100% to 102% . With 7 months CPI points it was estimated that there would be 10% to 12% Hike from existing rate of 90%. The AICPIN for the month of November 2013 has almost confirmed the above estimate that it will not be less than 100%. Now the December months AICPIN confirmed that the rate of DA to be released from January 2014 will be exactly 100%. Even though there is a decrease in 4 points the rate of DA is 100%. The following table shows how the dearness allowance has reached 100% level.

DEARNESS ALLOWANCE FROM JANUARY 2014

DEARNESS ALLOWANCE FROM JANUARY 2014

| ||||

Month

|

Base Year 2001 =100

|

Total of 12 Months

|

Twelve month Avarage

|

% of Increase Over 115.76 for DA

|

January 2013

|

221

|

2535

|

211.25

|

80.83

|

Febraury 2013

|

223

|

2559

|

213.25

|

82.49

|

March 2013

|

224

|

2582

|

215.17

|

84.22

|

April 2013

|

226

|

2603

|

216.92

|

85.88

|

May 2013

|

228

|

2625

|

218.75

|

87.39

|

June 2013

|

231

|

2648

|

220.67

|

88.97

|

July 2013

|

235

|

2671

|

222.58

|

90.62

|

August 2013

|

237

|

2694

|

224.50

|

92.28

|

September 2013

|

238

|

2717

|

226.42

|

93.94

|

October 2013

|

241

|

2741

|

228.42

|

97.32

|

November 2013

|

243

|

2766

|

230.5

|

99.11

|

December 2013

|

239

| 2786 | 232.16 |

100.55

|

Courtesy : http://www.gservants.com/2014/01/31/dearness-allowance-january-2014-will-100/

Entries in ACRs/APARs and proper disposal of representation in a quasi-judicial Manner by the competent authority against remarks in ACRs/APARs or for upgradation/downgradation of the final grading.

To view DoPT memo No. 21011/1/2005-Estt (A)(Part.III) dated 31st January 2014, please CLICK HERE.

DEPARTMENT OF POST’s APPEAL TO WITHDRAW THE STRIKE

We have already given strike notice to Cabinet Secretary taking in the Consideration the fact that Postal Department can not settle common demands of the Central Government Employees.

(M. Krishnan)

Secretary General

NFPE

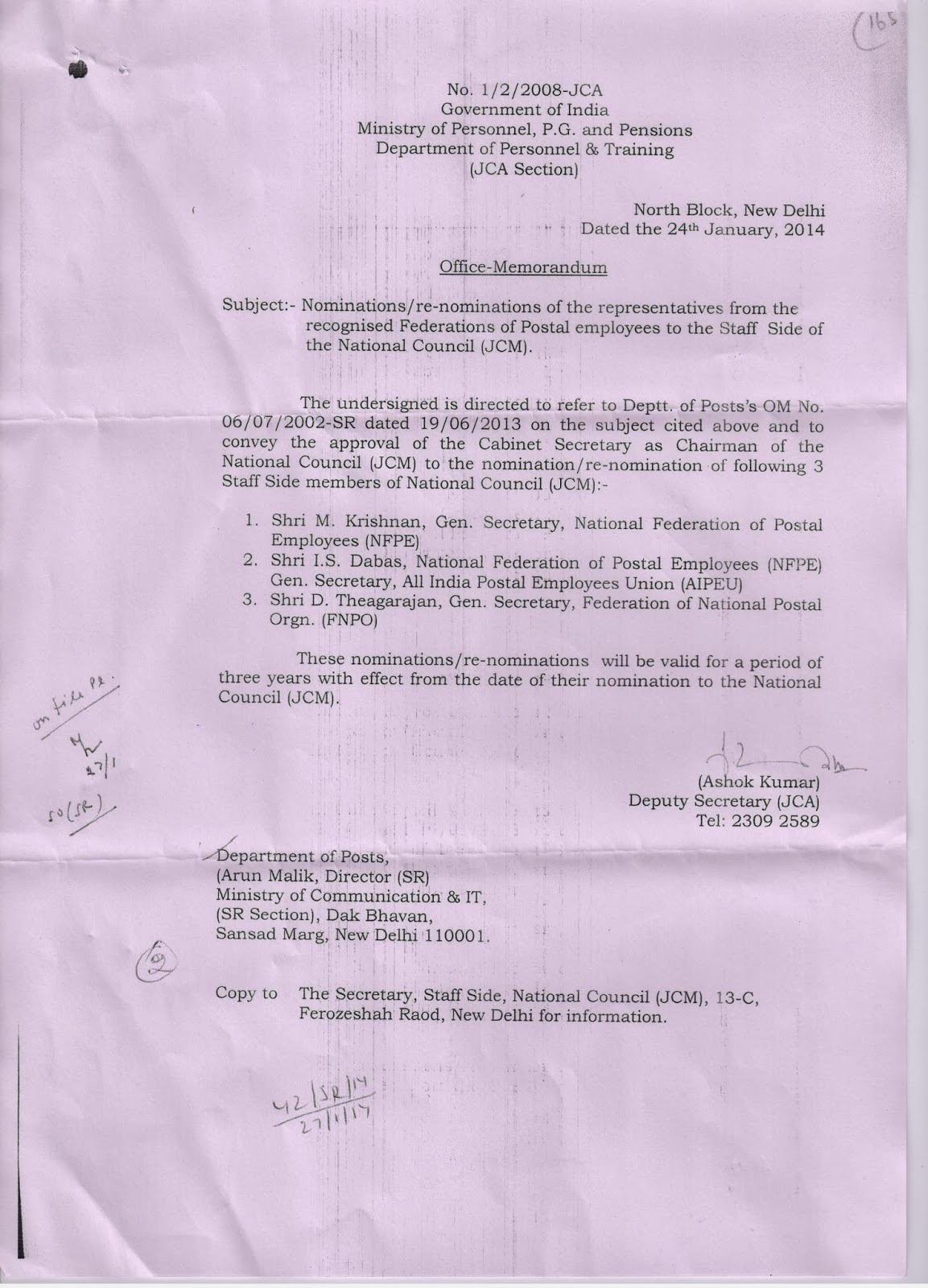

JCM NATIONAL COUNCIL – NOMINATIONS FROM POSTAL APPROVED