Kavalipost AFFILIATED TO NATIONAL FEDERATION OF POSTAL EMPLOYEES COMPRISING POSTAL UNIONS OF AIPEU GROUP-C, AIPEU POSTMEN & MTS (GROUP D)and AIPEU- GDS (NFPE) KAVALI BRANCH-524201 A.P An Organisation highlighting the principle of unity and struggle for the advancement of postal workers Welcome to the Official website of National Federation of Postal employees

KAVALIPOST

Wednesday 31 December 2014

Tuesday 30 December 2014

Clarification regarding issue of medicines under CGHS

No. 2-2/2014/CGHS(HQ)/PPTY / CGHS(P)

Government of India

Ministry of Health & Family Welfare

Department of Health & Family Welfare

Nirman Bhawan, Maulana Azad Road

New Delhi 110 108

Government of India

Ministry of Health & Family Welfare

Department of Health & Family Welfare

Nirman Bhawan, Maulana Azad Road

New Delhi 110 108

Dated: the 23rd December, 2014

OFFICE MEMORANDUM

With reference to the above mentioned subject the undersigned is directed to state that the situation arising out of issue of Office Memorandum No 2/2014/CGHS(HQ)/PPTY / CGHS(P) dated the 25th August ,2014 has been engaging the attention of Government for quite some time. Various representations about the difficulties being encountered have been received from different stakeholders i.e., beneficiaries and doctors, necessitating a review of the matter. It was accordingly considered by a Committee under the Chairmanship of AS&DG,CGHS. After careful review and keeping the recommendations of the Committee in mind, the following guidelines are issued to streamline the functioning of the Wellness Centres:

i. The medicines are to be issued as per the CGHS Formulary and guidelines issued by this Ministry in this behalf.

ii. In case the prescribed medicines are not available in CGHS formulary, but are essential for the treatment of the patient, they can be issued / indented by the doctors of the CGHS Wellness Centre on the basis of a valid prescription of the authorized specialist subject to the condition that such medicines are neither dietary supplements/ food items nor banned drugs. Instructions on this issue i.e., non-admissibility of food items etc. issued vide O.M .No. 39-3/2003-04/CGHS/MSD/RS dated 23rd July 2009 and 3rd August 2009 must be followed.

iii. In case of anti-cancer drugs and other life-saving drugs that are not approved by the DCG1 for use in India, each case should be considered by the Expert Committee under the Chairmanship of Special DG(DGHS).

iv. The technical Standing Committee constituted vide 2-2/2014/CGHS(HQ)/PPTY / CGHS(P) dated 27.08.2014 of this Ministry will review addition or deletion of drugs in the CGHS Formulary/ list of Treatment procedures / investigations / listed implants. The Technical Committee will meet once in three months or as per need, whichever is earlier. In the meantime reimbursement for unlisted procedures / implants will be made at the rates approved by AIIMS/GB Pant Hospital / actuals, whichever is less.

2. The O.M. of even number dated 25.08.2014 is superseded to the above extent while O.M. of even number dated 1.10.2014 is withdrawn.

Sd/-

(Bindu Tiwari)

Director, CGHS(P)

(Tel 2306 1831)

Director, CGHS(P)

(Tel 2306 1831)

'Technology to be used to provide quick postal services'

VISAKHAPATNAM: The postal department will use new technology to provide quick service to customers and introduce new products to generate revenue, Chief Post Master General of Andhra Pradesh Circle B V Sudhakar said here today.

Launching a smart phone-based Andriod solution to monitor letter box clearance at the Lawson's Bay Colony post office here today, he said that the facility is now functioning at Hyderabad and Vijayawada.

Launching a smart phone-based Andriod solution to monitor letter box clearance at the Lawson's Bay Colony post office here today, he said that the facility is now functioning at Hyderabad and Vijayawada.

The facility will enable people and the postal department to know the status of letter box clearance and its dispatch to customers through a a smartphone which would be given to postal clearance personnel who clear post boxes.

He said that 700 post boxes are being monitored using the solution, which would be extended to more than 500 post boxes in Visakhapatnam in a phased manner by February 2015.

He said that the Andhra Pradesh circle has decided to sell Tirumala Darshan tickets of Rs 50 and Rs 300 denomination through all 95 head post offices in Andhra Pradesh and Telangana region from January 5, 2015. The facility would be extended all sub-post offices in the circle from February 2015, he said.

He said that the postal department had already begun selling non-judicial stamps through post offices in the Telangana region.

Cashless transactions would be introduced in post offices in the rural areas, he said.

He said that payments for registered post, parcels and other services would be accepted debit and credit cardsby installing swiping machines at post offices.

In rural areas where there is no banking facility, the postal department would allow customers to draw upto Rs 1,000 from post offices.

He said that the postal department's revenue deficit had come down from Rs 465 crore in 2011-12

to Rs 265 crore in 2013-14, adding that it has been planned to wipe out the deficit in 2014-15.

Source : http://economictimes.indiatimes.com/

He said that the postal department had already begun selling non-judicial stamps through post offices in the Telangana region.

Cashless transactions would be introduced in post offices in the rural areas, he said.

He said that payments for registered post, parcels and other services would be accepted debit and credit cardsby installing swiping machines at post offices.

In rural areas where there is no banking facility, the postal department would allow customers to draw upto Rs 1,000 from post offices.

He said that the postal department's revenue deficit had come down from Rs 465 crore in 2011-12

to Rs 265 crore in 2013-14, adding that it has been planned to wipe out the deficit in 2014-15.

Source : http://economictimes.indiatimes.com/

PREPARE FOR INDEFINITE POSTAL STRIKE FROM 2015 MAY 6TH.

GRAMIN DAK SEVAKS DO NOT WANT SEPEREATE GDS COMMITTEE

SEPERATE COMMITTEE (WHETHER JUDICIAL OR BUREAUCRATIC)

IS A WASTE AND FARCE.

Ø 2.76 lakhsGDS do not want a separate GDS Committee.

Ø 2.76 lakhs GDS want inclusion of GDS in the 7th CPC.

Ø NFPE & AIPEU-GDS(NFPE) demanding inclusion of GDS in 7th CPC.

Ø FNPO & NUGDS demanding inclusion of GDS in 7th CPC.

Ø Confederation of Central Govt. Employees & Workers demanding inclusion of GDS in 7th CPC.

Ø JCM National Council (staff side) organisations including Railway & Defense Federations demanding inclusion of GDS in 7th CPC.

BUT RECOGNISED GDS UNION OF SHRI.MAHADEVAIAH IS DEMANDING SEPARTE COMMITTEE FOR GDS

* Hon’ble Supreme Court stated that GDS are Civil Servants and they are Central Govt. Employees.

* Justice Singhal, Chairman 4th PC stated GDS are Civil Servants and they are Central Govt. Employees.

* Justice Charanjit Jalwar stated that GDS are Civil Servants and they are Central Govt. Employees.

* Talwar Committee recommended to the Govt. that GDS should be included in Pay Commission and no separate committee should be appointed in future.

* Govt. appointed 7th Pay Commission for Central Govt. Employees.

* NFPE & AIPEU-GDS (NFPE) says GDS are part of Central Govt. Employees and they should be included in 7th CPC itself.

* Confederation of Central Govt. Employees & Workers says that GDS are part of Central Govt. Employees and they should be incuded in 7th CPC itself.

* JCM National Council (staff side) orgisastions including Railway & Defence Federations says GDS are part of Central Govt. Employees and they should be included in 7th CPC itself.

* BUT RECOGNISED GDS UNION OF SHRI. MAHADEVAIAH ACCEPTED THE GOVT. STAND THAT GDS ARE NOT PART OF CENTRAL GOVT. EMPLOYEES AND HENCE HE IS DEMANDING SEPERATE COMMITTEE FOR GDS. HE DON’T WANT GDS TO BE INCLUDED IN 7TH CPC. HIS MAIN DEMAND IN THE CHARTER OF DEMANDS IS SEPERATE COMMITTEE FOR GDS .

* NFPE & AIPEU-GDS (NFPE) declared joint indefinite strike under the banner of JCA from 2015 May 6th for inclusion of GDS in 7th CPC.

* FNPO & NUGDS also declared joint indefinite strike under the banner of JCA from 2015 May 6th for inclusion of GDS in 7th CPC.

& Confederation, Railways & Defence Federations organised joint National Convention of entire JCM staff side orgnisations and decided to organise massive Parliament March in April 2015 to declare indefinite strike of entire Central Govt. Employees. Inclusion of GDS in 7th CPC is included in the charter of demands as number one demand.

RECOGNISED GDS UNION OF SHRI MAHADEVAIAH DON’T WANT JOINT STRIKE OF GDS & REGULAR EMPLOYEES. HE ALWAYS DECLARES FRAGMENTED STRIKE TO TORPEDO THE UNITY OF GDS AND REGULR EMPLOYEES. HE IS DESPERATELY TRYING TO RETAIN HIS CONTROL OVER GDS. HE HAS WRITTEN TO THE GOVT. NOT TO ALLOW NFPE & FNPO TO DISCUSS GDS ISSUES. GOVT. ALSO WANTS TO DIVIDE GDS AND REGULAR EMPLOYEES SO THAT THEY CAN EASILY DENY THE LEGITIMATE DEMANDS OF THE GDS INCLUDING CIVIL SERVANT STATUS AND ALL BENEFITS OF REGULAR EMPLOYEES.

LET US ORGANISE JOINT INDEFINITE STRIKE OF FIVE LAKHS GDS & REGULAR EMPLOYEES FROM 2015 MAY 6TH UNDER THE BANNER OF POSTAL JOINT COUNCIL OF ACTION (NFPE, FNPO, AIPEU-GDS (NFPE) & NUGDS) DEMANDING INCLUSION OF GDS IN 7TH CPC & GRANT OF ALL BENEFITS OF REGULAR EMPLOYEES TO GDS ALSO.

RECOGNISED GDS UNION OF MAHADEVAIAH IS AGAINST FILING CASE IN SUPREME COURT for grant of Civil Servant status and all benefits of regular employees to GDS. NFPE & AIPEU-GDS (NFPE) has filed a Writ Petition in Supreme Court and after the preliminary hearing Supreme Court transferred the case to Delhi High Court. The next hearing of the case in Delhi High Court is on 4th February, 2015.

But Shri. Mahadevaiah had filed a case in the Karnataka High Court for his own benefit requesting to grant Foreign Service benefits to him. (Writ Petition No.24106/2005 (S.CAT).

When he has filed Writ Petition in High Court for his own benefit it is perfectly alright, but when NFPE & AIPEU-GDS (NFPE) filed case in Supreme Court for the benefit of 2.76 lakhs GDS he is ridiculing it and opposing it.

P.PANDURANGA RAO R.N.PARASHAR

General Secretry. Secretary General,

AIPEU-GDS(NFPE) NFPE.

(NB: Shri.Mahadevaiah has published in December 2014 a circular in his website in which again he has used filthy and unparliamentary language against the NFPE leadership. He has called the leadership of NFPE as “Cowards” “impotent” and “liars”. NFPE & AIPEU-GDS (NFPE) don’t want to stoop to the level of Shri. Mahadevaiah by replying him using such indecent and low-level third-rate language in our writeups).

RTP PRINCIPAL CAT CASE

NEXT DATE OF HEARING OF RTP PRINCIPAL CAT CASE is 15.03.2015

Minutes of the JCM, Departmental Council eeting held on 16/12/2014

CLICK HERE FOR DETAILS

SB Order No 13/2014 : Grant of Savings Bank allowance to Postal Assistants working in Savings Bank / Certificate Branches - Clarification - reg

JCM SUBJECT DISCUSSED ON 16.12.2014

64.

|

17

|

Eligibility of SB Allowance of SB qualified officials

The eligibility for appearing for the SB Aptitude test is reduced from 5 years to one year vide SB order No. 16/2011 dated 23.08.2011. The principal SB order No. 26/89 issued vide DG Posts letter No. 2-3/86-SB dated 27.04.1989, it is prescribed that the SB Allowance will be admissible only to those Postal Assistants who are selected to be posted in SB Branch having at least 5 years of service with good record and pass in the aptitude test/such other test as may be prescribed and the allowance will be paid for the period they actually work in the SB Branch.

Subsequently vide SB order No. 16/2011 issued vide Directorate letter No. 113-07/2010-SB dated 23.08.2011, the eligibility for appearing in the SB Aptitude test is reduced to one year and many young Postal Assistants are now qualified and they are denied for grant of SB Allowance s the principal SB order No. 26/89 requires a revision in consonance with the subsequent SB order No. 16/2011.

Hence it is requested to cause suitable clarification allowing the drawal of SB Allowance to the officials qualified irrespective of their service and render justice at the earliest.

|

Agreed. It is under process in consultation with IFW.

|

DDG

(Estates

& MM)

|

7th CPC RESCHEDULED ITS VISIT TO KOLKATA

Due to unavoidable circumstances, the 7 th Central Pay Commission's visit to Kolkata /

Andaman & Nicobar Islands has been rescheduled. As per the revised schedule, the Commission will visit Kolkata from 11th - 14th January, 2015.

Delegation of Financial Powers to Heads of Circles in the Department of Posts

To view please Click Here.

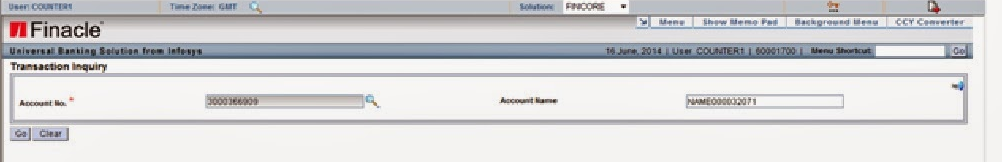

FINACLE : TTUM SALARY / PENSION UPLOAD VIDEO TUTORIAL

Uploading The Salary / Pension File In Finacle

MENU - HTTUM (This option is available only for SYSTEM ADMINISTRATOR)

Please note: Uploading of salary and pension has to be done only after BEGIN OF DAY (BOD) of last working day ie 31/01/2014 January 2014

- In ‘Report to Field’, enter ‘DoP’.

- Transaction subtype should be selected as ‘Transfer – Bank Induced’.

- Select ‘POST’ option for Action.

- Select ‘On successful upload’ for Rename File after Upload.

- Select ‘Local File Path’ and click on ‘Submit’ button.

Thanks to Rajesh H for Video Demo

Download Latest TTUM File

Monday 29 December 2014

PAYMENT OF SOCIAL SECURITY PENSIONS ARE INCLUDED IN THE WORK LOAD OF BPMs - AP CIRCLE

The payments of Social Security Pensions has been taken into the work load of the BPMs. The item has been taken up in RJCM meeting held with CPMG, AP Circle.

COPY of the Order :

DEPARTMENT OF POST - INDIA

BUSINESS DEVELOPMENT GROUP

O/o CHIEF POST MASTER GENERAL - ANDHRA PRADESH CIRCLE

HYDERABAD - 500 001

To

The Postmaster General

Hyderabad / Vijayawada / Visakhapatnam / Kurnool Regions.

No.BD/RJCM/Misc/13-14 dated at Hyderabad - 1 the 01-12-2014

Sub:- Request for considering work load of Social Security Pensions into BPMs TRCA instead of incentive payments - regarding.

This is regarding taking work load of Social Security Pensions into BPMs TRCA instead of payment of incentive. In this regard, please find enclosed a copy of Directorate letter No.5-1/2007-WS-1(Pt) dated 16-12-2010 on the above subject for information and necessary action.

2. I am directed by the Competent Authority to reiterate the instructions as detailed below:

i. All the concerned should follow the Directorate instructions issued vide letter No.5-1/2007-WS-1(Pt) dated 16-12-2010 while calculating the work load of disbursement of old age pensions being disbursed by GDSBPMs through Savings Bank Accounts with immediate effect.

ii. Payment of incentive being paid to GDSBPMs @ 0-50ps per transaction may be stopped immediately in respect of old age pensions.

The circular may be brought to the notice of all concerned. Please acknowledge the receipt of the letter by next post.

sd.x.x

Asst. Postmaster General (FS&BD)

O/o Chief Postmaster General

A.P Circle, Hyderabad - 500 001

Grant of SB Allowance to PAs working in SB Branch - Clarification - SB Order no 13/2014

..

Declaration of Assets and Liabilities under Lokpal and Lokayuktas Act, 2013 - extension of last date for filing of revised returns by public servant

The last date for filing revised returns by Public Servants has been extended by a period of four months i.e. from 31st December, 2014 to 30th April, 2015.

The formats for submission of Statements regarding movable properties (Form-II) and for submission of Statements on debts and liabilities (Form-IV) are being revised and will be notified as part of the amendments to the aforesaid rules.

click here to view Department of Personnel and Training OM No.407/12/2014-AVD-IV (B) dated 25-12-2014 please.

Click here to view Postal Directorate's Memo No. 20-1/2014-SPG dated 26.12.2014.

Click here to view Postal Directorate's Memo No. 20-1/2014-SPG dated 26.12.2014.

Sunday 28 December 2014

Various Accounts Closure in Finacle

SB ACCOUNT CLOSURE:

Before account closure, withdraw the entire sum and make the balance zero

In case of cheque account, select all the unused cheques and then destroy them.

To close the SB account: Menu Option HCAAC

Ø Select ‘Close’

Ø Enter the account no.

Ø Navigate the General/Closure details/Closure exception pages

Verification by the Supervisor

Ø Select verify

Ø Select the account no. from searcher or enter the account no.

Ø Complete the vefication

MIS Account Closure (By Cheque)

Always use Trial close option first, note down the closure proceeds in HPR and then do the original closure.

Ø Menu option - HCAACTD

Ø Enter the MIS account number. Always use the Trial close option to verify the amount & click Go.

Ø General / closure details / closure exceptions pages will be displayed under different tabs.

Ø In the General tab, check for the Name of the depositor, date of opening and amount.

Ø In the closure details tab, if the closure amount can be paid by cash, select the option in Close mode – By cash.

Ø If cheque, select the option – Repayment account, enter the Repayment account id as the Post master Cheque account id – 781001000340.

Ø In the closure exception tab, enter the reason - whether death or Normal. (select the reason only from the searcher)

Ø Submit.

Ø Closure details will be listed below.

Ø Go to HPR.

Ø In the HPR, the final amount to be paid will be listed.

Ø Then Start the Regular Closure in the option – Z - Close.

Verification :

Ø HCAACVTD – Visit all the pages and submit.

Ø Then go to HPR, to verify the final amount to be paid.

ACCOUNT CLOSURE (BY CASH) :

Always use Trial close option first, note down the closure proceeds in HPR and then do the original closure.

Ø Follow the same procedure as above.

Ø In the close mode select, cash.

Ø Use HCASHPND finally to pay the amount.

Ø Dr. Repayable/parking account Cr. Teller cash account

SCSS ACCOUNT CLOSURE:

(always use Trial close option to verify the amount)

- Menu option- HCAACTD

- If Close mode is chosen as cash – then proceeds go to repayment a/c . From Repayment a/c placeholder, user needs to invoke the menu HCASHPND for transferring it to teller cash a/c.

- If cheque has to be paid, select the close mode as Repayment account and enter the Postmaster cheque account id – SOL id ending with 0340.

- Use Menu- HCAACVTD Verify account closure (Verification by Supervisor)

- Use Menu- HTDTRAN Enquire TDA transaction(To enquire closure proceeds.)

- Use Menu- HFTI Tran enquiry (To enquire the transaction details and note down the tran-id.)

RD ACCOUNT CLOSURE:

(always use Trial close option to verify the amount)

- Use Menu- CRDCAAC to close RD account by counter PA

- If the RD account is linked with the loan account (loan taken already), the LIEN marked on the RD account should be lifted first using HALM menu before closing.

- If it is not a death closure, select the radio button as No.

- If the Repayment mode is selected as Transfer, then the Repayment A/c is to be specified. We can specify the savings account of the customer in this.

- If Repayment mode is chosen as cash – then proceeds go to repayment a/c . From Repayment a/c place holder, user needs to invoke the menu HCASHPND for transferring it to teller cash a/c.

- If cheque has to be issued, enter the Repayment mode as Transfer and enter the Postmaster Cheque account (ac id – SOL id ending with 0340)

- Use Menu- CRDCAAC (Verification by Supervisor) Enter the account number or select from the searcher

- Use Menu- HFTI Tran inquiry Note down the tran-id generated in the closure menu and enquire the transaction details.

- Use menu- HCASHPND (To PAY cash by to the customer by the Counter PA Select Unprocessed)

- Enter the account number or tran id.

PPF account closure:

- Use Menu- HCAAC (To close the PPF account by the Counter PA)

- Enter the PPF account number.

- Enter all the mandatory details, closure reason code, close mode, etc.

- For cash payment select the close mode as cash. Then payout using HCASHPND.

- If payment is to be made by cheque, select the close mode as transfer, enter the Postmaster Cheque account number – SOL id ending with 0340 as the Transfer account id.

- If it is an SB transfer, SB account number can be entered.

- Note down the closure amount.

- Use Menu- HCAAC (Verification by the Supervisor)

- Enter the PPF account number

- Submit

NSC/KVP discharge:

- Use Menu- NSCAC (To discharge NSC/KVP by the Counter PA)

- Select NSC or KVP

- Enter the CIF id and registration number.

- In case of bulk issue, all the certificates will be listed out.

- Select each certificate and click the close radio button.

- Submit

- Use Menu- NSCAC (Verification by the Supervisor)

- Enter the CIF no. and registration number.

- Submit

- Go to HPR and note down the amount to be paid in the certificate. (Counter PA cannot view the amount)

Courtesy : http://bnjho.blogspot.in/

Process of PPF Transfer in DOP Finacle

PPF TRANSFER IN PROCEDURE IN DOP FINACLE

Procedure to open PPF transfer in Account or PPF accounts wherein incorrect account open date or balance has been migrated

- Account Opening mode to be TRANSFER

- Old PPF Account Number to be given

- BOD (Begin of Day) date will be automatically populated as Transfer In date

- Original PPF Account Open date is mandatory

- PPF Maturity date is mandatory

- No. of documents received is mandatory

- Old Bank-branch details to be entered

- Advice of Transfer Number to be entered

3. PPF account to be verified

4. This new PPF account number to be entered in the Excel sheet in Finacle PPF Account Number field. Transaction details to be correctly. Year end indicators should be correctly marked.

5. .txt file to be generated from the excel sheet entered.

6. Invoke the menu HTRFTOUN from Counter Login .

- Browse the path of the .txt file

- Destination directory to be always /dop/

- Click on Upload

Invoke the menu CTUPLD in Operator Login

- Enter the new PPF account number

- Enter the filename uploaded in the sl. No. 6 along with extension

- Click on Submit

Data uploaded successfully message will be thrown (Run time error will be thrown if the date format is incorrect mm/dd/yyyy is the format)

9. Invoke the menu CTPROC through SUPERVISOR login

- Select the Function – Verify

- Enter the PPF account number

- Click on GO

- Click on Submit

Invoke the menu HACLI

Invoke the menu CTINQ for viewing the ledger entries

Click on Go

15. Entries entered in excel sheet will be displayed. Confirm the correctness of the entries

15. Entries entered in excel sheet will be displayed. Confirm the correctness of the entries

Please note that the entries other than the current year entries are available in the above screen.

16. Now close the old PPF account (wrong account open date or balance) by invoking the menu HCAAC. Closure reason to be selected as TRANSFER TO BANK.

17. Suitable error book entries to be made for reference.

Thanks to : pofinacleguide.blogspot.in

VIRUS EFFECT REMOVER : TO RESET COMMON ISSUES

Virus Effect Remover

Although it’s stuffed full of advanced options and functions to help with removing the after effects of virus infections and also helping to prevent them in future, Virus Effect Remover can be used to easily reset the common items disabled during an infection like Task Manager, Command Prompt, and the Registry Editor. Some othermore advanced features include autorun control, file unlocking, file and folder security permissions, services control and startup items control.

The One Click Registry Heal button does what it says and resets everything shown in the information box. The Windows Tools section will first make sure Task Manager, Regedit or MSConfig are enabled, and then launch the respective tool.

Download Virus Effect Remover Tool

Subscribe to:

Posts (Atom)